|

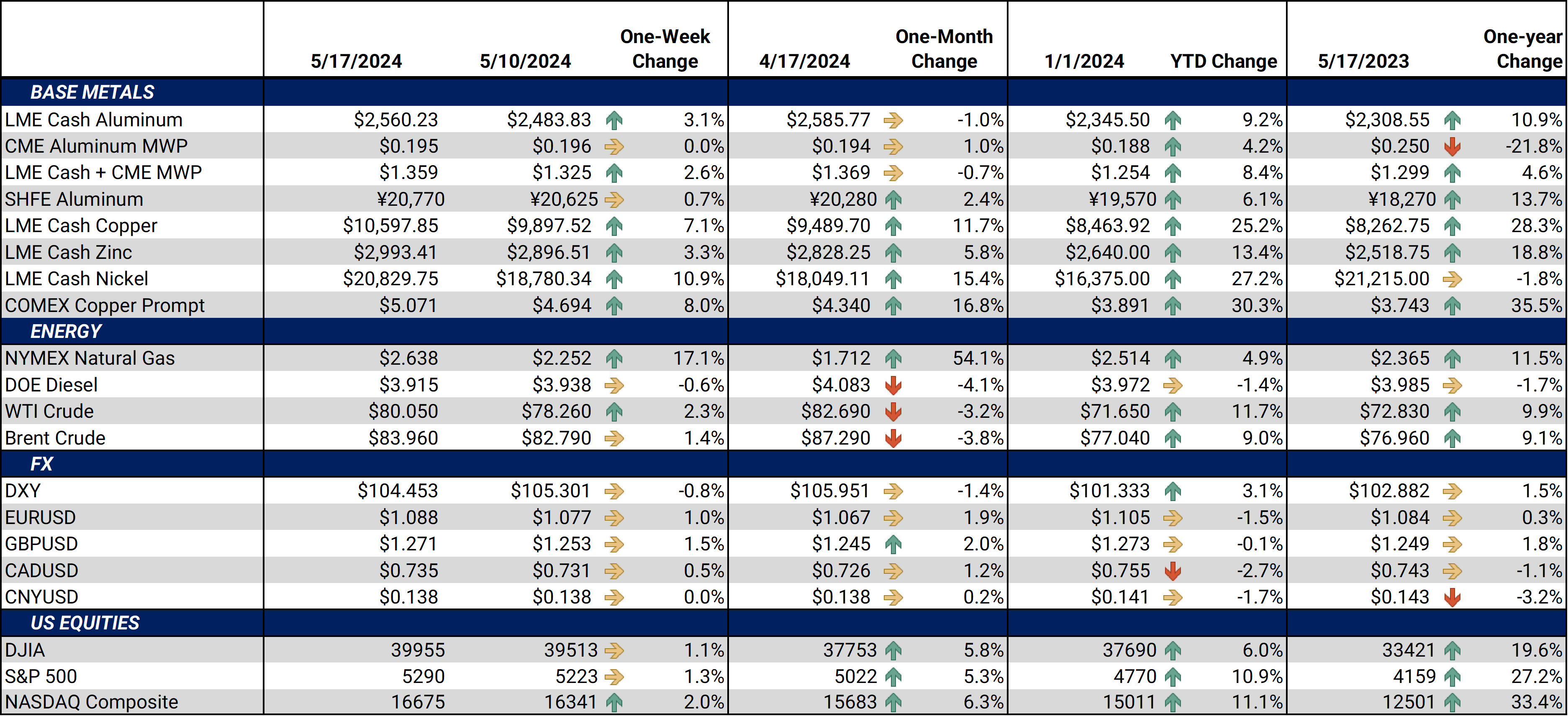

Aluminum Metals prices experienced a significant surge on Monday, primarily driven by the Chinese government's new stimulus efforts. The country’s Finance Ministry announced the sale of additional bonds, specifically for infrastructure spending, while major cities lifted restrictions on residential purchases. This wave of stimulus follows an unexpected credit issuance contraction in April, indicating a proactive approach to economic recovery. (Source: Bloomberg) |

|

|

That said, it appears that investment funds could finally be taking profits on their long position in LME aluminum. As of last Friday, investment funds, generally speculators in metals markets, were net long approximately 99,125 contracts, down from the nearly 103,000 net long position they had the Friday prior. This was the first time this long position had decreased since early March. The actions of investment funds are usually positively correlated with price action, which is likely why prices fell 1% last week. (Source: LME) On Tuesday morning, the LME saw its second large arrival of aluminum in less than a week. The most recent influx of 131,500 mt occurred in Malaysian warehouses, which are a known repository of Indian aluminum. Last week, LME on-warrant stockpiles, meaning the metal is available to trade, surged by 560,875 mt, the largest one-day jump in history, with approximately 75% going into Malaysian warehouses. AEGIS contacts tell us that Friday’s total inflow was likely of both Indian and Russian-origin aluminum. After the US and UK banned their citizens from trading Russian metals and the LME subsequently banned such deliveries, several large trading houses were briefly able to take advantage of a loophole in the LME’s new rules. The inflows of Indian aluminum could stem from LME’s recently announced proposal that would require aluminum producers to submit carbon data beginning in early 2025. (Sources: Bloomberg, LME) Since Wednesday, over 340,000 mt of aluminum warrants have been canceled, continuing the saga inside LME’s Malaysian warehouses. On Wednesday, Thursday, and Friday, canceled warrants (meaning the metal is set for delivery) from LME Malaysian warehouses spiked by 99,900 mt, 182,350 mt, and 60,000 mt, respectively. The total volume of on-warrant inventories (meaning the metal is available to trade) in Malaysian warehouses now stands at 426,900 mt. This is down from 709,250 mt on Tuesday after the huge inflow of likely Indian aluminum occurred. It is unclear if the newly canceled warrants will be re-delivered later or removed from the warehouses. (Source: LME) |

