|

Aluminum Aluminum spreads are suggesting that spot demand has collapsed in recent weeks. Currently, the LME Cash contract is trading at a $45/mt discount to the benchmark 3M contract. This is nearly $70/mt lower than about six weeks ago, when the cash contract was trading at an approximate $27/mt premium to the 3M contract. This suggests that spot demand has slumped significantly while prices were increasing. (Source: LME) |

|

|

Due to a new electricity supply agreement, Rio Tinto will be able to keep its New Zealand-based aluminum smelter open through 2044, the company announced late last week. Before this agreement, the smelter was set to close later this year due to high energy costs and lackluster aluminum demand. This smelter is the only one in New Zealand and has an annual production of approximately 330,000 mt. According to the company, nearly 90% of its production is exported. (Source: Rio Tinto) China’s aluminum processing industry contracted last month, according to a survey from Shanghai Metal Market. New orders slumped significantly last month, largely due to historically high aluminum. China’s E.V. sector has been a boon for aluminum demand in recent months but has started to push back at the elevated prices. (Source: Shanghai Metal Market) The global aluminum industry is set to expand its scrap-based capacity by 22 million tons by 2026, driven by decarbonization efforts and high market prices. This includes a significant 15 million ton increase in China. Companies like Rio Tinto and Norsk Hydro are investing in recycling to meet consumer demand for greener products, although sourcing sufficient scrap remains a challenge. (Source: Bloomberg) |

|

Copper LME copper has closed lower for the third consecutive week. Copper tumbled after strong U.S. jobs data reduced expectations for Federal Reserve interest rate cuts. Copper prices fell as much as 3.9% to their lowest since May 2 amid renewed concerns that the Fed will maintain higher interest rates. Rising stockpiles in Shanghai Futures Exchange warehouses, now at their highest in over four years, have exacerbated concerns over weak demand in China. (Bloomberg) Late last week, government data showed that China’s manufacturing sector is contracting again. Surprisingly, though, metals initially had a muted reaction to this news. AEGIS would like to point out that China’s manufacturing sector has largely been stagnant for the past several years and could keep a cap on prices for copper, aluminum, and other important industrial metals. (Sources: Bloomberg, China govt) Trafigura claims copper's recent price spike to $11,104.50/ton wasn't justified by supply and demand fundamentals. Chief Economist Saad Rahim attributed the rally to investment flows, noting that prices have since fallen to $10,025. Despite this, Trafigura still sees a tighter market ahead due to supply constraints, such as the closure of First Quantum Minerals' Panama mine, which has caused a significant shortage in copper concentrates and forced smelters to cut production. (Source: Bloomberg) Copper prices head for a third straight weekly loss as inventories in China hit a four-year high, signaling weak demand and causing a sharp retreat from recent record highs. Despite this, long-term prospects remain optimistic with new investments like Sprott Inc.'s $100 million copper fund, anticipating future supply constraints and increased demand from the E.V. and renewable sectors. (Source: Bloomberg) |

