| |

|

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here.

|

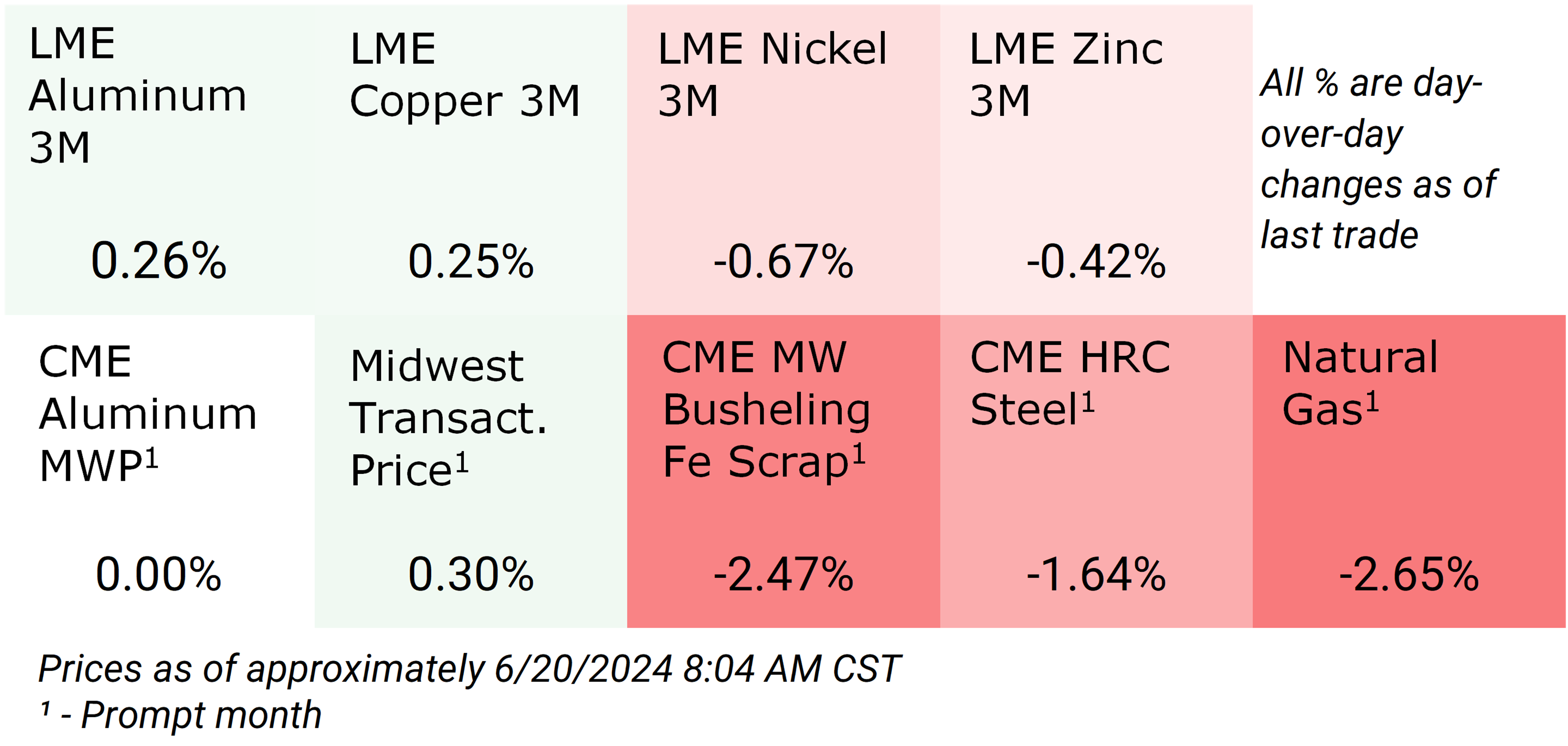

