Eastern Gas (formerly Dominion) South Prices have trended higher over the past few months as supply fell and egress constraints eased.

Recent Situation – The seasonal strip chart below is a great tool to see how prices reacted following recent announcements. Note: We use Eastern Gas to discuss price action in Appalachia, serving as a proxy to other named hubs.

- (September 25, 2024) EQT plans to reverse some production curtailments in October and November as demand and prices rise. The company had previously curtailed significant volumes since last spring due to the weak price environment.

- (September 16, 2024) The 1 Bcf/d Cove Point LNG export facility in Maryland is expected to go down from September 20 through mid-October. This loss of demand could weigh on Northeast basis pricing.

- (July 24, 2024) EQT will continue to keep some production curtailed into the second half of the year. After cutting output by about 1 Bcf/d in February, EQT announced they will keep about 0.5 Bcf/d curtailed. EQT's CFO described the move as a response to market fundamentals and noted the large storage surplus in Northeast inventories.

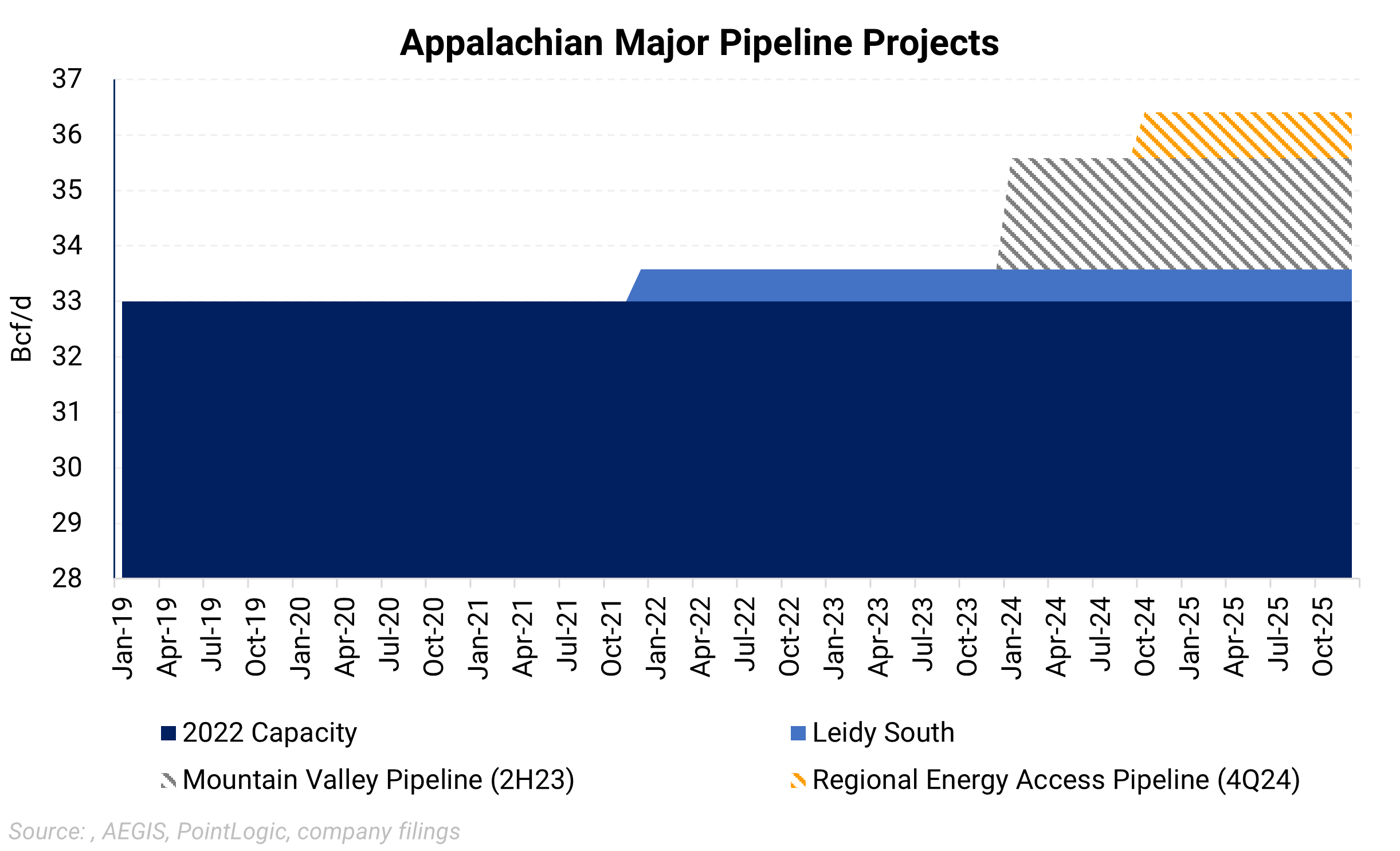

- (June 11, 2024) Transco requests approval to bring another 160 MMcf/d of capacity online by July 1 on the Regional Energy Access expansion, connecting supply to demand centers in the Northeast. The expansion is expected to be fully operational by Q4 2024.

- (June 10, 2024) Mountain Valley Pipeline has requested FERC approval to commence commercial operations on June 11, 2024, with the project mechanically complete and final segments being purged and packed with gas.

