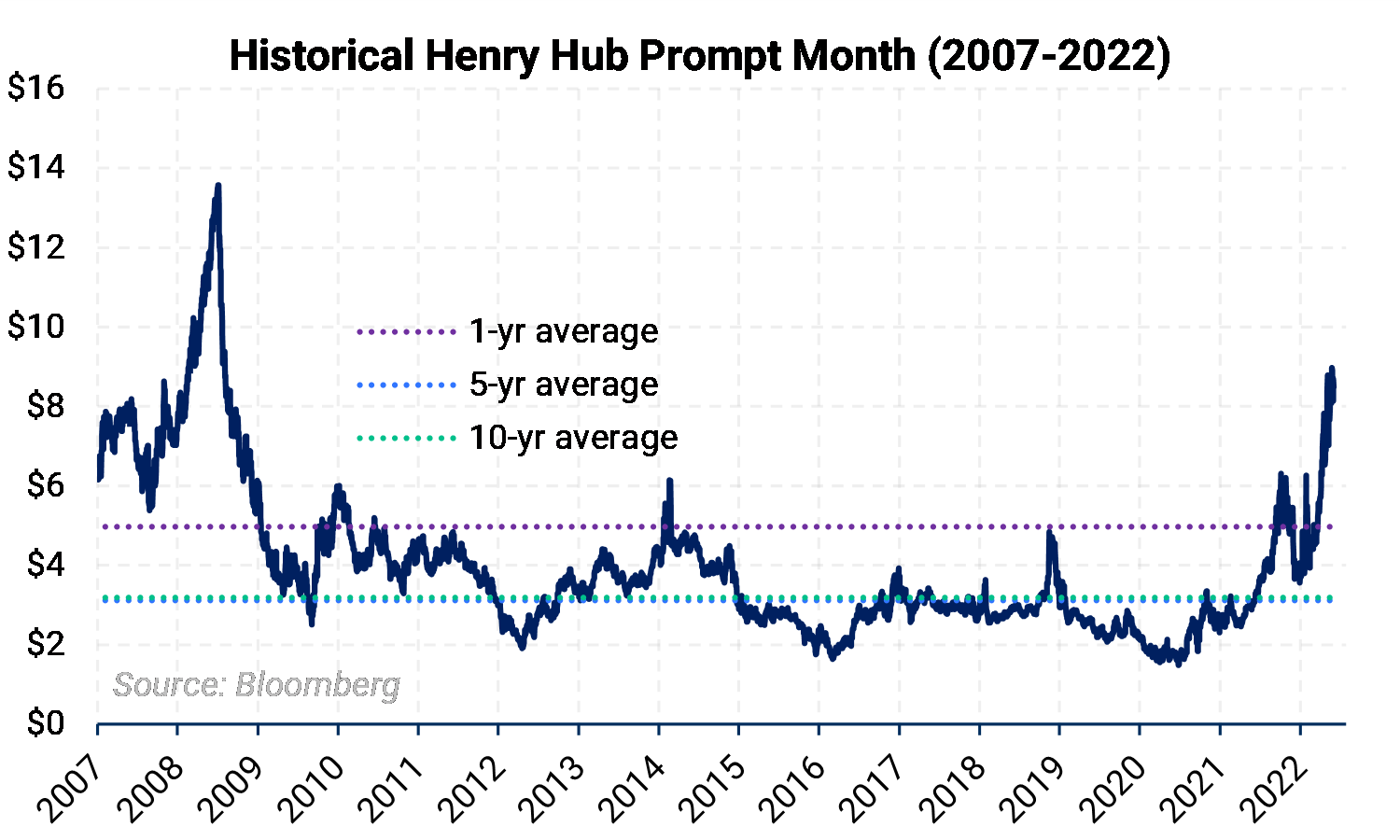

Extreme volatility has driven great uncertainty and resulted in changes in how producers and consumers execute and plan their hedging strategies.

Challenges

Price volatility causes swap dealers – those with whom you make hedging trades – to rethink how they offer hedges. But, there are ways to mitigate these challenges.

Tighter credit policy. Every hedge AEGIS conducts on behalf of clients is done over-the-counter (OTC) with banks or merchant traders. Increased volatility has reduced the ability of many counterparties to extend additional credit. When market uncertainty increases, traders’ margin requirements increase, thereby reducing the ability to trade without posting additional capital. Read more here (Oil Market Volatility Reduces Liquidity).

“Wider” markets. Many clients are experiencing wider mid-to-bid indications from counterparties. This means the price you are offered by a hedging counterparty may appear to be worse than the published price from exchanges. A greater spread between what the counterparties offer and what is considered “fair value” could cause some to second-guess executing the hedge. However, higher prices have helped mitigate this hurdle, as we discuss later.

Onboarding delays. Those needing to add counterparties are sometimes experiencing longer lead times. AEGIS can often minimize delays because we pay constant attention to the process, working with counterparties daily to help expedite. The process from the first step, counterparty introduction, to the last step, being able to execute hedges, can now take six to nine weeks on average. In the past, the average ISDA** negotiation, or onboarding process, would take between three and six weeks. Each client is unique and lead times will depend on many factors.

Both natural gas and oil prices are at or above decade highs. Producers have been locking-in higher prices and consumers have been working to protect against further price rallies.

|

|

|

Benefits

Higher prices. Producers for both oil and gas are often able to hedge into prices not seen in over a decade. The previously mentioned bid-mid (or bid-ask, as most understand it) spread inflation from counterparties becomes less of an issue when prices run higher.

Option skew. The reward for “extrinsic value” is higher than normal. For gas producers, call-option values, relative to put-option values, have traded at much higher premiums. What does this mean? It allows producers to hedge with costless collars that provide much more upside participation than in previous time periods. In contrast, this phenomenon is a hedging challenge for many consumers. Their traditional call-option strategy to protect against rising prices is currently quite expensive, but there are other choices available.

What to do?

Yes, hedging in today’s environment can be more difficult than in the past. But AEGIS helps navigate clients through the process to assess fair value. It’s not all about execution though. A reduction in credit capacity, or the number of volumes one can trade with a counterparty, can be lower as prices push mark-to-markets around. Get access to more trading partners can be key. Our trading team focuses on guiding clients to additional counterparties to entice competition and open up more credit. At AEGIS, our role is to help customers assess fair value, understand the trade-offs of various, approaches, and ultimately make a well-informed decision on how to best protect their organization in a highly volatile market.

** ISDA refers to the standard (plus custom modifications) International Swap Dealer’s Association Master Agreement that, among other things, governs how counterparties (usually swap dealers) and hedgers will trade financial instruments between themselves. Learn more at ISDA.org.

Disclaimer

Commodity interest trading involves risk and, therefore, is not appropriate for all persons; failure to manage commercial risk by engaging in some form of hedging also involves risk. Past performance is not necessarily indicative of future results. There is no guarantee that hedge program objectives will be achieved. No representation is being made that any client will or is likely to achieve hedge profits similar to those which may be discussed in this email. Certain information contained in this email may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as ‘edge,’ ‘advantage,’ ‘opportunity,’ ‘believe’ or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities. Neither this trading advisor nor any of its trading principals offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Hedge advisory services are performed by the registered commodity trading advisor Aegis CTA, LLC, a wholly owned subsidiary of Aegis Hedging Solutions, LLC.