Houston Ship Channel (HSC) prompt-month has been under heavy selling pressure since mid-2022. Is the Freeport LNG 2 Bcf/d outage squarely to blame, or are other forces pushing HSC lower? We also believe HSC will face longer-term headwinds as supply growth in Texas continues, and LNG demand growth expands in Louisiana.

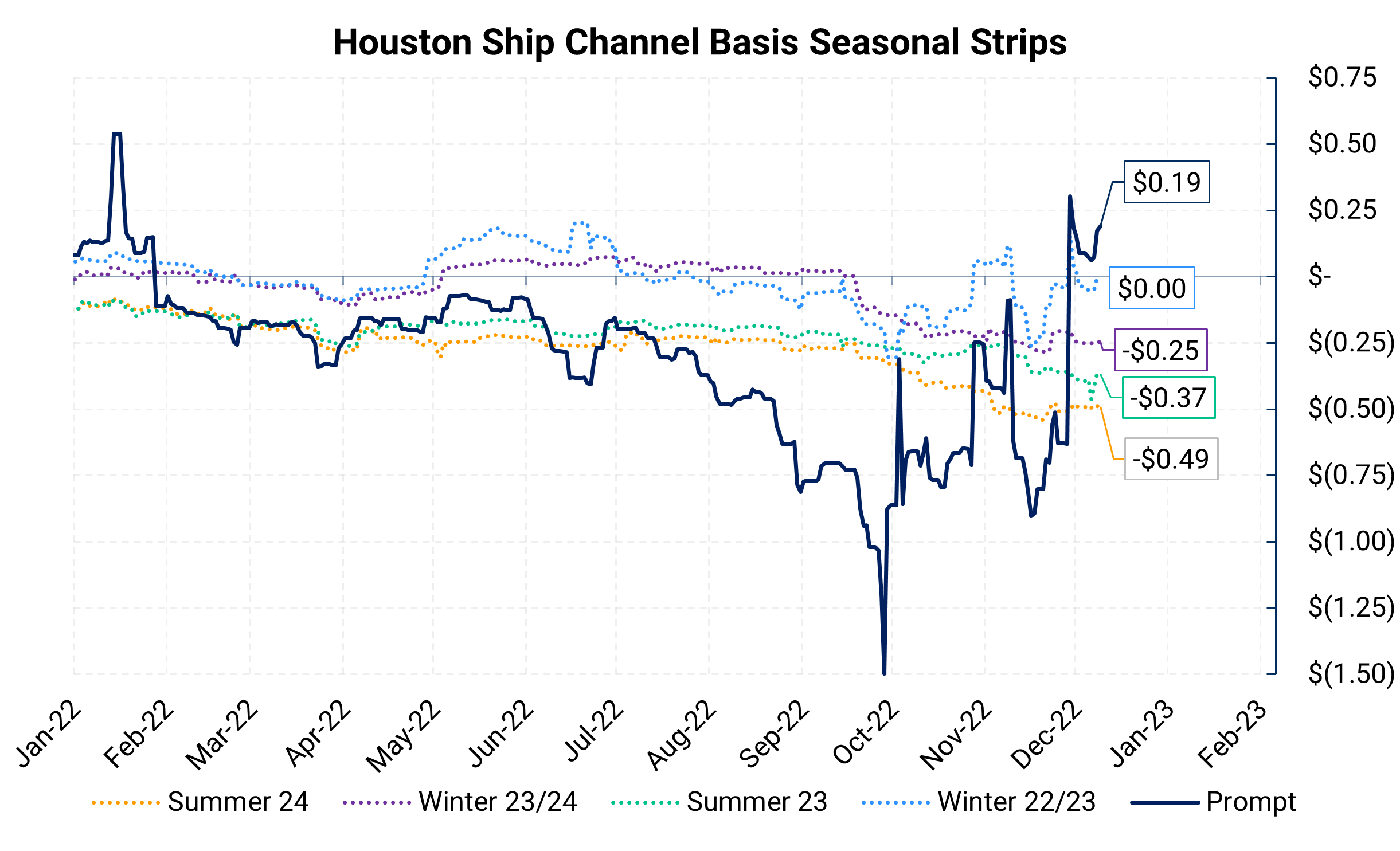

The chart below shows the rolling HSC basis (discount to Henry Hub) prompt-month contract (navy blue line) and subsequent seasonal HSC strips since the beginning of 2022. It’s probably fair to say that most of the prompt weakness in 2H 2022 has been because of the loss of Freeport LNG on June 8 (read more here Lost LNG Demand Weighs On Houston Ship Channel Basis ). However, the Houston gas market is also seeing an influx in additional supply as the Permian basin, Eagle Ford, Haynesville (TX), ramp up production growth. More supply into East Texas, combined with the loss of 2 Bcf/d from Freeport LNG, has been undoubtedly bearish.

Source: AEGIS, Bloomberg

What do future prices at HSC look like beyond the prompt month? Looking again at the chart above, HSC seasonal strips of Summer ’23, Winter ‘23/’24, and Summer ’24 have moved materially lower since September. Freeport LNG flows are likely to fully return in 1Q 2023, so the Freeport outage can’t be blamed for the downward slide in the later part of the curve. However, additional supply can be.

As mentioned before, additional Texas and Louisiana gas supply will enter the Texas Gulf Coast market over the following years. At the same time, the next LNG facility or expansion to come online in Texas is at least three years away with the addition of Cheniere’s Corpus Christi Stage III.