|

Copper The copper markets have also been a source of drama this week. The spread between the CME and LME copper contracts usually trades within a relatively tight range, but a short squeeze on the CME led to a historic blowout of this spread. This “short squeeze” stems from trading houses and speculators that were short CME copper and were ultimately forced out of their positions amid rising prices and potential margin calls. On Tuesday, the spread between the prompt month CME contract and LME Cash settled at an astounding $912/mt, but temperament has cooled since then. (Sources: CME, LME) Unlike aluminum, investment funds continue to buy LME Copper. Last week, investment funds added another 4,200 (net) contracts, bringing their total position to an astounding 63,590 net long contracts. This is slightly more than the 3,700 (net) contracts they added during the week ending May 3. LME copper prices rallied about 1% last week, likely due to the continued buying activity by investment funds. (Source: LME) The LME Copper Cash to 3M spread, a key gauge of spot demand, continues to trade near record lows. Last week Wednesday, the cash contract closed at $136/mt discount to the benchmark contract 3M, the lowest level this spread has traded since at least 1994. The spread has recovered slightly since then, but not enough to suggest that spot demand has meaningfully improved. This ultimately implies that spot demand has slumped while prices have surged. (Source: LME) Lastly, after rejecting two bids by rival BHP, copper miner Anglo American says it will spin or sell off several assets, including its coal, diamonds, and platinum businesses. This would help streamline operations and reduce operating costs by about $800 million per year. Likewise, this would allow Anglo to focus on its more lucrative copper operations and could make the company more valuable for any potential new takeover bids. (Source: Reuters) |

|

Other Important LME and CME Metals & Markets

|

|

|

|

|

|||||

|

|

|||||

LME Aluminum |

|||||

|

LME Aluminum 3M settled at $2,612/mt, up $82.5/mt on the week. Aluminum prices were up this week. Compared to last week, the futures forward curve has shifted vertically higher by approximately $80/mt. It remains in a steep contango, meaning nearby prices are lower than forward prices. Aluminum consumers concerned about increasing prices might consider hedging future needs by buying swaps or call options. Depending on risk tolerance, end-users might consider strategies that use only swaps or options or a combination of both. The aluminum market has sufficient liquidity to use swaps and options. Please get in touch with AEGIS for specific strategies that fit your operations. |

|||||

Midwest Premium |

|||||

|

Prompt month CME MWP last traded/settled at 19.5¢/lb this week. The CME Midwest Premium market is now in a contango from the May ‘24 contract on forward. The CME Midwest Premium swap market is thinly traded, with no options market. Hedging in this thinly traded market is challenging, so we recommend using limit orders. Please get in touch with AEGIS for specific strategies that fit your operations. * Please note all these charts are for desktop only. * |

|||||

LME Copper |

|||||

|

LME Copper 3M settled at $10,668/mt, up $664/mt on the week. Compared to last Friday, LME Copper's forward curve has shifted vertically higher by approximately $660/mt and is in contango throughout 2024 and early 2025. The copper market has sufficient liquidity to use swaps and options. Depending on their risk tolerance, consumers might consider strategies that use only swaps, options, or a combination of both. Please get in touch with AEGIS for specific strategies that fit your operations.

|

|||||

|

|||||

|

LME Nickel 3M settled at $21,080/mt, up $2,128/mt on the week. As prices were upthis week, nickel’s forward curve has also shifted vertically higher by about $2,100/mt. It remains in a steep contango, meaning that nearby prices are lower than futures prices. The nickel market has sufficient liquidity to use swaps and options. Depending upon your risk tolerance, consumers might consider strategies that use only swaps or options or a combination of both. Please get in touch with AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

|

|

|||||

CME Hot Rolled Coil (HRC) Steel |

|||||

|

Prompt month HRC Steel last traded/settled at $787/T, up $7/T on the week. Steel mill profit margins improved dramatically throughout 3Q and 4Q2023 and are also starting 2024 on a good note. The CME HRC Steel – CME MW Busheling Fe Scrap spread, which is generally used as a gauge for steel mill profitability, is now approximately $400/st, up from about $320/st on September 1. This is mainly due to decreasing scrap prices. Thus, steel mills should consider hedging production and raw material usage for 2024. For most steel producers, this would consist of buying CME MW Busheling Scrap swaps and selling CME HRC swaps. Options are available for CME HRC, but they are relatively illiquid. Please get in touch with AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

AEGIS Insights |

|||||

|

5/15/2024: AEGIS Factor Matrices: Most important variables affecting metals prices 5/2/2024: Important US Economic Data (AEGIS Reference) 4/25/2024: Mexico's New Tariffs on Steel and Aluminum Imports Create Uncertainty in US Markets 2/27/2024: Aluminum Consumers Should Still Implement Hedges, Even Though Russia Sanctions Mean Little |

|||||

Notable News |

|||||

|

5/15/2024: Trafigura, IXM caught in COMEX copper short squeeze as prices hit record 5/14/2024: Anglo breakup gives investors a free option on M&A 5/14/2024: Biden's new China tariff wall faces leakage via Mexico, Vietnam 5/14/2024: Biden sharply hikes US tariffs on an array of Chinese imports 5/13/2024: Weaker supply will drive the platinum deficit higher than expected in 2024, WPIC says 5/13/2024: How hard will new US tariffs hit China EVs and other exports? 5/13/2024: France backs nickel refinery project to bolster battery supply chain 5/13/2024: BHP says Anglo American rejected $42.7-billion revised proposal 5/13/2024: India's Jindal Steel posts Q4 profit jump as costs ease |

|||||