|

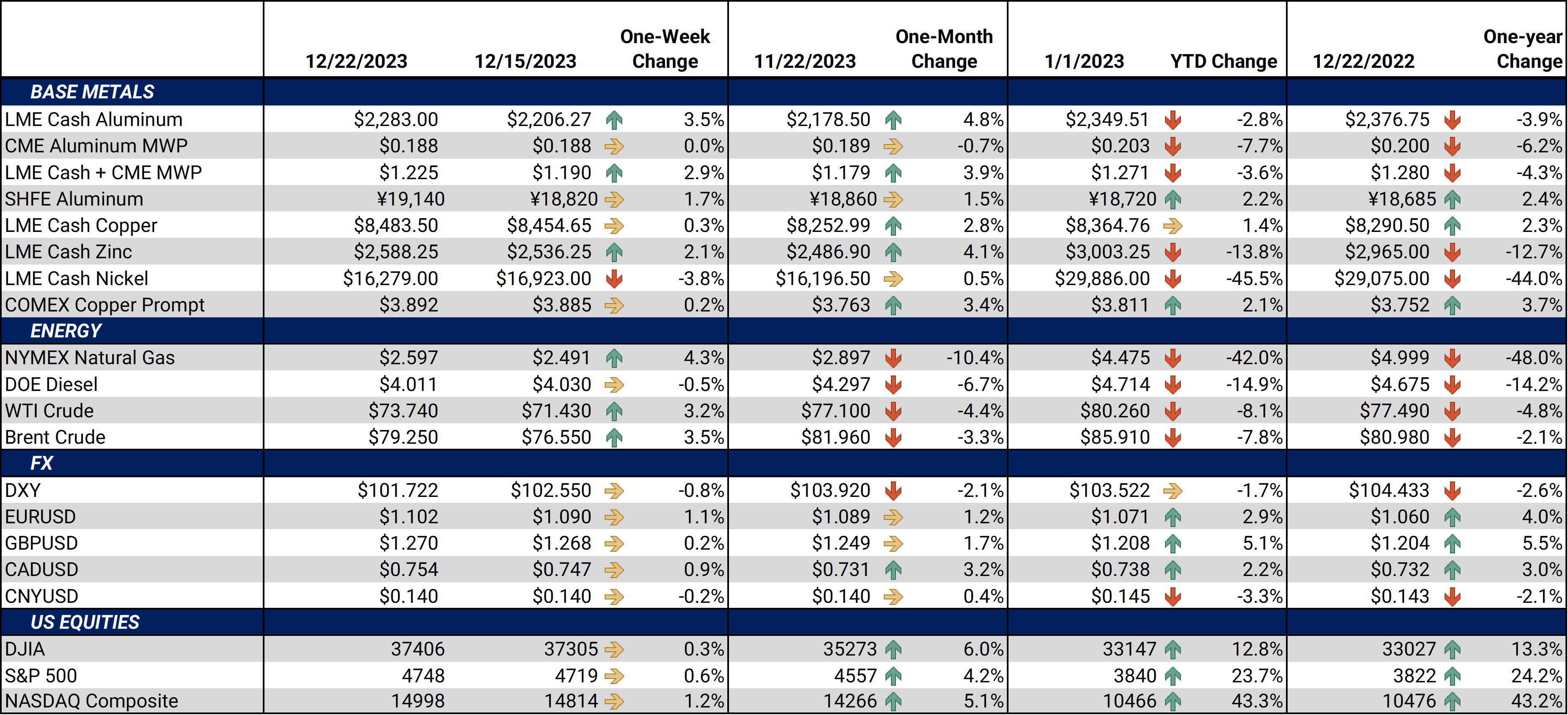

Aluminum *The LME will be closed on Monday, December 25, and Tuesday, December 26, due to the Christmas and Boxing Day holidays. We will not produce the Metals First Look either morning. The trading desk will provide CME coverage on Tuesday, and current clients can contact metals@aegis-hedging.com for indications. * |

|

|

Speculators have dramatically reduced their short position in LME aluminum. As of last Friday, investment funds, which are purely speculators in metals markets, are net short approximately 21,000 contracts, having purchased about 15,000 contracts last week. LME aluminum prices are highly sensitive to the actions of these investment funds, so this is likely why prices rallied over 5% last week. (Source: LME) |

|

|

|

Aluminum stocks in LME warehouses, surged by 13% on Monday after the United Kingdom implemented sanctions that bar its citizens and companies from trading Russian-origin metals. As of this writing, LME aluminum stocks now total 508,650 mt, up nearly 64,000 mt compared to last Friday. Nearly all of this recent surge in stocks occurred in Asian warehouses, which are known repositories of Russian aluminum. Even before the latest jump in inventories, the impact of Russian metal in the LME has been a hot-button issue recently. In an emailed statement, the LME addressed these concerns, saying, “We note the UK Government’s recent statement that further action on Russian metal is being contemplated when this can be done ‘in concert with international partners’, and we will reflect any such future measures as appropriate. We continue to closely monitor the levels and flow of Russian metal through the LME warehouse network to ensure the LME is best placed to meet the needs of its participants and the market more widely.” (Source: Bloomberg) |