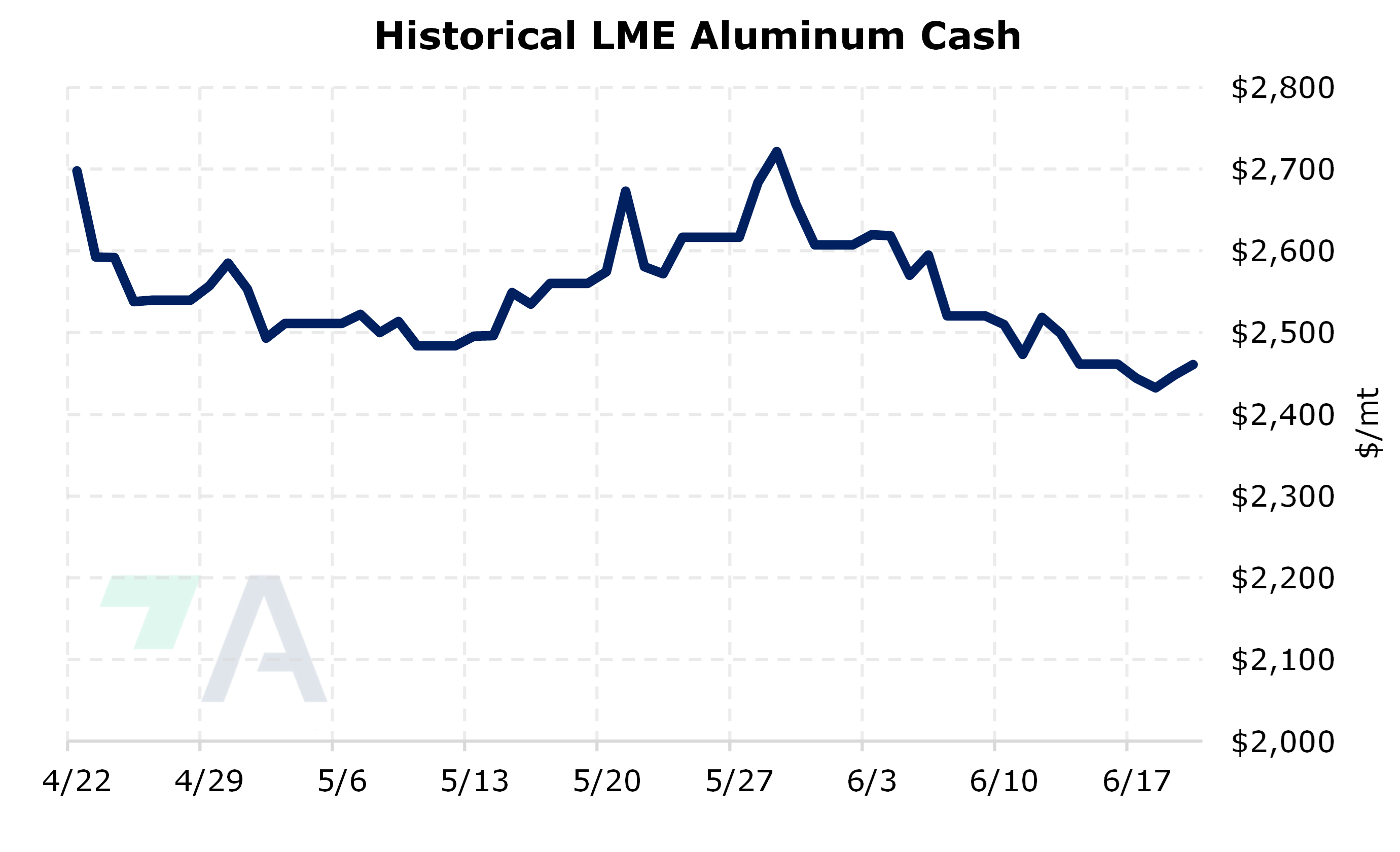

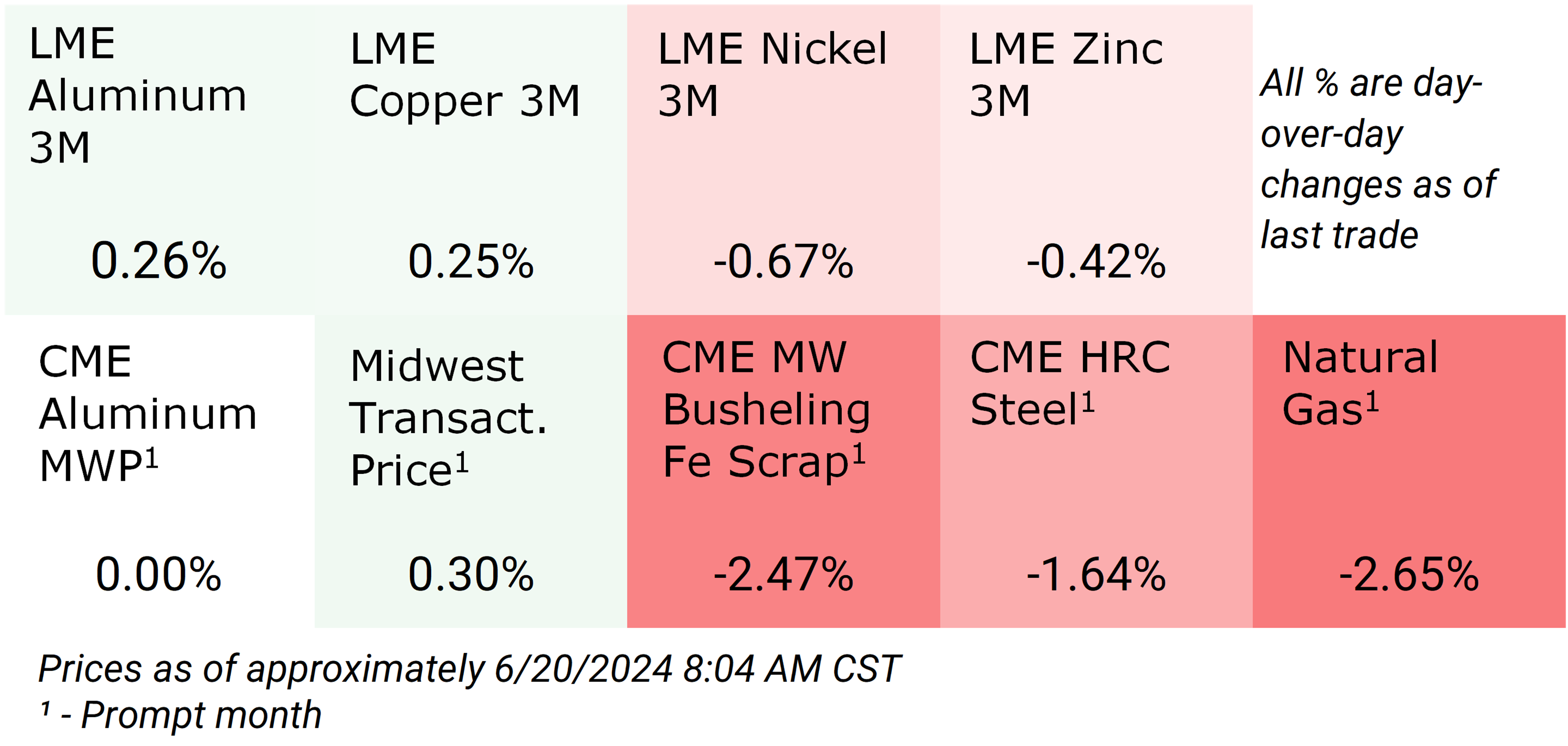

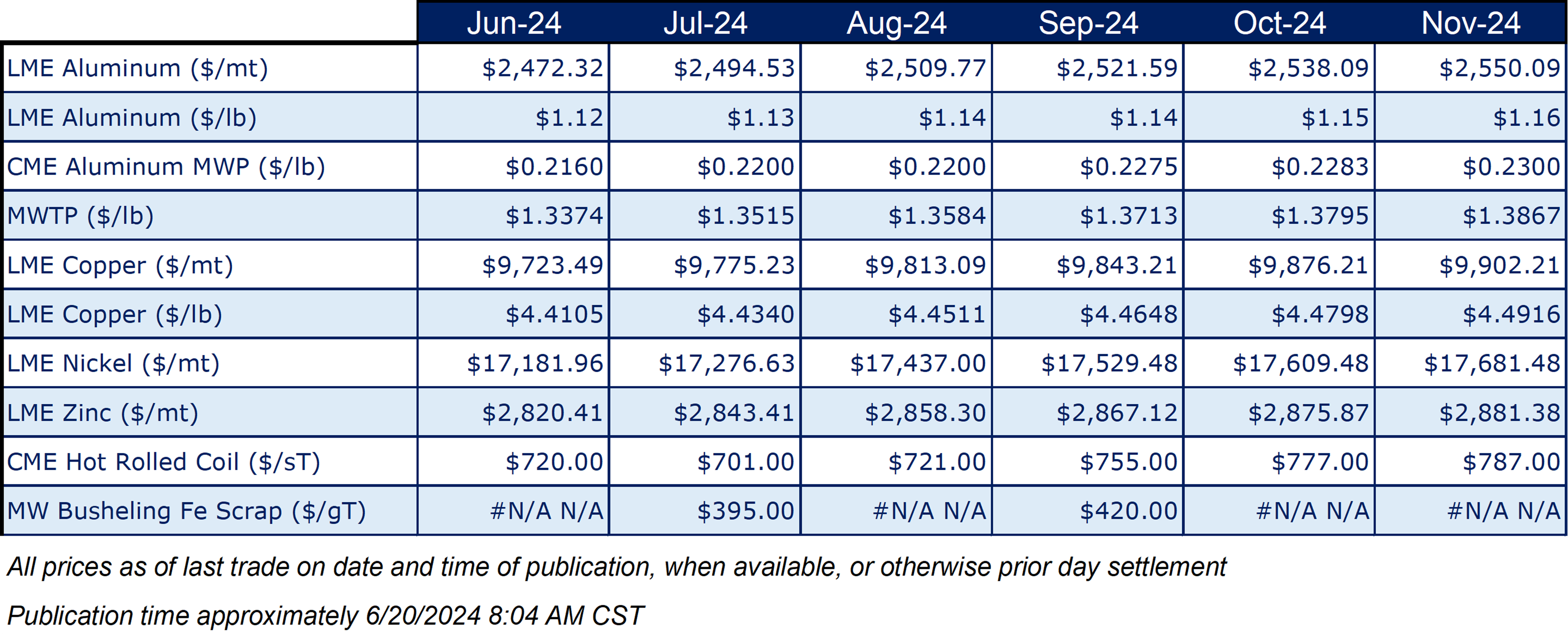

