Natural gas prices in the Houston Ship Channel (HSC) area have tightened significantly versus Henry Hub year-to-date. The return of Freeport LNG just south of Houston has provided a solid demand boost for HSC, tightening the basis.

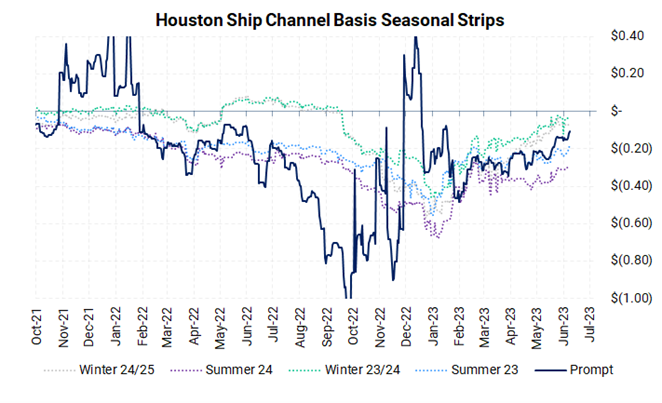

The chart below shows the rolling HSC basis (discount to Henry Hub) prompt-month contract (navy blue line) and subsequent seasonal strips since late 2021. Since 2 Bcf/d of LNG demand has returned, HSC has been restored to a more typical discount to the Hub. The Winter ‘23-’24 and Winter ’24-’25 strips have edged up to near parity with Nymex at -$0.03/MMBtu and -$0.06/MMbtu, respectively. Summer strips have risen as well but remain at an 18c discount for the balance of the Summer 2023 strip and a 29c discount for Summer 2024.

We expect HSC will continue to trade at a discount to Henry Hub on average, except for brief periods of heightened demand in Texas, where gas needs to stay local. Winter holds most of this local demand risk premium. This is why HSC winter strips trade at less of a discount to Hub than summer.

The Ship Channel area will continue to face additional supply from the Permian and Eagle Ford in the next few years. Yet, at the same time, new demand in the form of LNG is only targeting locations in Louisiana, with new LNG in Texas multiple years away. This dynamic will keep gas flows heading toward Louisiana from Texas for most of the year and holding HSC at a discount to Hub. [verb echo]

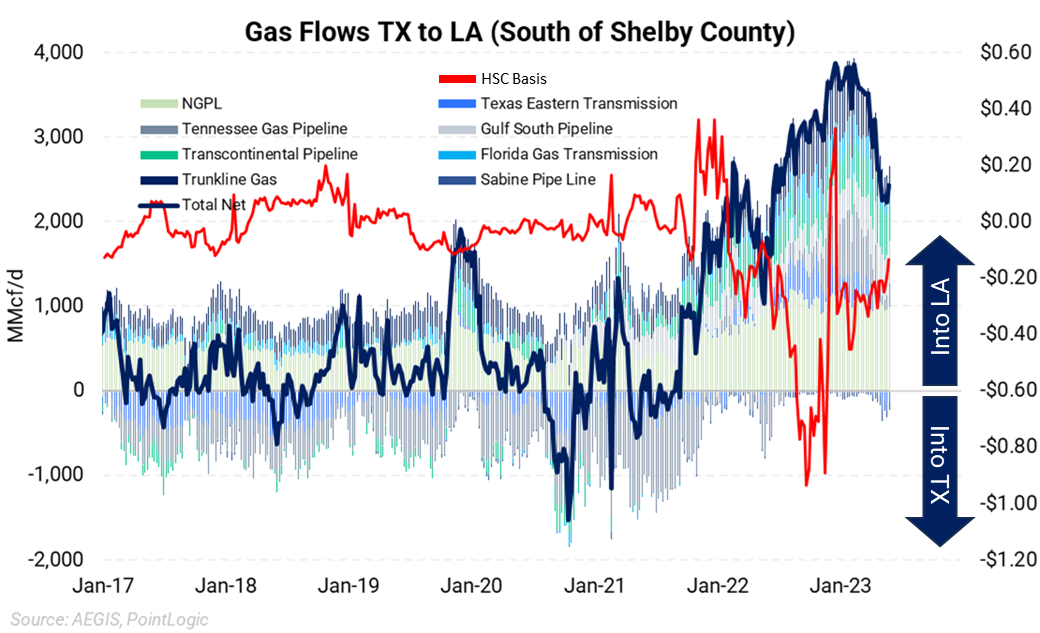

The chart below shows how gas flows, measured at the Texas-Louisiana border south of Shelby County, have changed over the years. From 2017 to late 2021, gas ebbed and flowed almost evenly between the two states. Yet as more LNG demand came into service in Louisiana and the Permian basin continued to grow gas production, net gas flows were effectively going toward Louisiana.