- (June 4, 2024) Northeast production is showing signs of recovery after a weak start to summer. Some have speculated thar EQT is returning some curtailed volumes to the market, in advance of higher power sector gas demand and the startup of MVP.

- (May 7, 2024) On May 1, a rupture occurred during hydrostatic testing of the Mountain Valley Pipeline, potentially delaying its operational start

- (May 1, 2024) DT Midstream announced an expansion of the Stonewall gas gathering system, increasing its capacity and adding a new interconnect with the soon-to-be-operational Mountain Valley pipeline, to enhance its 68-mile, 1.5 Bcf/d pipeline and support mid-Atlantic market growth driven by data center and AI demand

- (April 12, 2024) Texas Eastern (TETCO) maintenance hinders the Northeast’s ability to shed its inventory surplus

- April 2024: Outage from Gladeville to Athens impacts flow; Gladeville station outflows are 100 MMcf/d less than in April 2023 and March 2024, with station utilization at 81% up to April 11, compared to 93% in April 2023.

- April 15-23, 2024: Hanover Lease station's capacity reduced to 300 MMcf/d, down from over 500 MMcf/d early April.

- April 26-May 25, 2024: TETCO’s Line 40-G VS4 is set to see a 21-day outage starting during the 30-day window from April 26-May 25. Enbridge says “the outage duration of 12 days may be extended due to unforeseen issues such as pipeline conditions or sea/weather conditions."

- (February 21, 2024) Equitrans delayed the 2 Bcf/d Mountain Valley Pipeline startup from late 1Q 2024 to 2Q 2024, with completion targeted by May 31, 2024, due to unforeseen construction challenges and severe winter weather