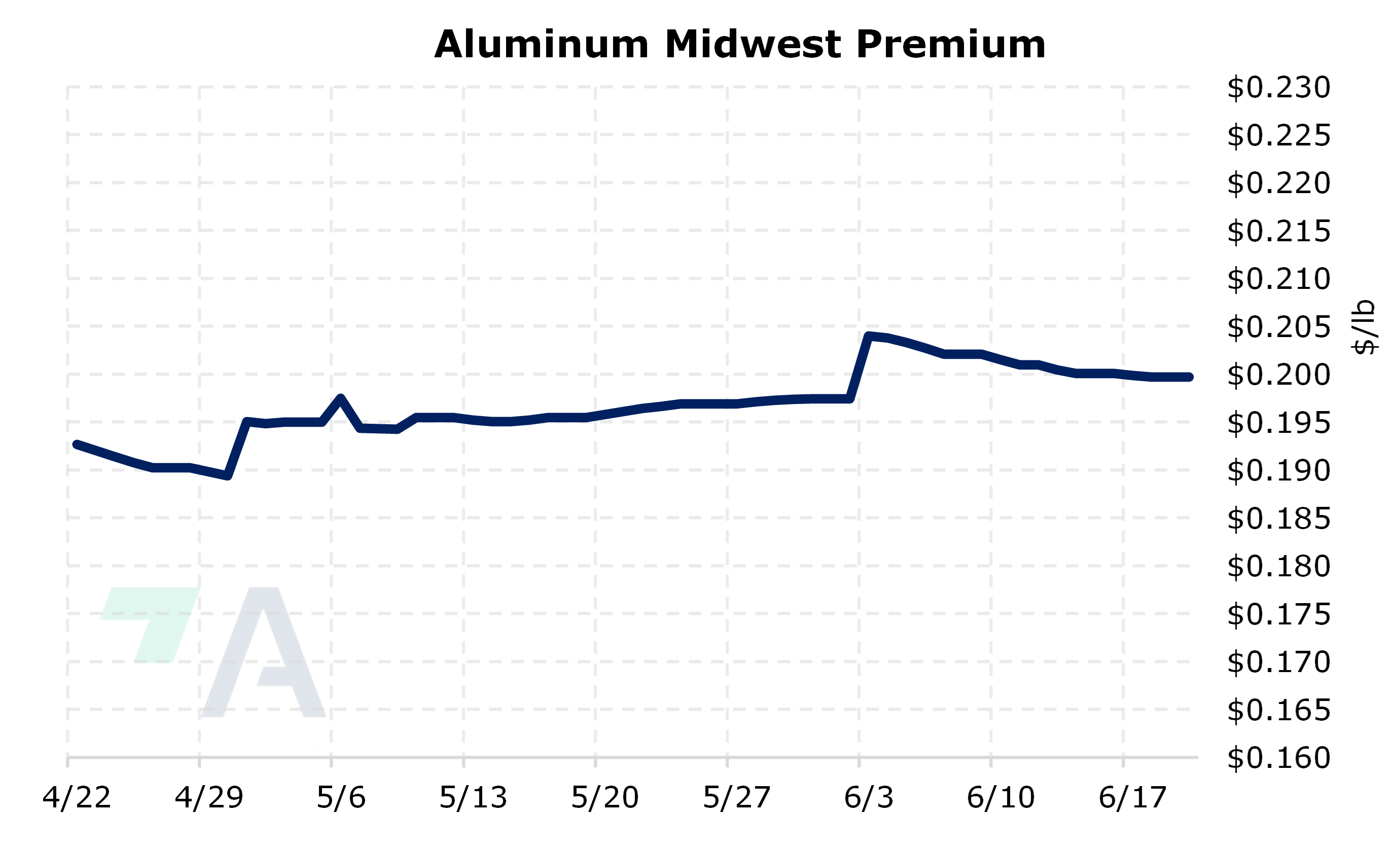

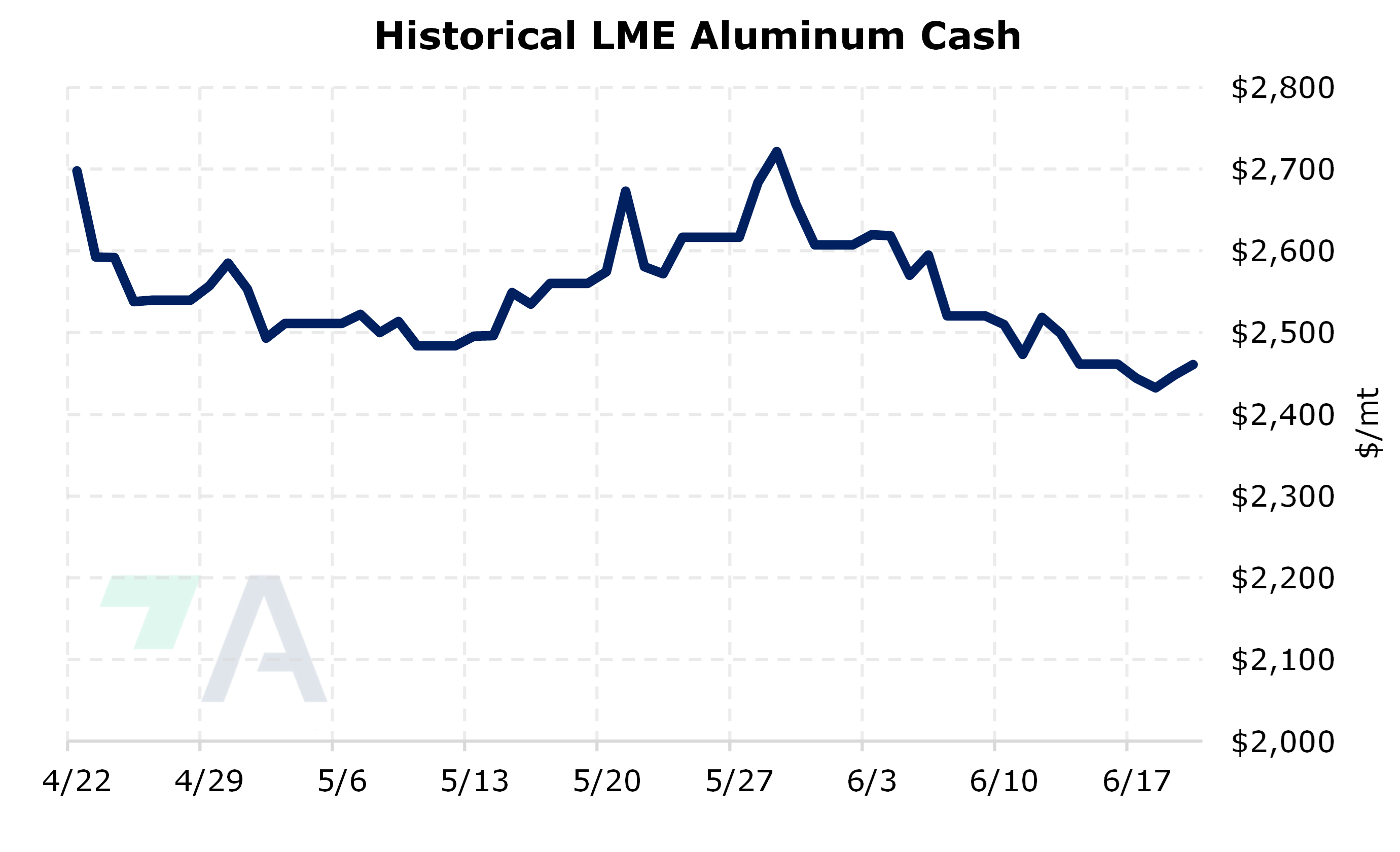

- LME Aluminum 3M Select is up $13.34/mt, extending gains from yesterday

- Last trade was $2,461/mt (9:00AM CST)