HSC basis price action followed the change in gas flows. Until late 2021, HSC basis traded mostly between +$0.10 and -$0.10/MMBtu. HSC basis has been under heavy downward pressure since net flows shifted almost exclusively towards Louisiana. Most of the weakness can be attributed to the Freeport LNG outage, but going forward, we don’t expect HSC basis to settle comfortably back within the historical average, like 2017 through 2021 on average.

We have discussed the new LNG coming into service in Louisiana over the next few years, about 4-5 Bcf/d. But what about new supply into the Texas Gulf Coast and Ship Channel area?

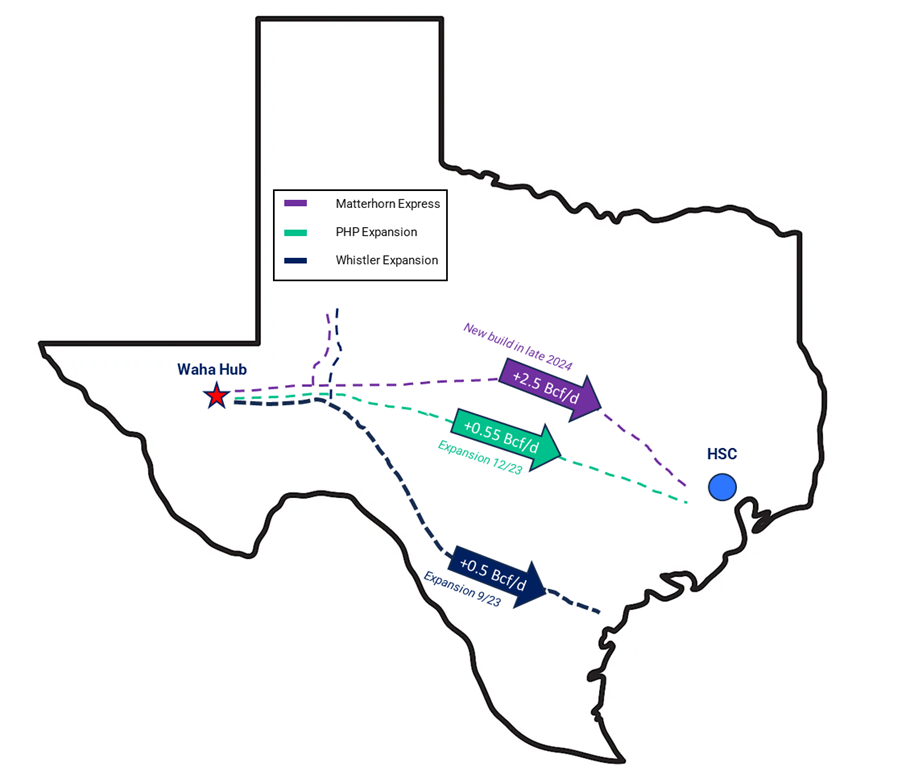

The graphic below highlights the new brownfield and greenfield projects targeting the coast from the Permian. An extra 1 Bcf/d will reach the Gulf by the end of 2023 and a whopping 2.5 bcf/d into the Ship Channel region in late ’24 and ’25 as the Matterhorn pipeline fills up.

The added supply will likely continue to pressure the HSC basis and keep the region well-supplied. The added supply coming from the west and new demand residing in Louisiana doesn’t mean we are calling for steep discounts at HSC. We forecast that HSC will remain a little wider than the average discounts observed between 2017 and 2021. The story does change when looking further into the future as a new LNG proposed and planned in late 2025 through the end of the decade targets Texas. The added export demand in Texas could incentivize more gas to stay in Texas and buoy HSC, but there are many years between now and then.