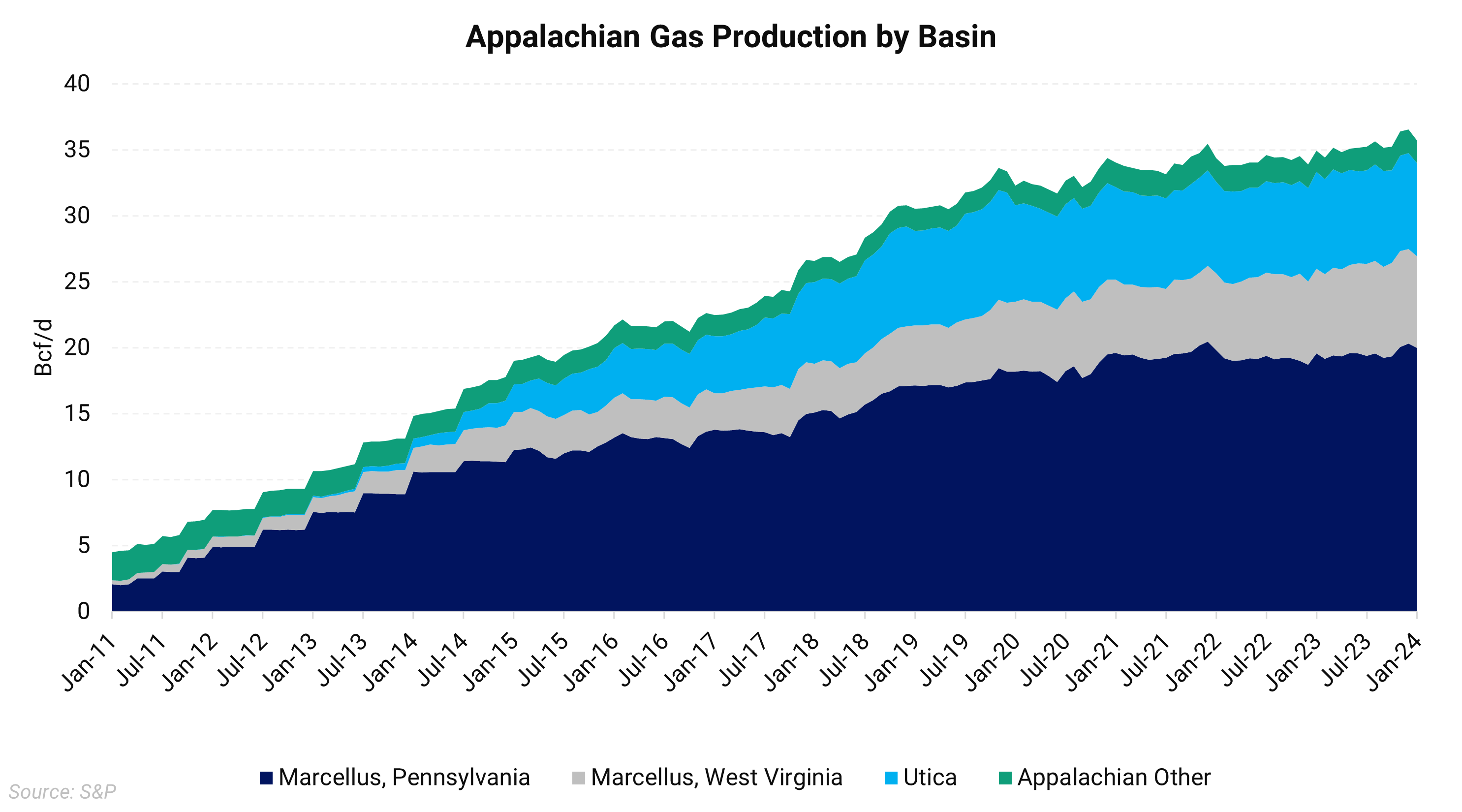

- (January 17, 2024) The January 2024 EIA report forecasts Appalachia's natural gas production will see the largest drop among U.S. shale regions, decreasing by 159 MMcf/d from January to February.

Price

January 13, 2025 - Prices have strengthened lately, with prompt month Eastern Gas South basis rising to the highest level since earlier this year. Weather-driven demand gains have supported price, with January 2025 being one of the coldest January of the past 25 years. Despite the strength in the front of the curve, Winter '25/'26 and Summer '26 have started to give up gains in recent weeks.