-

Aluminum trades higher amid optimism over potential stimulus measures aimed at bolstering China's economy, as discussed by Chinese officials and analysts. The People's Bank of China is exploring ways to enhance liquidity through government bond trading, potentially boosting infrastructure investment and industrial metal demand amidst a sluggish economic backdrop. (Source: Bloomberg)

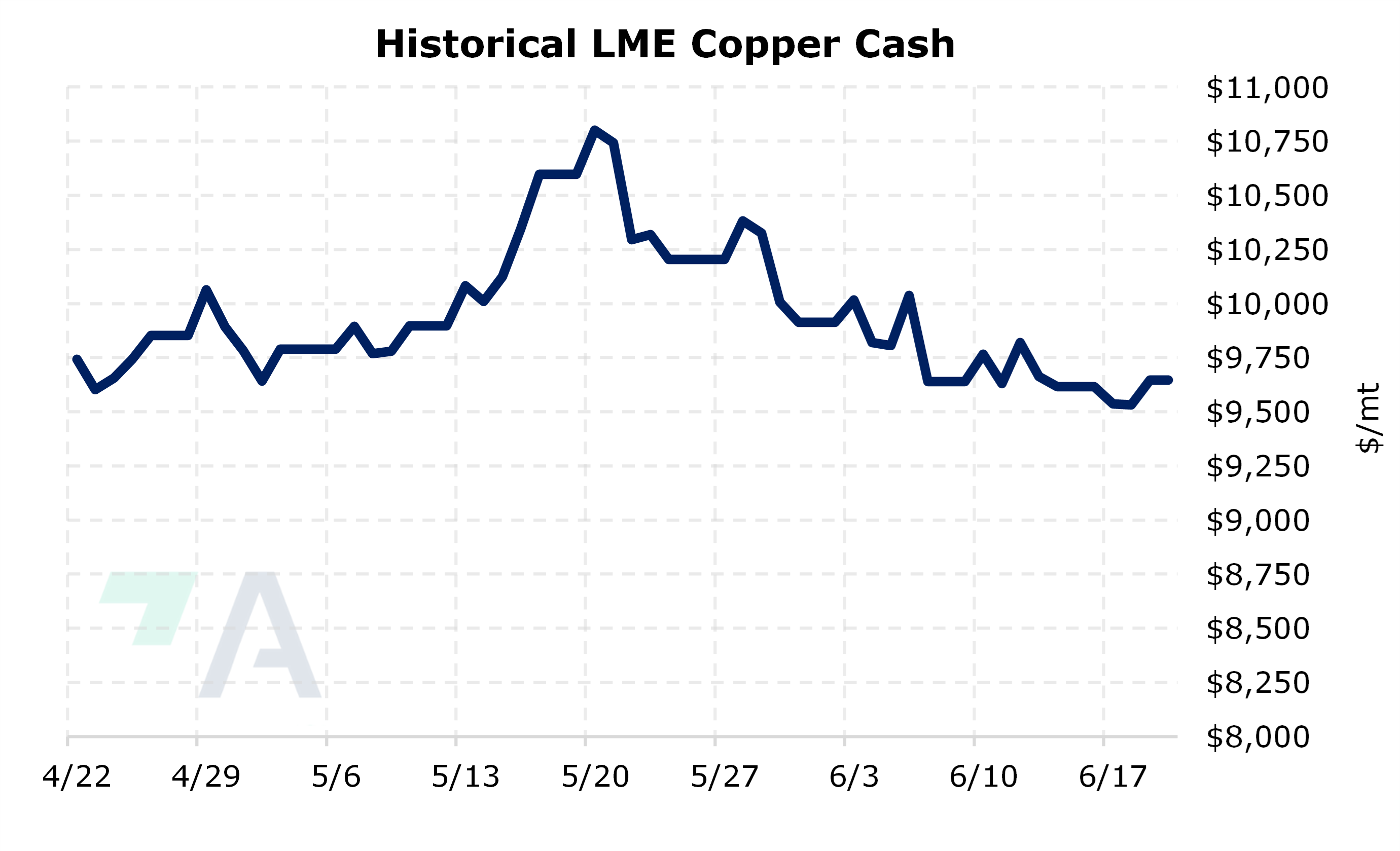

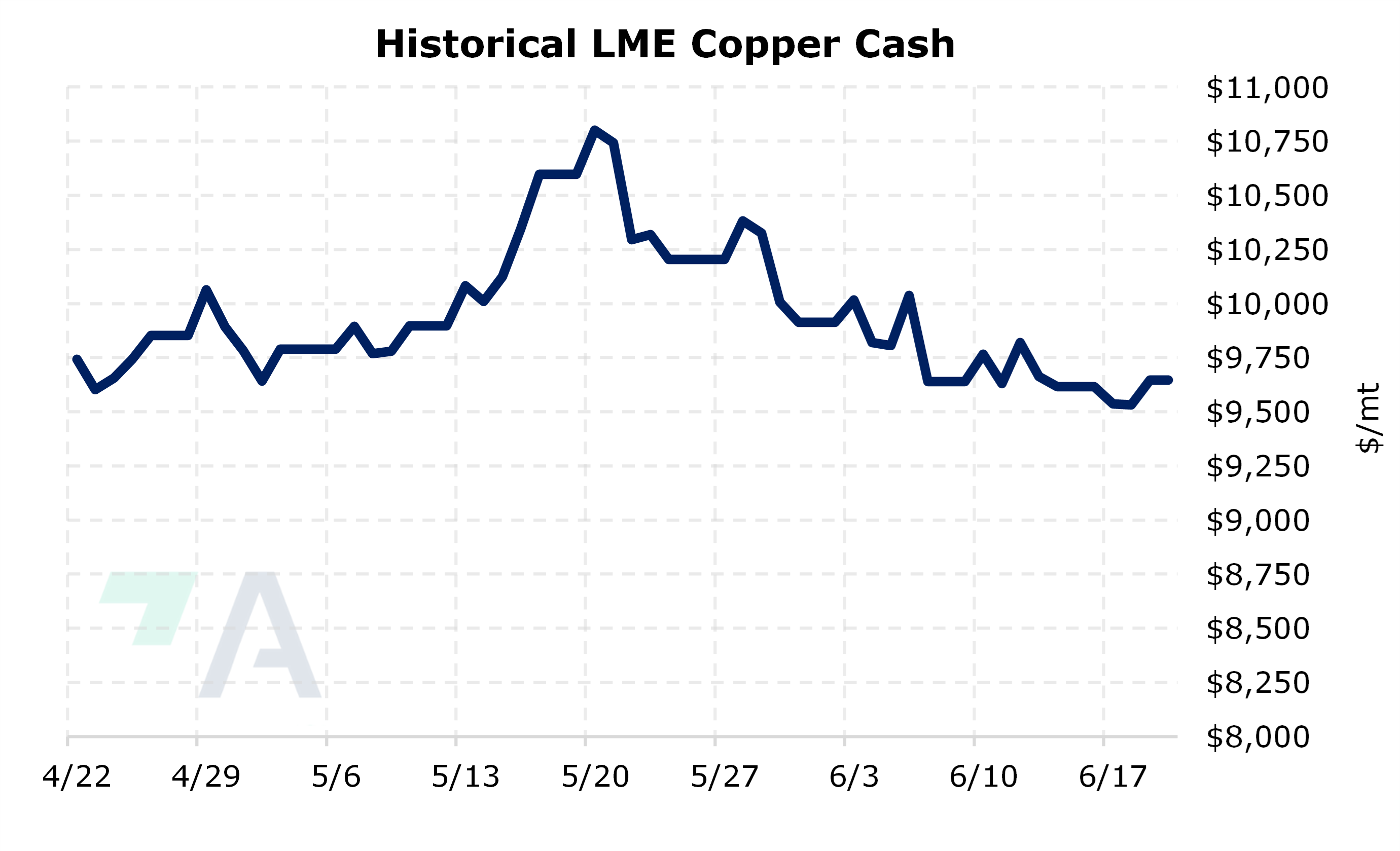

- LME Copper 3M Select is down $0.86/mt, as prices recover from near two-month lows

- Last trade was $9,646.35/mt (9:00 AM CST)

-

Copper prices held steady in London as traders monitored disruptions in mine supply and negotiations between Chilean miner Antofagasta Plc and Chinese smelters for lower refining fees in the second half of the year. Despite recent record highs, copper prices have fallen 12% due to weak domestic consumption in China and increased copper scrap imports. The market remains well-supplied globally, but concerns persist over shortages in US Comex warehouses, driving spot prices higher relative to futures contracts and potentially squeezing short positions. As of 11:32 a.m. local time, copper traded at $9,789 a ton on the LME, amid mixed trading in industrial metals. (Source: Bloomberg)

