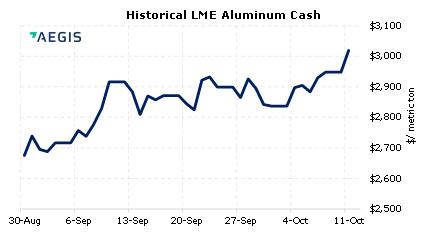

LME Aluminum 3M rallies past $3000/mt, setting new highs for the year. |

||

|

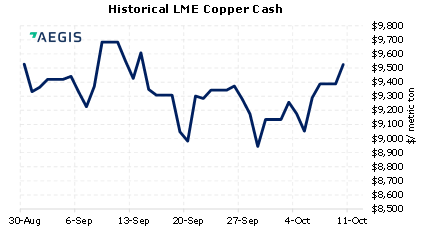

Domestic and foreign energy prices are mixed this morning, but base metals prices are surging higher. Chinese coal futures jumped to a record high last night after a flood hit an important production region. Metals production in China has already been hampered by fuel shortages. Base metals prices could continue to rally if these issues persist. (10/11/2021) |

|

|

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

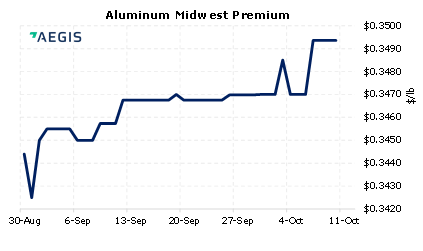

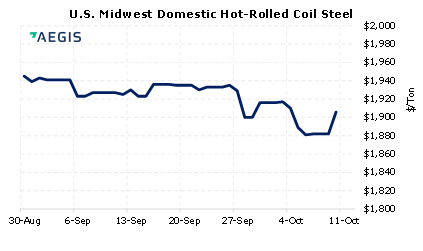

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

10/5/2021: Section 232 Tariffs: Most relevant developments (AEGIS Reference) 09/16/2021: AEGIS Factor Matrices: Most important variables affecting metals prices 09/07/2021: China Exports Are an Economic Spot as Value Hits All-Time High 08/09/2021: China's Copper Imports Slow as Prices Weigh on Demand |

||

|

|

||

Important Headlines & Economic Data |

||

|

AISI Steel Capability Utilization Rate Investing.com Economic Calendar 10/11/2021: Chinese coal prices hit record high and power cuts continue 10/11/2021: Global Energy Crisis Piles Pressure on Aluminum Supply 10/11/2021: LME to Develop Digital Metals Spot Market Beginning With 'Green' Aluminum 10/11/2021: Crisis looms in Britain, steel makers warn |

||

|

|

||

|

|

||

| Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program.

|

||