|

|

|

Compared to October, global daily primary aluminum production ticked lower last month, mainly due to lower output in top-producing China. Daily total output was 196,400 mt in November, down from 197,400 mt in October. Chinese daily production was 116,700 mt last month, down slightly from 117,900 mt in October. Africa was the only other region that experienced a significant drop in production on a month-over-month basis. Nearly every region has grown compared to November 2022. (Source: International Aluminum Institute, Bloomberg) The Australian government has approved Alcoa’s plan for bauxite production through 2027, the company announced late last week. This approval now ensures bauxite supplies to the company’s nearby alumina refinery. Prior to the announcement, Alcoa’s alumina refinery was under threat of curtailment or closure due to struggles in obtaining enough bauxite. (Source: Bloomberg) Finally, Rusal has asked the Russian government to exempt two of its aluminum smelters from export tariffs, Bloomberg reported on Thursday, quoting sources from inside Russia. The smelters, known as Tayshet and Boguchansk, are responsible for approximately 10% of Rusal’s production. The export tariff, which was implemented in October, ranges between 4% to 7%, depending on the currency exchange rate. (Source: Bloomberg) |

|

Copper Even though copper prices rallied in the past two weeks due to US interest rate expectations and Chinese stimulus measures, China’s economic recovery remains “patchy,” according to Bloomberg. Compared to 2022, China’s retail sales and industrial production were up last month, but these figures are “distorted” as China remained in COVID lockdowns late last year. “It’s obvious that China’s economy slowed further in November, especially in terms of retail sales and property,” Larry Hu, head of China economics at Macquarie, proclaimed. Investment in property development, as well as home prices, also fell last month. (Source: Bloomberg) Copper prices tumbled early this week after Federal Reserve officials backed away from earlier comments that lower interest rates were imminent. In an interview on CNBC, New York Fed President John Williams suggested that it is “premature” to consider cutting interest rates. Atlanta Fed President Raphael Bostic echoed similar comments, stating, “I’m not really feeling that this is an imminent thing.” Given that many industries, such as manufacturing and real estate, are large sources of copper demand and sensitive to interest rates, copper prices can rise or fall based on interest rates and, therefore, copper demand expectations. (Source: Bloomberg) As for copper production, China’s refined copper smelters produced a record 1.14 million mt last month, according to government data from Tuesday. This is mainly due to high smelting fees, which have incentivized smelters to increase production. As Bloomberg suggested, though, refined copper production could fall next year while supplies of copper concentrate dwindle. Several of the world’s largest copper miners, which supply copper concentrate to China’s refined copper smelters, have shuttered mines or are experiencing other production-related issues. (Source: Bloomberg) Antofagasta, one of the world’s largest copper miners, will spend $5.4 billion to expand its Centinela mine in Chile, the company announced on Wednesday. This expansion will add 144,000 mt to annual production and will also include cost-saving measures. “This decision reflects the confidence we have in copper. The world is facing an important scarcity of this metal owing to the increase in demand generated by electrification and decarbonization of major economies,” Antofagasta Chief Executive Officer Ivan Arriagada stated. (Source: Bloomberg) |

|

|

|

Through November, approximately half of the cars sold in the EU were fully or partially electric, according to the European Automobile Manufacturers Association (ACEA). Earlier this month, the ACEA stated Europe’s EV demand could fall behind that of other regions if the EU doesn’t implement the right strategies or incentives. China’s dominance of EV-related supply chains could also impact European EV demand and production, the ACEA also proclaimed. Car makers such as Volkswagen and Mercedes-Benz have echoed similar concerns. This will likely impact copper demand and prices over the coming years. (Source: Reuters) |

