|

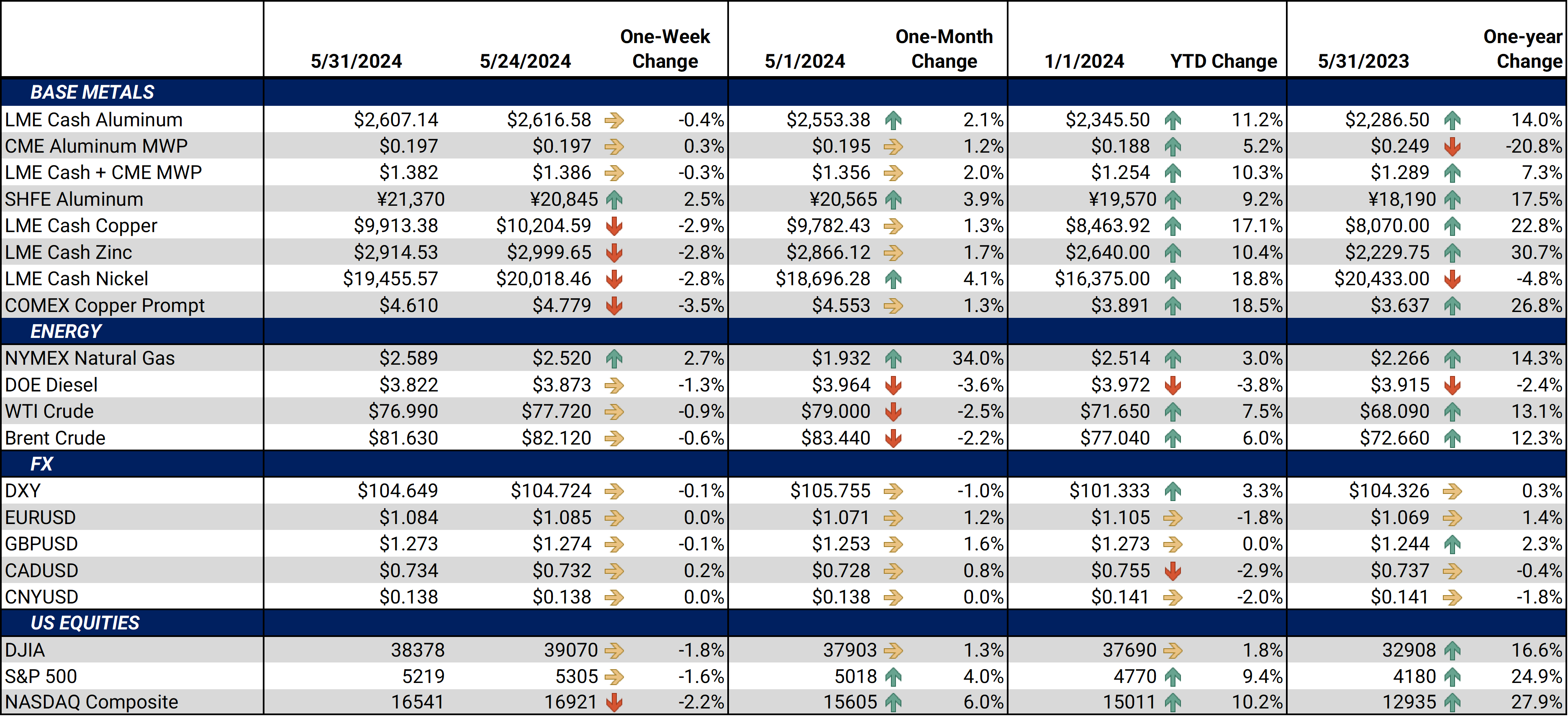

Aluminum With LME aluminum prices trending sideways for the past several weeks, some analysts are similarly mixed about the short-term direction of the market. Chinese buyers are boosting stockpiles, which is supportive of prices. Others, however, believe these stockpiles are already burdensome and could be bearish if Chinese traders begin to liquidate. Similarly, deliveries into LME’s Asian warehouses have spiked in recent days and could also keep a cap on global aluminum prices. (Sources: LME, Bloomberg) |

|

|

Due to falling prices for bauxite and other raw materials, India’s NALCO, one of the country’s largest aluminum producers, reported far better fourth-quarter earnings than analysts expected. Plunging global aluminum prices hindered earnings, however. Similarly, rival company Hindalco reported better-than-expected earnings late last week due to lower costs. (Source: Reuters) Novelis, a Georgia-based aluminum recycler, seeks to raise $945 million in an upcoming initial public offering (IPO). Although it's unclear how the funds will be used, this IPO comes when aluminum companies have had to grapple with high interest rates and spotty demand in recent years. The company had a net income of $600 million last year but was down 9.5% compared to 2022 due to weaker demand and prices. Novelis, which is the world's largest aluminum recycler and producer of flat-rolled aluminum products, is a subsidiary of India’s Hindalco. (Sources: Reuters, Bloomberg) Lastly, on Wednesday, Chinese authorities announced new measures that aim to cap emissions from metals production. This also includes capacity controls on alumina refineries. For aluminum, they will continue to strictly implement the “aluminum swap scheme,” in which a newer, less-polluting aluminum smelter can only be opened after an older, higher-polluting one is shuttered. (Source: Bloomberg) |

