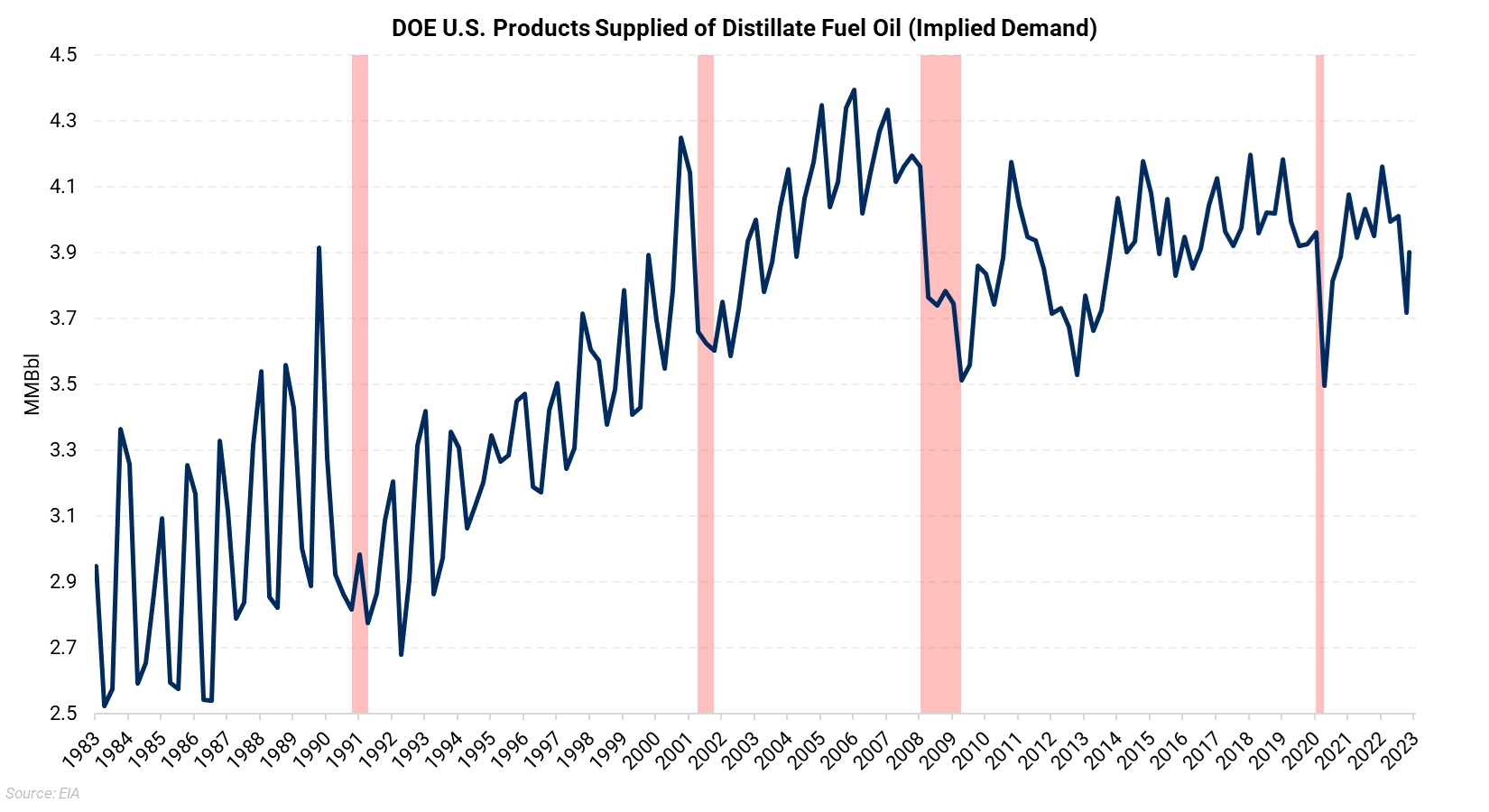

The chart above shows how diesel demand has contracted during periods of economic slowdown. Noteworthy examples include the postwar recession of the early 1990s, the manufacturing downturn in 2001, the 2008 financial crisis, and the pandemic.

While the global oil market remains set to tighten in 2H2023, diesel, the fuel that drives the industry, is failing to gain pace in the upswing. Demand for diesel, which powers everything from commercial trucking fleets to construction equipment, has not kept up with broader oil demand recovery.