Price Location: Eastern Gas (Dominion) South

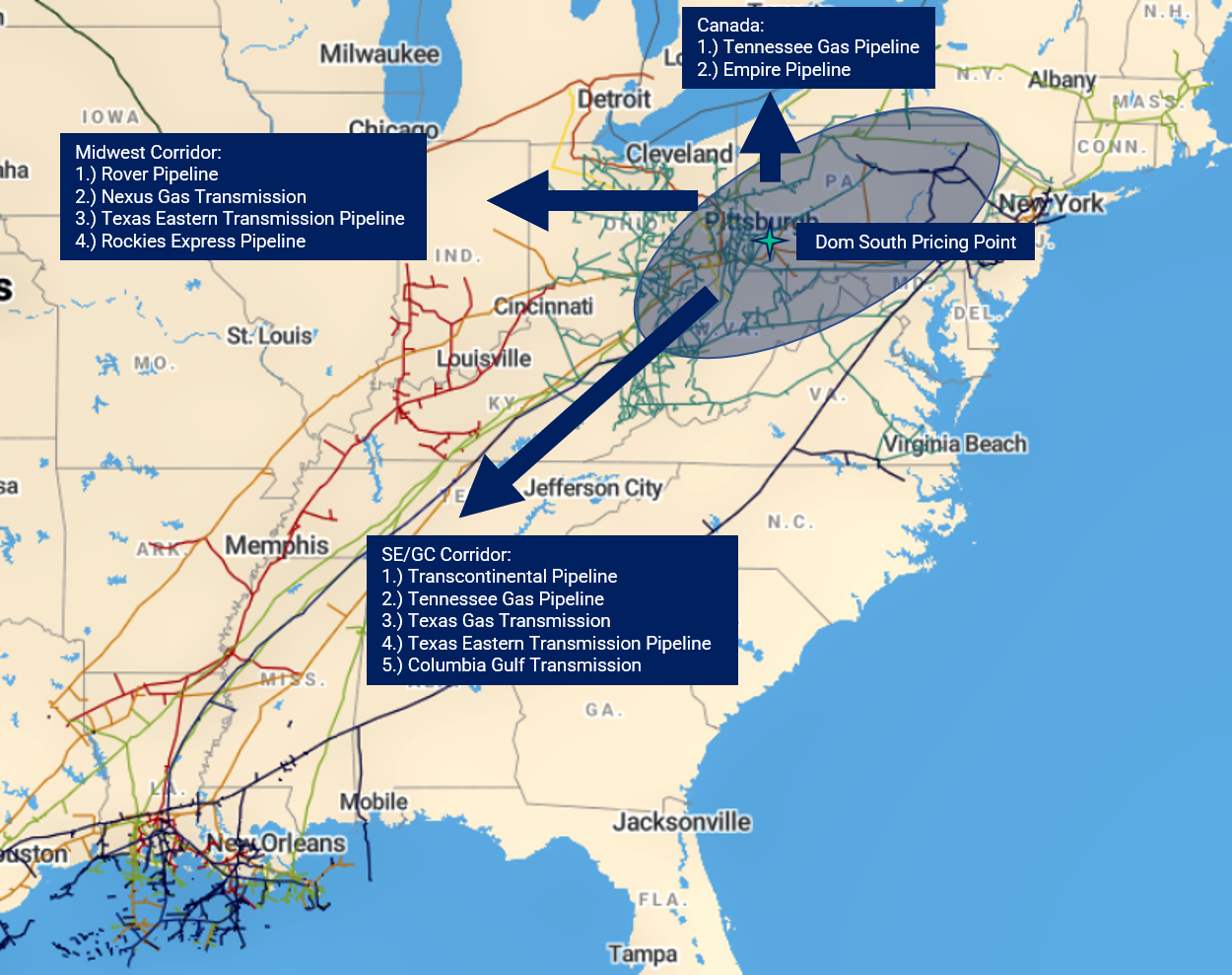

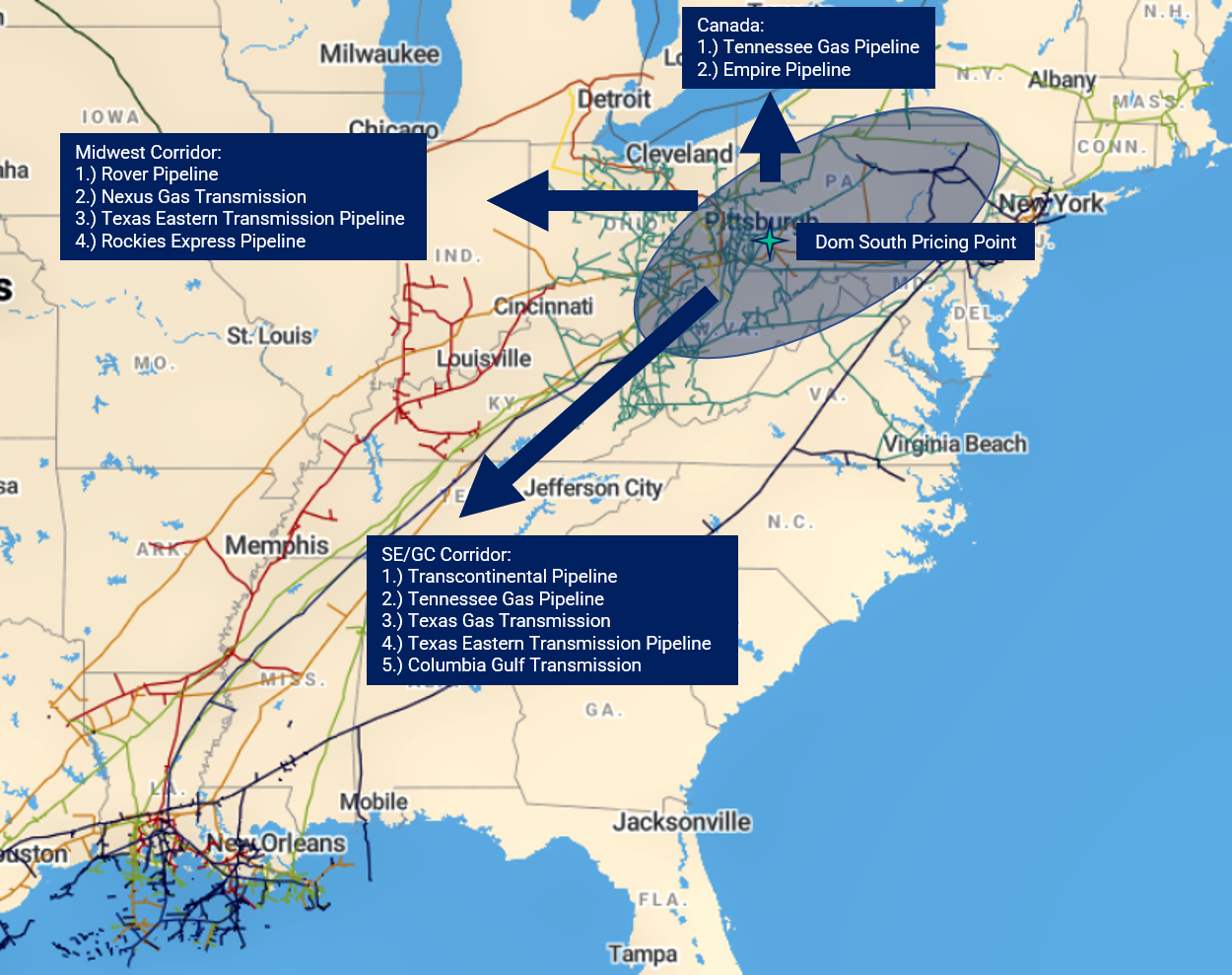

The Eastern Gas (Dominion) South point is located in the Appalachian Basin, near Pittsburgh, PA, and serves as a liquid proxy for Northeast gas basis. The Northeast gas market has undergone dramatic changes over the last several years. The pipeline map shows the different corridors out of the Appalachian basin as well as the Eastern Gas (Dominion) South pricing point. The shaded circle is where the bulk of the Appalachian supply is located.