|

Steel The EU and US have agreed on a temporary truce that will avoid tariffs on steel and aluminum imports, according to an announcement from Tuesday. The new arrangement will last through March 31, 2025. Despite the agreement, the EU could not convince US officials to modify the current tariff-rate quota (TRQ) system. Currently, 3.3 million mt of EU-produced steel and 384,000 of aluminum can come into the US tariff-free. Any volume above those amounts would be tariffed at 25% for steel and 10% for aluminum. (Sources: Bloomberg, Reuters) Nippon Steel, a Japanese steelmaker, has agreed to purchase US Steel for $14.9 billion, the company announced on Monday. The combined company will now have 86 million mt of total production, making it the world’s second-largest steel producer. Since most steel markets are regional, this merger will likely have little impact on steel supply, demand, or prices in the US. (Source: Bloomberg) Nippon Steel’s buyout of US Steel will likely face scrutiny by US officials, President Joe Biden stated on Thursday. The Committee on Foreign Investment in the United States (CFIUS), a regulatory body that reviews such deals for possible national security threats, will likely drag out its review process into late 2024, sources told Reuters earlier this week. Political posturing during an election year is the main reason why the review process could take longer than usual, Reuters’ sources also proclaimed. (Source: Reuters) South32, one of the world's largest suppliers of ferro-nickel, a key raw material for stainless steel production, has scaled back operations at a Columbian mine due to ongoing indigenous protests, the company announced late last Thursday. Correcting a statement from earlier in the week, the company has yet to invoke “force majeure” at the facility. Protestors from two nearby communities are blocking roads into the facility, thus preventing products from leaving. (Source: Bloomberg) Stainless steel prices in the US fell by 10% due to weakening demand and falling prices for nickel, a key raw material for stainless steel production. Similarly, US production in 1H2023 fell by 13.5% to 942,000 mt due to poor demand. This tepid end-user demand will likely carry into 2024, Argus suggested earlier this week. (Source: Argus) |

|

|

|||||

|

|

|||||

LME Aluminum |

|||||

|

LME Aluminum 3M settled at $2,326/mt, up $78.5/mt on the week. Aluminum prices were up this week. This has caused the futures forward curve to shift vertically higher by approximately $80/mt. It remains in a steep contango, meaning nearby prices are lower than forward prices. Aluminum consumers concerned about increasing prices might consider hedging future needs by buying swaps or call options. Depending on risk tolerance, end-users might consider strategies that use only swaps or options or a combination of both. The aluminum market has sufficient liquidity to use swaps and options. Please get in touch with AEGIS for specific strategies that fit your operations. |

|||||

Midwest Premium |

|||||

|

Prompt month CME MWP last traded/settled at 18.8¢/lb this week. The CME Midwest Premium market is now in a contango from the December ‘23 contract on forward. The CME Midwest Premium swap market is thinly traded, with no options market. Hedging in this thinly traded market is challenging, so we recommend using limit orders. Please get in touch with AEGIS for specific strategies that fit your operations. * Please note all these charts are for desktop only. * |

|||||

LME Copper |

|||||

|

LME Copper 3M settled at $8,573.5/mt, up $24.5/mt on the week. Compared to last Friday, LME Copper's forward curve has risen vertically by approximately $25/mt and remains in contango for the remainder of 2023 and throughout 2024 and 2025. The copper market has sufficient liquidity to use swaps and options. Depending on their risk tolerance, consumers might consider strategies that use only swaps, options, or a combination of both. Please get in touch with AEGIS for specific strategies that fit your operations.

|

|||||

|

|||||

|

LME Nickel 3M settled at $16,509/mt, down $641/mt on the week. As prices were down this week, nickel’s forward curve has also shifted vertically lower by about $640/mt. It remains in a steep contango, meaning that nearby prices are lower than futures prices. The nickel market has sufficient liquidity to use swaps and options. Depending upon your risk tolerance, consumers might consider strategies that use only swaps or options or a combination of both. Please get in touch with AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

|

|

|||||

CME Hot Rolled Coil (HRC) Steel |

|||||

|

Prompt month HRC Steel last traded/settled at $1,074/T, up $6/T on the week. Steel mill profit margins have improved dramatically in Q3 and Q4. The CME HRC Steel – CME MW Busheling Fe Scrap spread, which is generally used as a gauge for steel mill profitability, is now approximately $600/st, up from about $320/st on September 1. This is mainly due to prompt month CME HRC steel futures rallying alongside prices in the physical market. Since steel prices have increased significantly recently, mills should consider hedging production and raw material usage for late 2023 and early 2024. For most steel producers, this would consist of buying CME MW Busheling Scrap swaps and selling CME HRC swaps. Options are available for CME HRC, but they are relatively illiquid. Please get in touch with AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

AEGIS Insights |

|||||

|

12/20/2023: AEGIS Factor Matrices: Most important variables affecting metals prices 12/8/2023: Aluminum and Copper Markets Diverge but Hedging Opportunities Persist for End-Users 12/06/2023: Important US Economic Data (AEGIS Reference) 11/17/2023: Aluminum and Copper End-Users Should Hedge As Inflation Eases |

|||||

Notable News |

|||||

|

12/20/2023: Moscow takes control over assets of Western companies 12/20/2023: US 'buy now, pay later' splurges raise holiday debt hangover risk 12/19/2023: Viewpoint: Stainless weakness to persist into 2024 12/19/2023: US shuts Eagle Pass, El Paso rail links to Mexico 12/19/2023: Funds less negative on copper as supply landscape shifts: Andy Home 12/18/2023: Wall St builds on rally as Fed euphoria lingers 12/18/2023: Japan's Nippon Steel to acquire U.S. Steel for $14.9 billion 12/18/2023: Exclusive: LME plans new metals contracts using ShFE prices -sources |

|||||