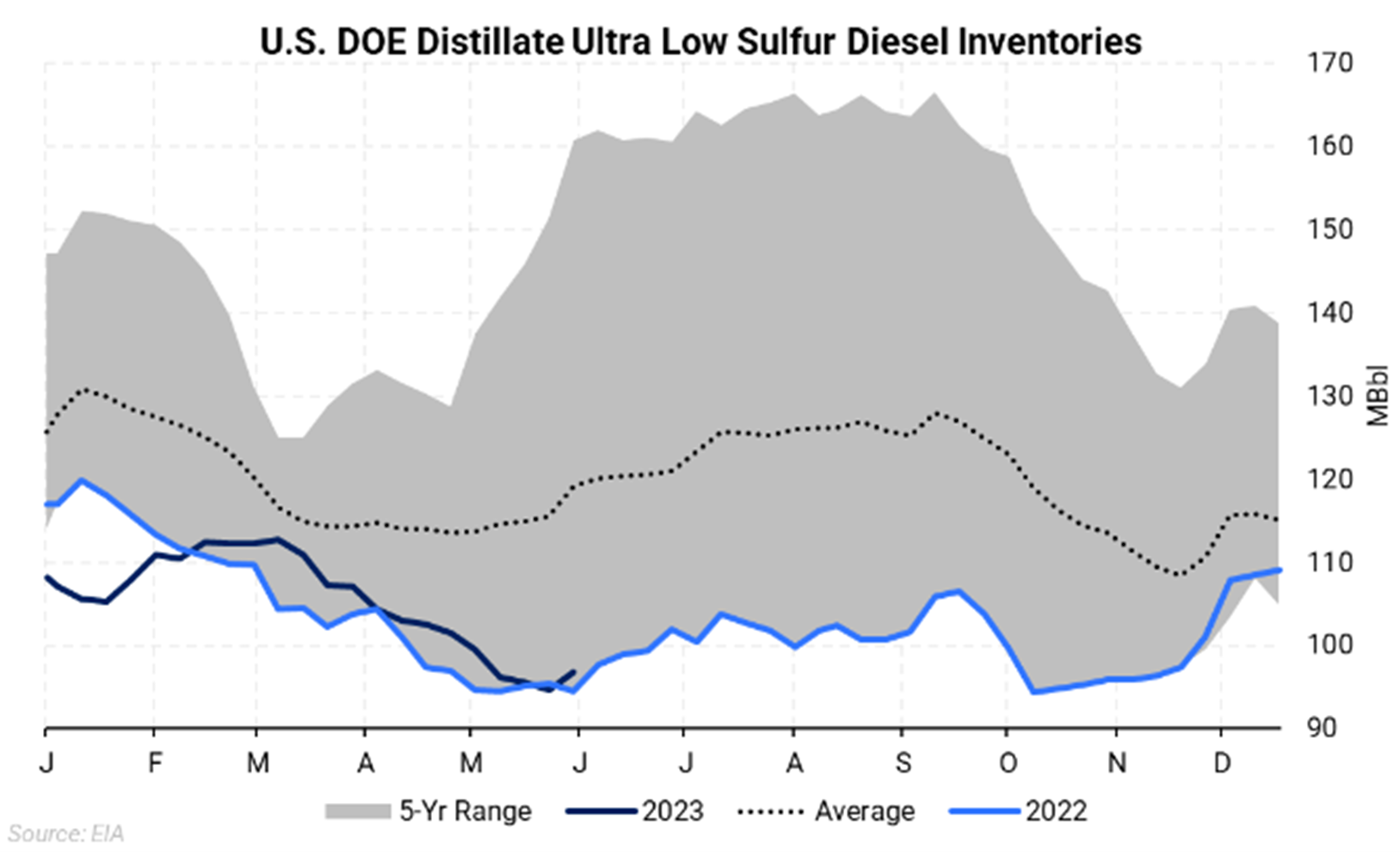

Seasonal U.S. distillate demand remains about 8% below the five-year average. The EIA, in its May STEO report, said that the diesel demand for 2H2023 is expected to be below the 2015-2019 average and then fall further in 2024. However, DOE distillate stocks for NY Harbor ULSD are still about 16% below the five-year average. Despite low diesel inventories, prices may have weakened due to persistently low demand— likely a result of seasonal variations in consumption, economic downturns reducing demand for goods and services (therefore freight transport), and resilient but cheap Russian fuel exports. Moreover, market expectations about future supply or demand could have also influenced prices.