Market Influences

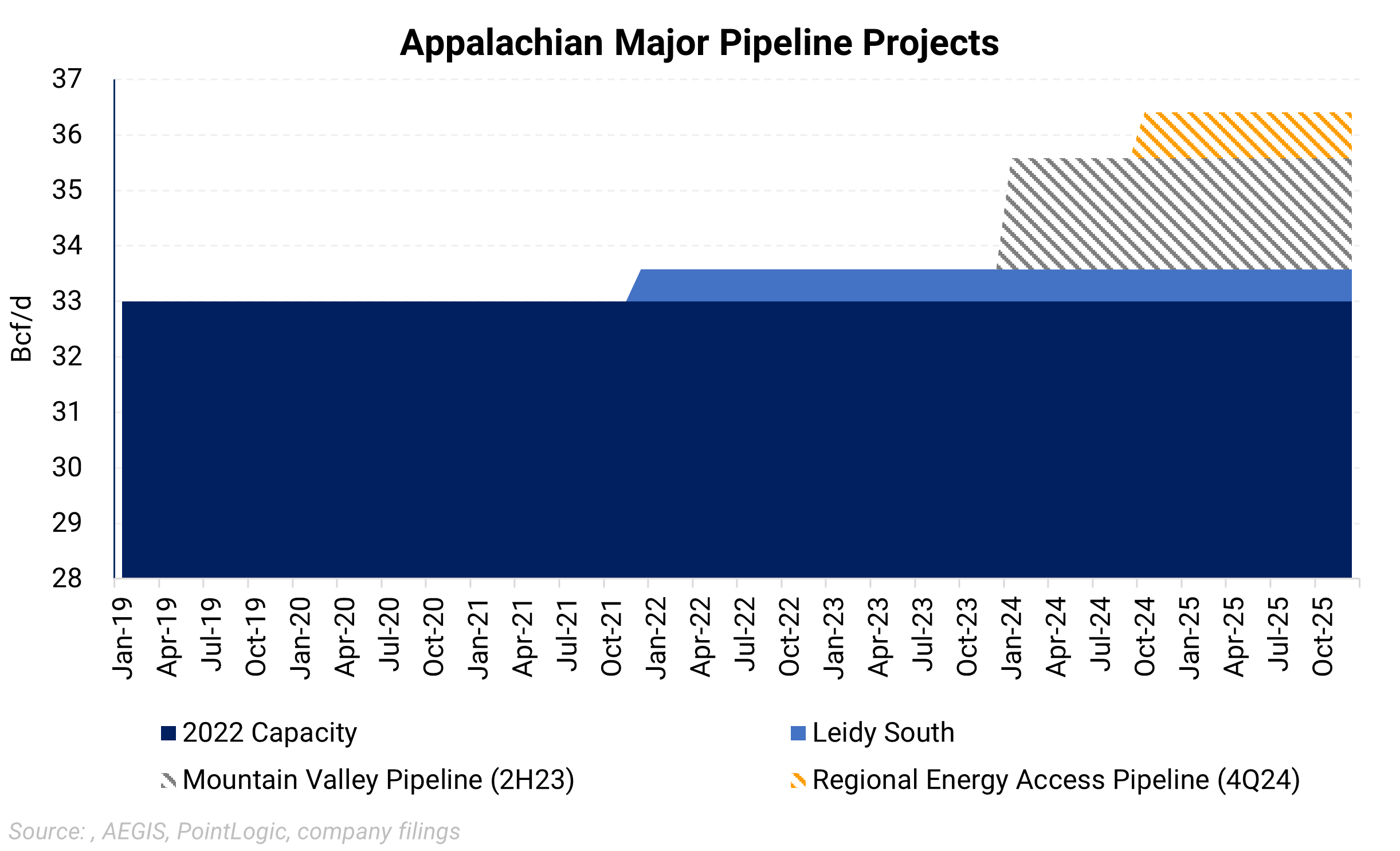

The in-service dates for the pipelines in the chart above were compiled using each company's investor presentations.

Mountain Valley Pipeline, which started up this summer, is now flowing about 1 Bcf/d onto Transco. This may be the last big pipeline project out of the Northeast for some time.

