Base metals see further setbacks as investors flock to safe-haven assets. |

||

|

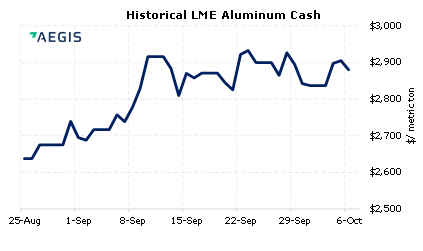

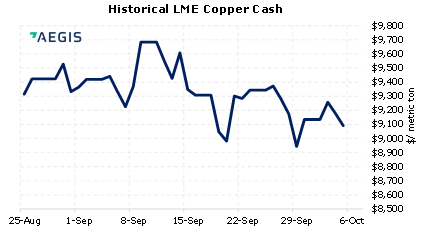

After a quiet start to the week, the USD Index is up nearly 0.5% this morning. The USD Index set news for the year last week, and this morning’s trade is slightly under that high-water mark. S&P 500 futures are down about 1%, but base metals are mixed. A continued flight to the USD could weigh on metals prices, as metals typically trade inversely to the USD. (10/6/2021) |

|

|

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

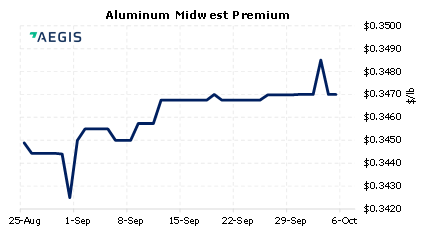

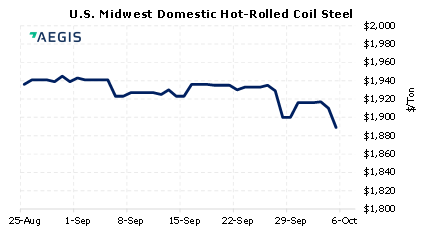

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

10/5/2021: Section 232 Tariffs: Most relevant developments (AEGIS Reference) 09/16/2021: AEGIS Factor Matrices: Most important variables affecting metals prices 09/07/2021: China Exports Are an Economic Spot as Value Hits All-Time High 08/09/2021: China's Copper Imports Slow as Prices Weigh on Demand |

||

|

|

||

Important Headlines & Economic Data |

||

|

AISI Steel Capability Utilization Rate Investing.com Economic Calendar Indebted Evergrande set to raise more cash from partial sale of its property services unit Hong Kong Stock Benchmark Closes Down 2.2%; Hopson Said Buying Evergrande Unit, Alibaba Drops Silicon metal and aluminum industries hit by China power shortages Column: China energy crunch may boost overseas metal producers Rio Tinto reaches new labour agreement for BC Works (Kitimat) Power outage, manufacturing slump: Key things to know about China’s economy China’s ‘golden week’ travel drops as zero Covid-19 approach forces consumers to stay home |

||

|

|

||

|

|

||

| Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program.

|

||