|

Copper LME copper has closed lower for the second consecutive week. Given the large rally in late April and early May, some analysts believe that the market fundamentals have become disconnected from price action. In an interview with Bloomberg on Thursday, Amelia Xiao Fu, head of commodities strategy at BOCI Global Commodities UK, stated “At these elevated price levels, there’s a clear disconnect between investors’ expectations and the reality in physical markets. We’ll continue to see this power play between macro players and the physical market.” With prices slumping nearly 6% in the past two weeks, the market could be realigned with fundamentals. (Sources: Bloomberg, LME) Not all of the recent price action has been down, however. Copper prices surged on Monday after Chinese authorities issued another round of stimulus measures. Some analysts interviewed by Bloomberg believe that last week’s 3.5% selloff was a pause in the rally as opposed to a change in investor sentiment. AEGIS cautions that the recent stimulus measures have done very little, and Chinese copper production remains near all-time highs amid spotty demand. (Source: Bloomberg) The arbitrage between CME and LME copper has begun to normalize in recent days. After spiking to a record of over $900/mt, the spread between the CME Prompt Month contract and LME Copper Cash is now approximately $240/mt, nearing the normal historical range. AEGIS’s contacts are telling us that both consumer and producer hedgers are returning to the market. (Sources: CME, LME) Finally, Chinese copper smelters continue to churn out near-record volumes of the red metal. Last month, the country produced 1.136 million mt of refined copper, down slightly from the 1.169 million mt they produced in December 2023. This stellar production comes despite reported issues with sourcing raw materials. (Source: Bloomberg) |

|

Other Important LME and CME Metals & Markets

|

|

|

|

|

|||||

|

|

|||||

LME Aluminum |

|||||

|

LME Aluminum 3M settled at $2,652.5/mt, down $9.5/mt on the week. Aluminum prices were down this week. Compared to last week, the futures forward curve has shifted vertically lower by approximately $10/mt. It remains in a steep contango, meaning nearby prices are lower than forward prices. Aluminum consumers concerned about increasing prices might consider hedging future needs by buying swaps or call options. Depending on risk tolerance, end-users might consider strategies that use only swaps or options or a combination of both. The aluminum market has sufficient liquidity to use swaps and options. Please get in touch with AEGIS for specific strategies that fit your operations. |

|||||

Midwest Premium |

|||||

|

Prompt month CME MWP last traded/settled at 19.7¢/lb this week. The CME Midwest Premium market is now in a contango from the June ‘24 contract on forward. The CME Midwest Premium swap market is thinly traded, with no options market. Hedging in this thinly traded market is challenging, so we recommend using limit orders. Please get in touch with AEGIS for specific strategies that fit your operations. * Please note all these charts are for desktop only. * |

|||||

LME Copper |

|||||

|

LME Copper 3M settled at $10,040/mt, down $284/mt on the week. Compared to last Friday, LME Copper's forward curve has shifted vertically lower by approximately $280/mt and is in contango throughout 2024 and early 2025. The copper market has sufficient liquidity to use swaps and options. Depending on their risk tolerance, consumers might consider strategies that use only swaps, options, or a combination of both. Please get in touch with AEGIS for specific strategies that fit your operations.

|

|||||

|

|||||

|

LME Nickel 3M settled at $19,170/mt, down $540/mt on the week. As prices were down this week, nickel’s forward curve has also shifted vertically lower by about $550/mt. It remains in a steep contango, meaning that nearby prices are lower than futures prices. The nickel market has sufficient liquidity to use swaps and options. Depending upon your risk tolerance, consumers might consider strategies that use only swaps or options or a combination of both. Please get in touch with AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

|

|

|||||

CME Hot Rolled Coil (HRC) Steel |

|||||

|

Prompt month HRC Steel last traded/settled at $787/T, up $7/T on the week. Steel mill profit margins improved dramatically throughout 3Q and 4Q2023 and are also starting 2024 on a good note. The CME HRC Steel – CME MW Busheling Fe Scrap spread, which is generally used as a gauge for steel mill profitability, is now approximately $390/st, up from about $320/st on September 1. This is mainly due to decreasing scrap prices. Thus, steel mills should consider hedging production and raw material usage for 2024. For most steel producers, this would consist of buying CME MW Busheling Scrap swaps and selling CME HRC swaps. Options are available for CME HRC, but they are relatively illiquid. Please get in touch with AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

AEGIS Insights |

|||||

|

5/29/2024: AEGIS Factor Matrices: Most important variables affecting metals prices 5/2/2024: Important US Economic Data (AEGIS Reference) 4/25/2024: Mexico's New Tariffs on Steel and Aluminum Imports Create Uncertainty in US Markets 2/27/2024: Aluminum Consumers Should Still Implement Hedges, Even Though Russia Sanctions Mean Little |

|||||

Notable News |

|||||

|

5/29/2024: Anglo rejects BHP's last-ditch attempt to continue takeover talks 5/27/2024: India's NALCO tops Q4 profit estimates on lower input costs 5/24/2024: India's Hindalco beats Q4 profit view as lower costs outpace weak aluminium prices |

|||||