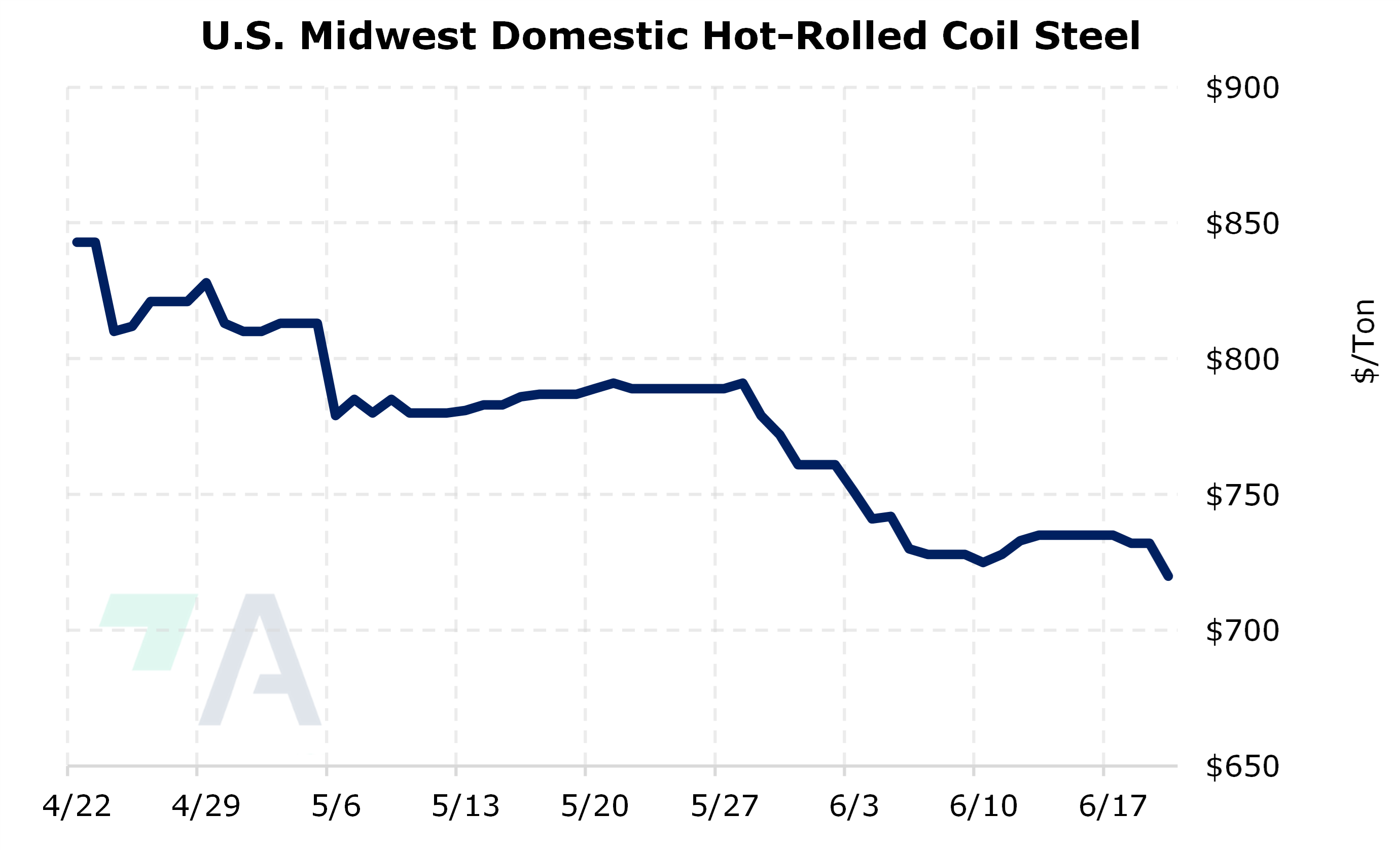

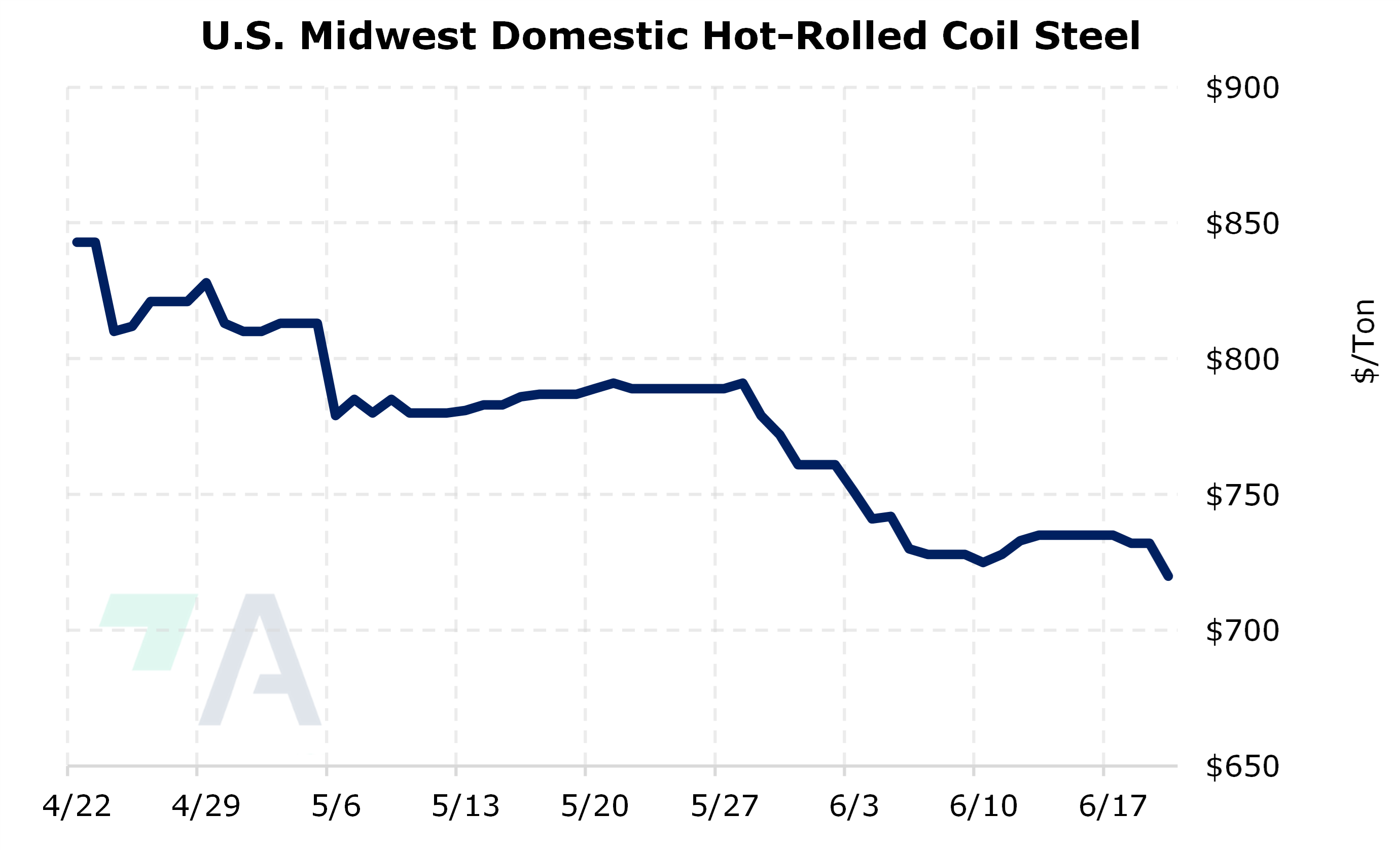

- Prompt month CME HRC Steel last traded at $720/st, the lowest since October 2023 (9:00AM CST).

