|

Aluminum Aluminum trades sideways amid optimism over potential stimulus measures aimed at bolstering China's economy, as discussed by Chinese officials and analysts. The People's Bank of China is exploring ways to enhance liquidity through government bond trading, potentially boosting infrastructure investment and industrial metal demand amidst a sluggish economic backdrop. (Source: Bloomberg) |

|

|

Chinese hydropower is surging, supporting aluminum production. Chinese aluminum production has reached an all time high last month as smelters brought back production. Heavy rains have boosted hydropower output in some regions, increasing electricity supply. (Source: Bloomberg) |

|

Copper China's declining real estate sector has sharply reduced demand for copper, pushing prices down to around $9,690.50 per ton on the London Metal Exchange. With property completions plunging over 20% monthly this year, compared to strong growth in 2023, the construction industry, a key consumer of copper, faces significant challenges. Despite optimism in sectors like electric vehicles and data centers, copper prices have fallen from record highs above $11,000 per ton last month due to rising inventories and economic uncertainties in China. (Source: Bloomberg) |

|

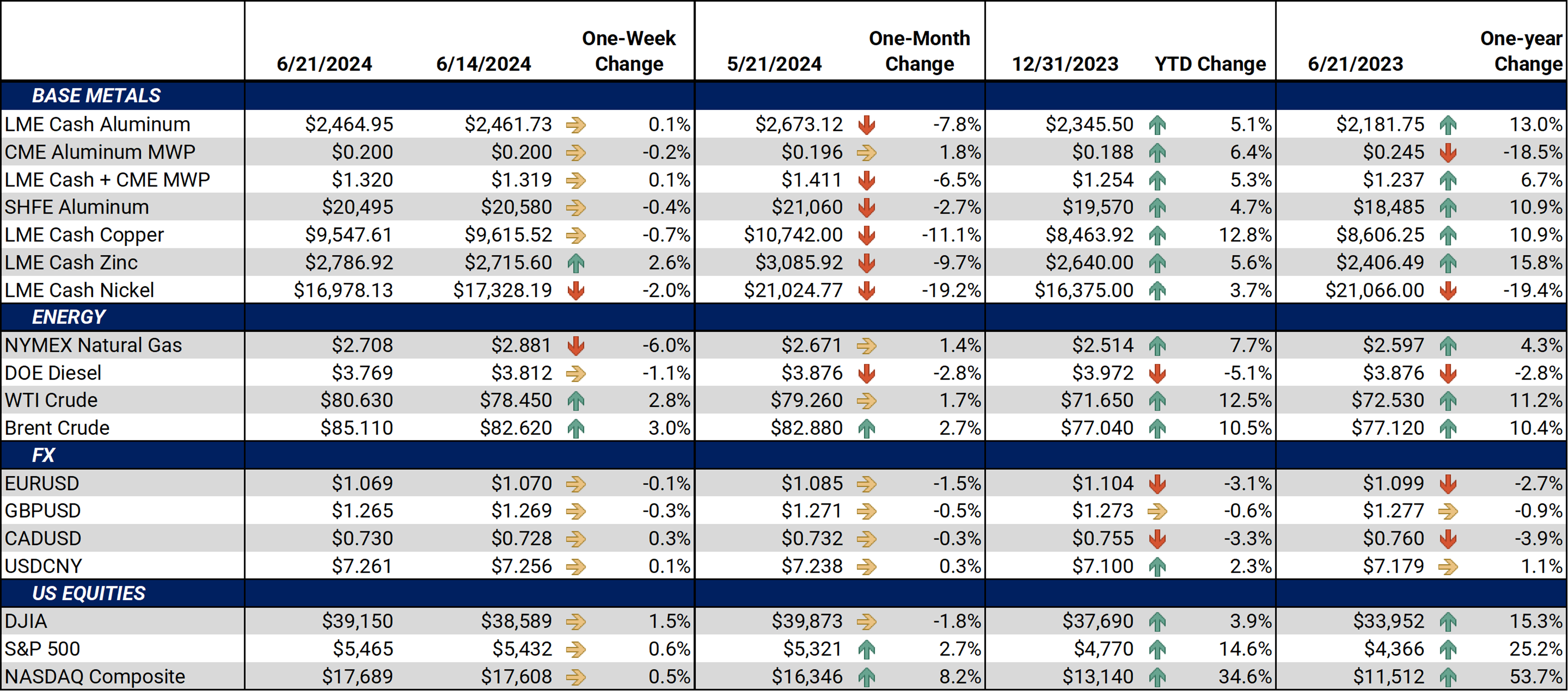

Other Important LME and CME Metals & Markets

|

|

|

|

|

|||||

|

|

|||||

LME Aluminum |

|||||

|

LME Aluminum 3M settled at $2,464.95/mt, down $3.22/mt on the week. Aluminum prices were modestly down this week. Compared to last week, the futures forward curve remains in a steep contango, meaning nearby prices are lower than forward prices. Aluminum consumers concerned about increasing prices might consider hedging future needs by buying swaps or call options. Depending on risk tolerance, end-users might consider strategies that use only swaps or options or a combination of both. The aluminum market has sufficient liquidity to use swaps and options. Please get in touch with AEGIS for specific strategies that fit your operations. |

|||||

Midwest Premium |

|||||

|

Prompt month CME MWP last traded/settled at 19.965¢/lb this week. The CME Midwest Premium market is now in a contango from the June ‘24 contract on forward. The CME Midwest Premium swap market is thinly traded, with no options market. Hedging in this thinly traded market is challenging, so we recommend using limit orders. Please get in touch with AEGIS for specific strategies that fit your operations. * Please note all these charts are for desktop only. * |

|||||

LME Copper |

|||||

|

LME Copper 3M settled at $9,682.5/mt, down $59/mt on the week. Compared to last Friday, LME Copper's forward curve has shifted vertically lower by approximately $105.98/mt and is in contango throughout 2024 and early 2025. The copper market has sufficient liquidity to use swaps and options. Depending on their risk tolerance, consumers might consider strategies that use only swaps, options, or a combination of both. Please get in touch with AEGIS for specific strategies that fit your operations.

|

|||||

|

|||||

|

LME Nickel 3M settled at $17,054/mt, down $351/mt on the week. As prices were down this week, nickel’s forward curve also shifted lower. It remains in a steep contango, meaning that nearby prices are lower than futures prices. The nickel market has sufficient liquidity to use swaps and options. Depending upon your risk tolerance, consumers might consider strategies that use only swaps or options or a combination of both. Please get in touch with AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

|

|

|||||

CME Hot Rolled Coil (HRC) Steel |

|||||

|

Prompt month HRC Steel last traded/settled at $728/T, down $7/T on the week.

|

|||||

|

|

|||||

AEGIS Insights |

|||||

|

5/29/2024: AEGIS Factor Matrices: Most important variables affecting metals prices 5/2/2024: Important U.S. Economic Data (AEGIS Reference) 4/25/2024: Mexico's New Tariffs on Steel and Aluminum Imports Create Uncertainty in U.S. Markets 2/27/2024: Aluminum Consumers Should Still Implement Hedges, Even Though Russia Sanctions Mean Little |

|||||

Notable News |

|||||

|

5/29/2024: Anglo rejects BHP's last-ditch attempt to continue takeover talks 5/27/2024: India's NALCO tops Q4 profit estimates on lower input costs 5/24/2024: India's Hindalco beats Q4 profit view as lower costs outpace weak aluminium prices |

|||||