|

|

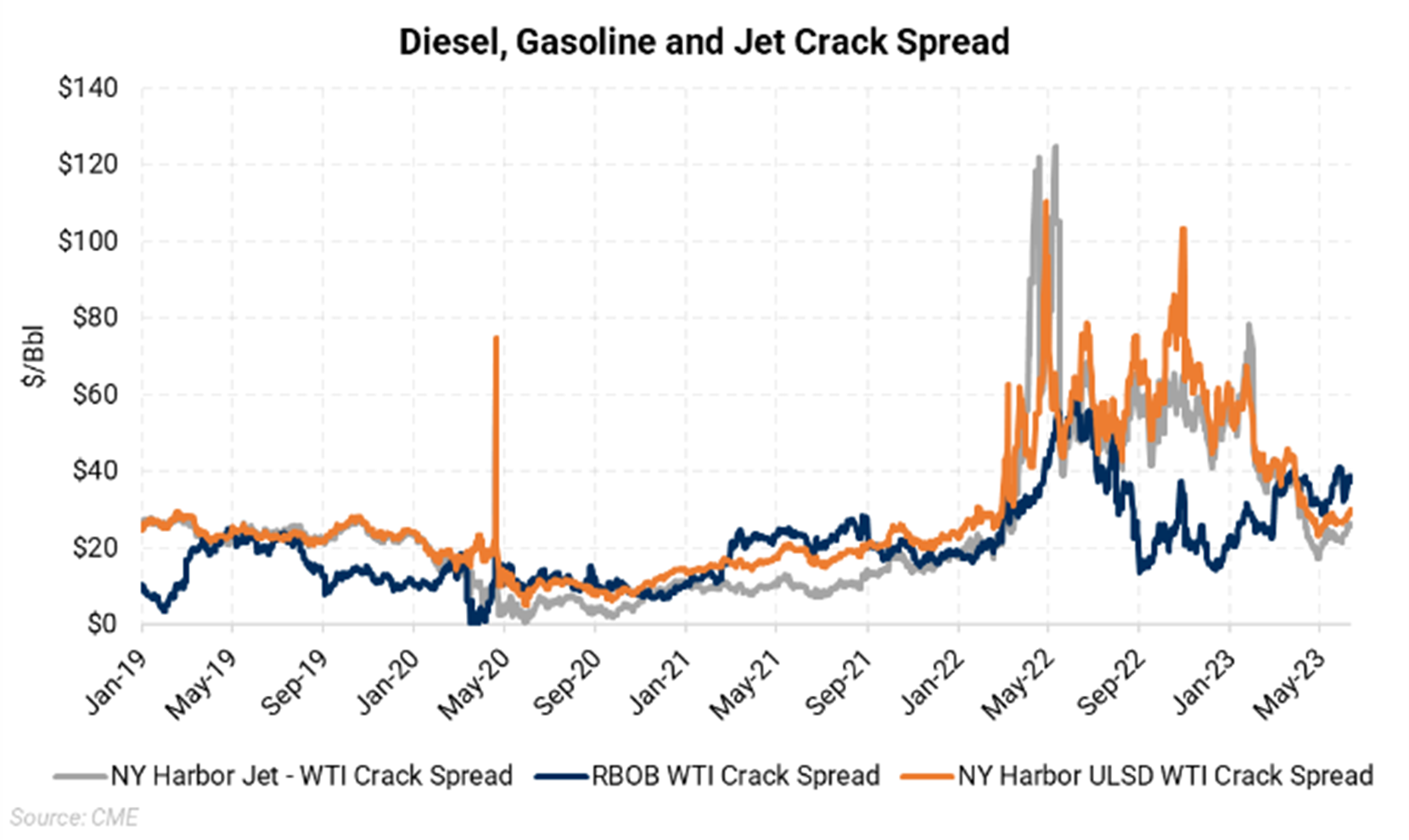

Meanwhile, refining margins are slowly recovering, and the expected rise in gasoline and jet fuel margins in anticipation of a stronger summer travel season might trigger an uplift in crack spreads. This could encourage refiners to increase the production of these alternatives. Nonetheless, there is enough inventory in place for gasoline and Jet to meet the demand. Jet fuel demand’s estimated at 1.1. MMBbl/d growth in 2023 is one of the key drivers behind the global oil demand growth estimates for 2023.

Furthermore, China, the largest crude importer, is also witnessing a decline in diesel demand. Data from the Ministry of Transport indicates a reduction in the number of trucks running on highways in addition to weak manufacturing activity in March. Similarly, European diesel's premium to crude futures recently dipped to the lowest level in over a year.

Yet, the sluggish industrial activity and strong mobility expected during the summer driving season have created a gap between gasoline and diesel demand. According to IEA, global gasoline demand is forecast to climb by 0.49 MMBbl/d this year. Conversely, gasoil (diesel) is expected to decline by 0.05 MMBbl/d. Thus, even as global oil demand growth is expected to increase by 2.2 MMBbl/d in 2023, diesel demand struggles to keep pace.

If you have any questions regarding how AEGIS can help your company protect itself from floating price risk during this time of unprecedented volatility, reach out to info@aegis-hedging.com.