- Iron ore prices rose for a second straight day as optimism grew around potential revival in Chinese steel demand, influenced by recent government measures to stimulate real estate markets. Despite falling housing prices and mixed steel production figures, analysts anticipate possible output curbs on steel production by Beijing, which could improve profitability for steel mills and support higher iron ore prices (Source: Bloomberg)

|

Price Indications

|

|

|

|

Today's Charts

|

|

|

|

|

AEGIS Insights

|

|

5/29/2024: AEGIS Factor Matrices: Most important variables affecting metals prices

5/2/2024: Important US Economic Data (AEGIS Reference)

4/25/2024: Mexico's New Tariffs on Steel and Aluminum Imports Create Uncertainty in US Markets

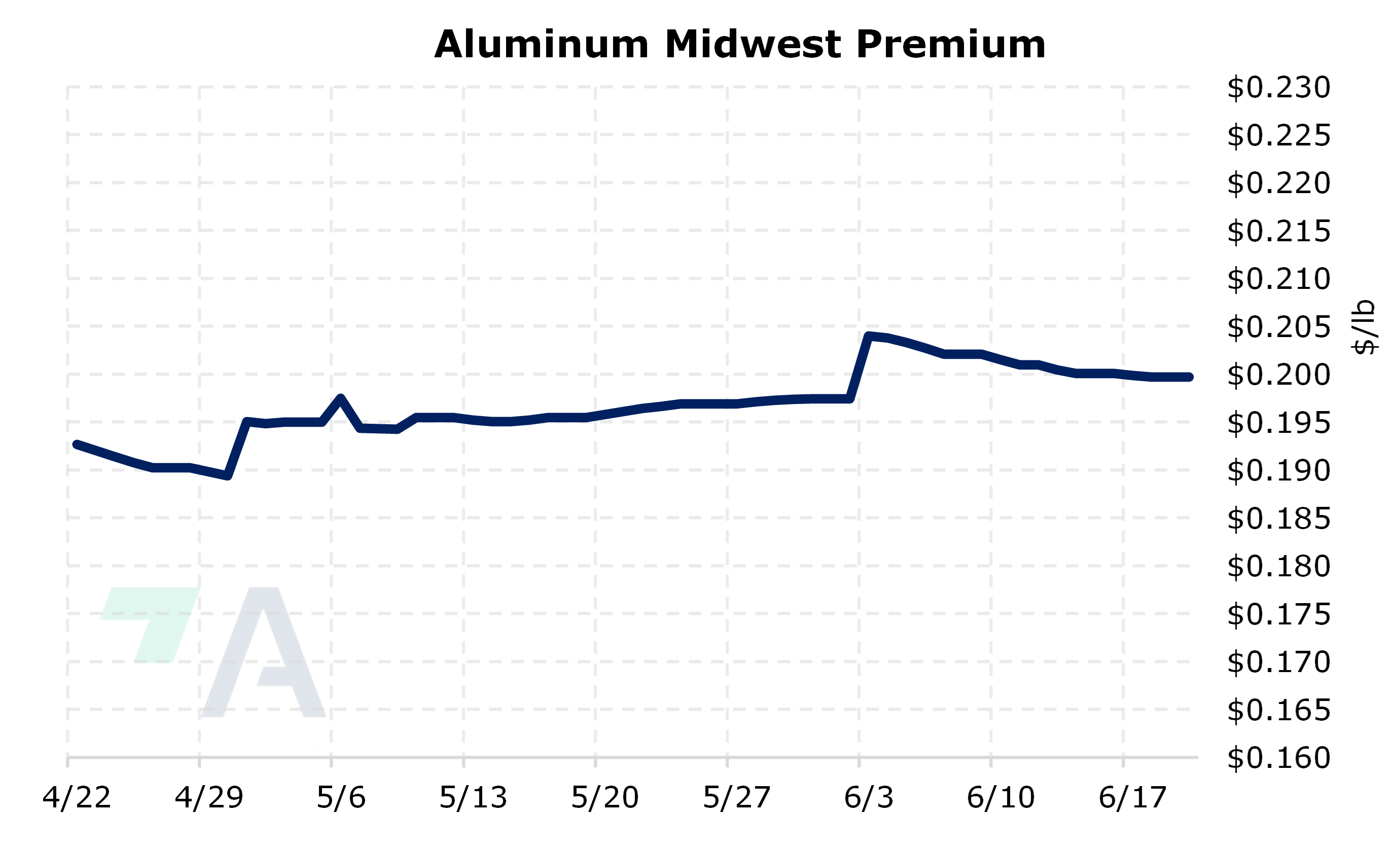

3/20/2024: Midwest Premium Buyers Should Hedge While Prices Hover at 3-Year Lows, and Demand Appears To Be Stabilizing

2/27/2024: Aluminum Consumers Should Still Implement Hedges, Even Though Russia Sanctions Mean Little

|

|

| Important Headlines |

|

6/4/2024: Volvo to issue world's first EV battery passport ahead of EU rules

6/4/2024: South Korea, Africa leaders pledge deeper ties, critical mineral development

6/3/2024: The PMI of the domestic aluminum processing industry recorded 41.7% in May | Shanghai Non ferrous Metals

6/2/2024: Nippon Steel's Mori returns to US this week for talks on US Steel takeover

|

|

|

|

Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as “edge,” “advantage,” “opportunity,” “believe” or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.

|