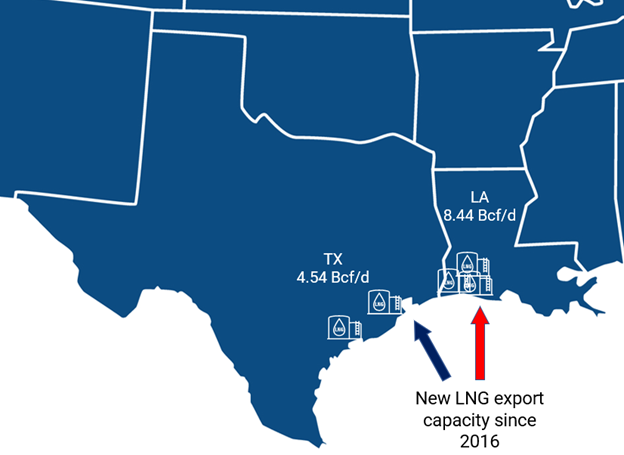

Most of the U.S. LNG export capacity built since 2016 has been in Louisiana. In fact, at 8.44 Bcf/d, Louisiana boasts almost twice the amount of LNG export capacity as Texas does (4.54 Bcf/d).

As more LNG demand growth has been centered just east of the Texas/Louisiana border, interstate gas flows have shifted to move supply toward demand.

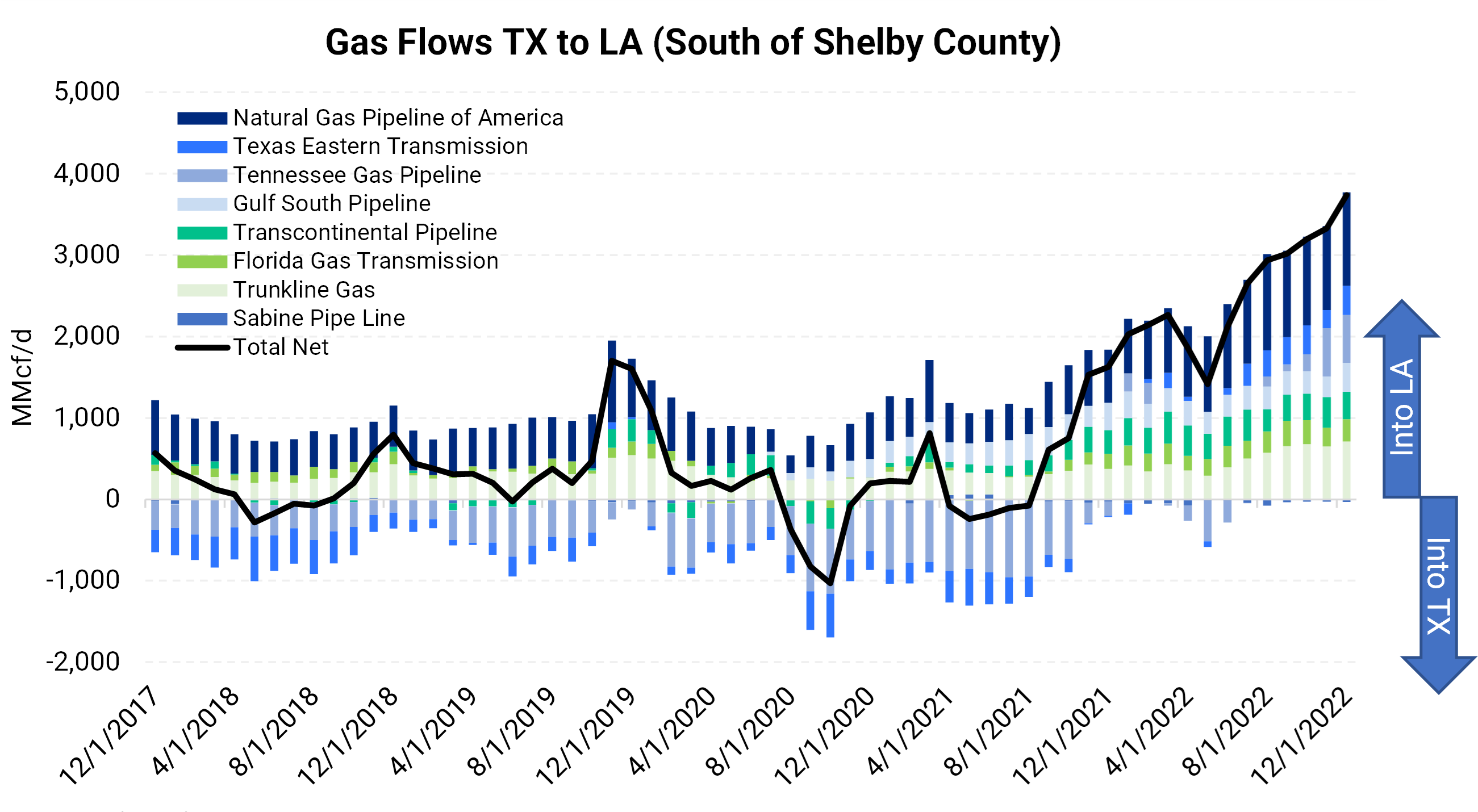

The chart below looks at natural gas flows across eight interstate gas pipelines measured at the Texas/Louisiana border. Over the past five years, flows have shifted back and forth between net flows headed into Texas and flows shifting toward the Henry Hub area. Notice how recently almost no pipeline flows toward Texas on a monthly average basis. As of December 2022, net gas flows from Texas into Louisiana measured 3.7 Bcf/d.

Source: AEGIS, PointLogic

The shift in flows toward Louisiana makes sense as most of the LNG demand resides in The Pelican State.

Where do HSC prices go from here? The Houston market might receive a pickup as Freeport LNG comes back online at the end of 2022, but southeast Texas is expected to see more and more supply from the Permian basin over time. Gas growth wouldn’t necessarily be a problem for HSC prices, except that Texas will not likely see any new LNG demand until 2025.