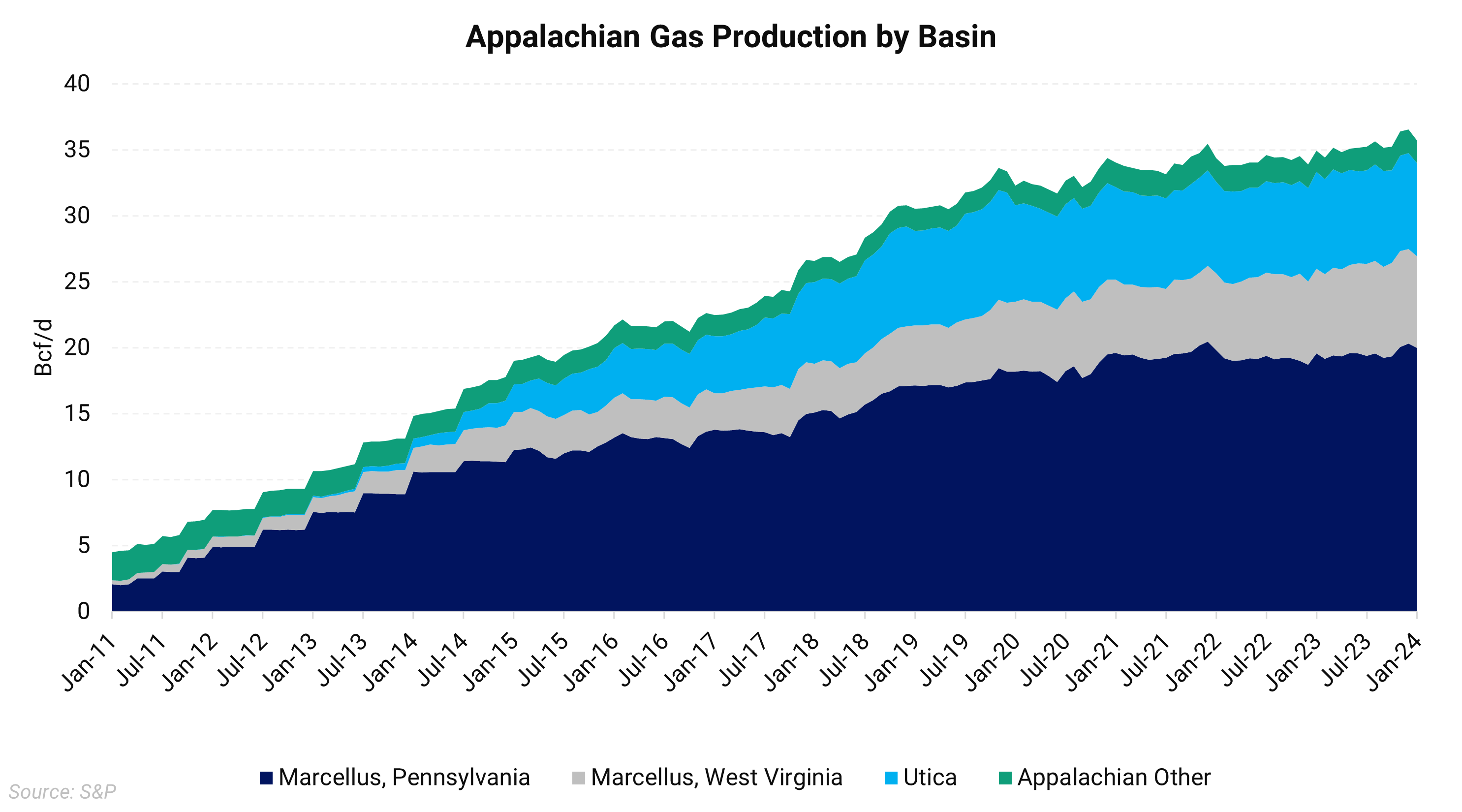

The basin's supply base has been growing rapidly for the last ten years and is finally showing signs of depletion or at least slowing production growth.

Recent Infrastructure Announcements

Mountain Valley Pipeline – The pipe will begin filling with gas this month (June 2024) and is expected to start commercial service as well.

The Mountain Valley Pipeline (MVP) project is a natural gas pipeline system that spans approximately 303 miles from northwestern West Virginia to southern Virginia and will bring nearly 2 Bcf/d of takeaway capacity from the Appalachian basin to the mid-Atlantic markets. The pipeline has faced numerous court challenges throughout its life, which is why it is now two years beyond the original in-service date of 4Q2018. MVP will not flow at full capacity until downstream constraints on the Transcontinental pipeline are alleviated over the next few years.

PennEast Pipeline - Cancelled

Regional Energy Access Pipeline - Williams announced that the Regional Energy Access Pipeline is on track to enter in-service during the fourth quarter of 2024. The 829-MMcf/d pipeline will help serve residential, commercial, and power demand in Pennsylvania, New Jersey, and Maryland.