|

Summary:

|

|

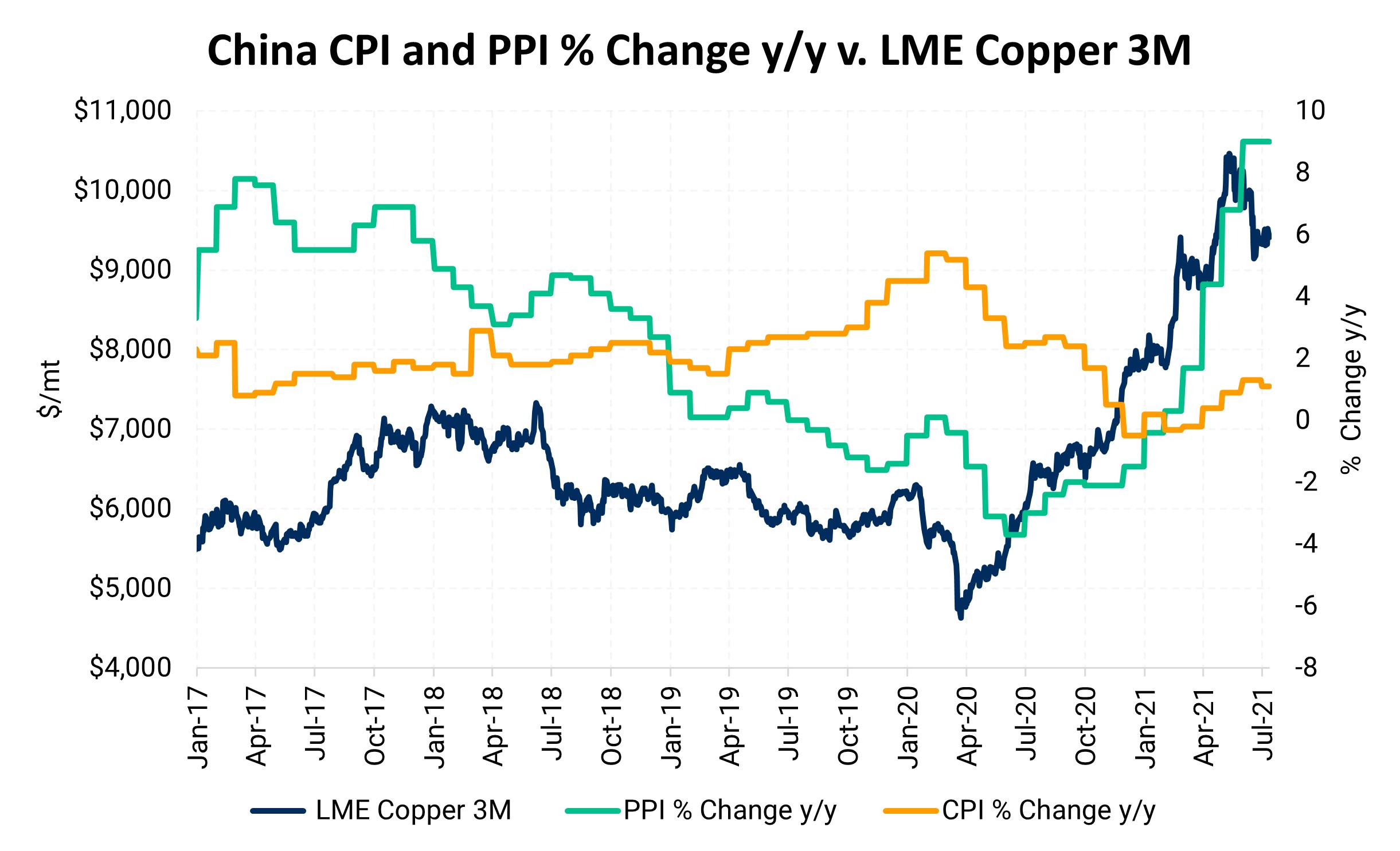

AEGIS Thoughts & Strategies: As commodities prices have skyrocketed this year, China's PPI and CPI have responded in kind. The PPI surged 8.8% y/y in June, a slight downtick from the 9.0% y/y reading in May. The CPI was up 1.1% y/y in June, a slight drop from 1.3% in May. CNBC recently reported that this rapid in inflation, the largest since 2008 for the PPI, has caused negative profit margins for some companies and others are barely holding their head above water. As we have commented before, data shows that China's economy is slowing, which could cool demand for commodities such as copper. Efforts to jump-start the economy, which we also discussed in a prior post, have both potentially inflationary and deflationary effects on metals prices. AEGIS believes that China's ability to get the economy going again depends ons its ability to rein commodity prices, and thus PPI. China's next important release of economic data, including Q2 GDP, will be 9PM CST on Wednesday, July 14. The forecast (according to investing.com), is for 8.1% y/y increase in GDP. A positive (or negative) read could reflect heavily on market participants view of metals prices, and thus expectations of inflation. |