|

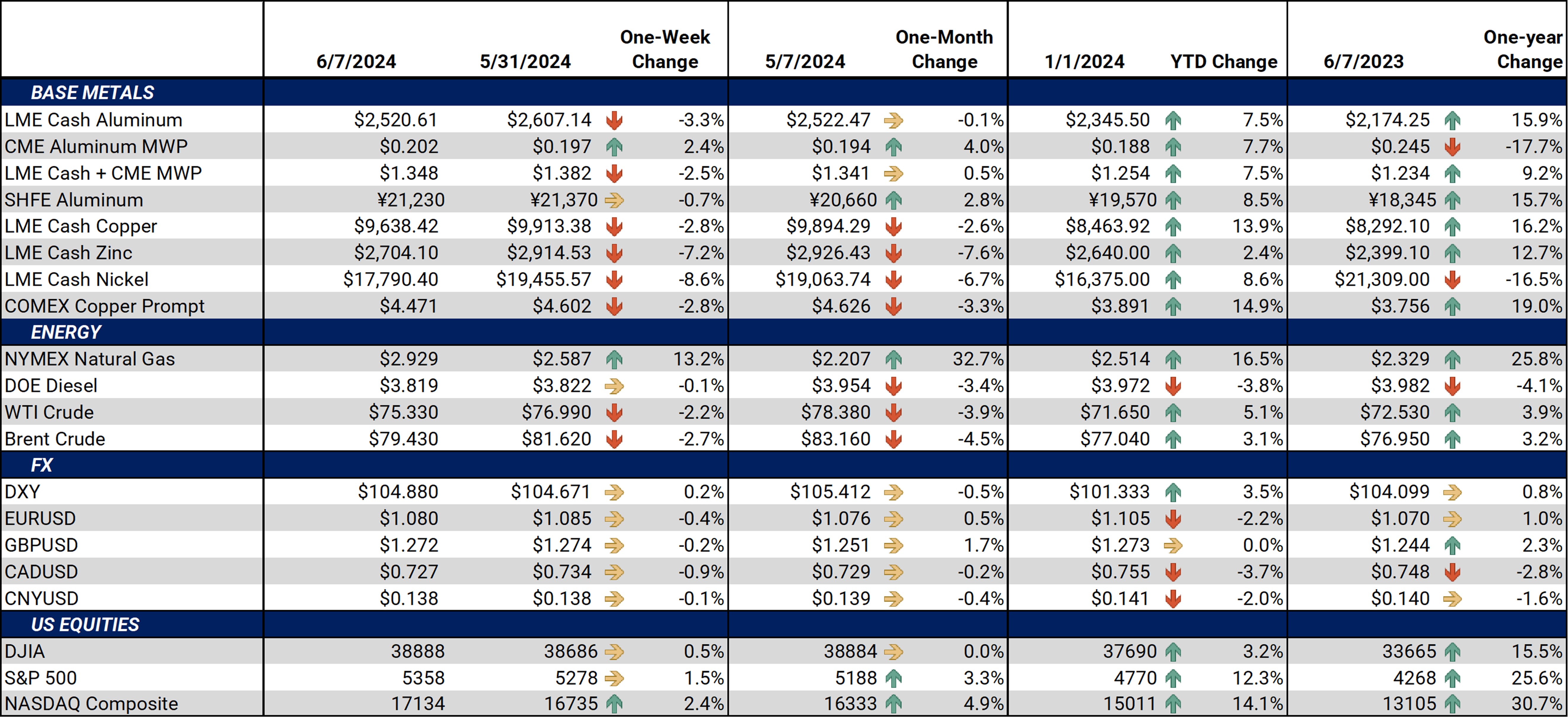

Other Important LME and CME Metals & Markets

|

|

|

|

|

|||||

|

|

|||||

LME Aluminum |

|||||

|

LME Aluminum 3M settled at $2,578/mt, down $74.5/mt on the week. Aluminum prices were down this week. Compared to last week, the futures forward curve remains in a steep contango, meaning nearby prices are lower than forward prices. Aluminum consumers concerned about increasing prices might consider hedging future needs by buying swaps or call options. Depending on risk tolerance, end-users might consider strategies that use only swaps or options or a combination of both. The aluminum market has sufficient liquidity to use swaps and options. Please get in touch with AEGIS for specific strategies that fit your operations. |

|||||

Midwest Premium |

|||||

|

Prompt month CME MWP last traded/settled at 20.2¢/lb this week. The CME Midwest Premium market is now in a contango from the June ‘24 contract on forward. The CME Midwest Premium swap market is thinly traded, with no options market. Hedging in this thinly traded market is challenging, so we recommend using limit orders. Please get in touch with AEGIS for specific strategies that fit your operations. * Please note all these charts are for desktop only. * |

|||||

LME Copper |

|||||

|

LME Copper 3M settled at $9,762.50/mt, down $277.5/mt on the week. Compared to last Friday, LME Copper's forward curve has shifted vertically lower by approximately $280/mt and is in contango throughout 2024 and early 2025. The copper market has sufficient liquidity to use swaps and options. Depending on their risk tolerance, consumers might consider strategies that use only swaps, options, or a combination of both. Please get in touch with AEGIS for specific strategies that fit your operations.

|

|||||

|

|||||

|

LME Nickel 3M settled at $18,031/mt, down $5/mt on the week. As prices were down this week, nickel’s forward curve also shifted lower. It remains in a steep contango, meaning that nearby prices are lower than futures prices. The nickel market has sufficient liquidity to use swaps and options. Depending upon your risk tolerance, consumers might consider strategies that use only swaps or options or a combination of both. Please get in touch with AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

|

|

|||||

CME Hot Rolled Coil (HRC) Steel |

|||||

|

Prompt month HRC Steel last traded/settled at $728/T, down $33/T on the week. Steel mill profit margins improved dramatically throughout 3Q and 4Q2023 and are also starting 2024 on a good note. The CME HRC Steel – CME MW Busheling Fe Scrap spread, which is generally used as a gauge for steel mill profitability, is now approximately $318/st, down from about $320/st on September 1. This is mainly due to decreasing scrap prices. Thus, steel mills should consider hedging production and raw material usage for 2024. For most steel producers, this would consist of buying CME MW Busheling Scrap swaps and selling CME HRC swaps. Options are available for CME HRC, but they are relatively illiquid. Please get in touch with AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

AEGIS Insights |

|||||

|

5/29/2024: AEGIS Factor Matrices: Most important variables affecting metals prices 5/2/2024: Important U.S. Economic Data (AEGIS Reference) 4/25/2024: Mexico's New Tariffs on Steel and Aluminum Imports Create Uncertainty in U.S. Markets 2/27/2024: Aluminum Consumers Should Still Implement Hedges, Even Though Russia Sanctions Mean Little |

|||||

Notable News |

|||||

|

5/29/2024: Anglo rejects BHP's last-ditch attempt to continue takeover talks 5/27/2024: India's NALCO tops Q4 profit estimates on lower input costs 5/24/2024: India's Hindalco beats Q4 profit view as lower costs outpace weak aluminium prices |

|||||