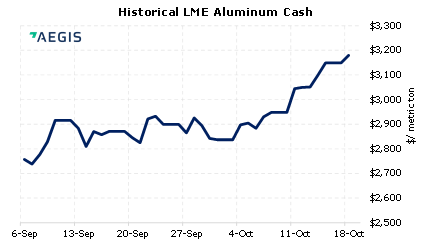

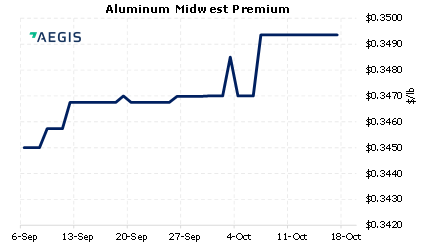

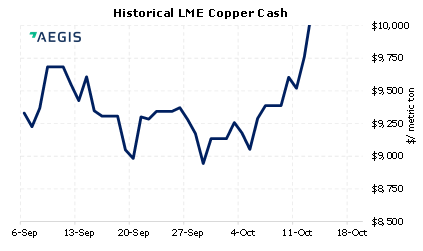

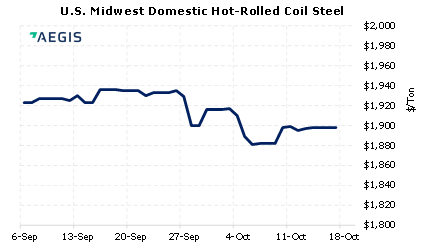

Base metals prices are mixed despite lower-than-expected China GDP data. |

||

|

Metals prices are largely dependent on the health of China’s economy. Last night China pegged their 3Q GDP at 4.9% annual growth, which was lower than analysts’ estimates of 5.3%. S&P futures are down about 0.3% on this news. (10/18/2021) |

|

|

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

10/14/2021: Is It Wise to HRC Steel with Crude Oil? 10/5/2021: Section 232 Tariffs: Most relevant developments (AEGIS Reference) 09/16/2021: AEGIS Factor Matrices: Most important variables affecting metals prices 09/07/2021: China Exports Are an Economic Spot as Value Hits All-Time High 08/09/2021: China's Copper Imports Slow as Prices Weigh on Demand |

||

|

|

||

Important Headlines & Economic Data |

||

|

AISI Steel Capability Utilization Rate Investing.com Economic Calendar 10/18/2021: Dow futures shed 100 points as investors await a big week of earnings 10/15/2021: Rusal plans to supply 300,000-400,000 tonnes of aluminium to China in 2021

|

||

|

|

||

|

|

||

| Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program.

|

||