World Bank predicts higher aluminum prices in 2022. |

||

|

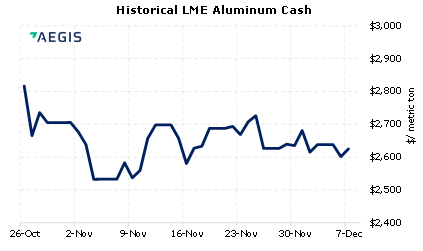

In our email, we said "according to recent reports", please note the World Bank report we cited is from October 2021. In that report, the World Bank is predicting that LME aluminum will rise by 6% in 2022 due to tight supplies and strong demand (Source: Commodity Markets Outlook). However, the bank thinks the energy production difficulties that have hampered supply will eventually ease. Electricity supply crunches have reduced production in China and elsewhere in recent months. (12/7/2021) |

|

|

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

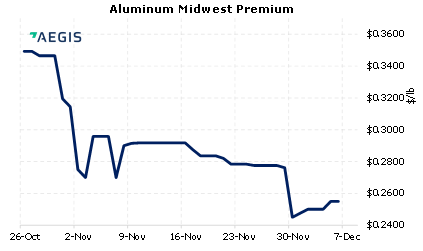

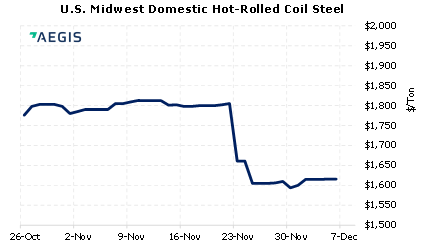

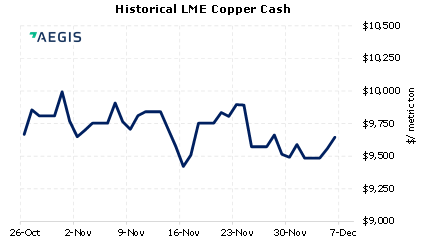

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

11/30/2021: Section 232 Tariffs: Most relevant developments (AEGIS Reference) 11/30/2021: Will the Omicron COVID Variant Impact South African Metals Production or Exports? 11/24/2021: AEGIS Factor Matrices: Most important variables affecting metals prices |

||

|

|

||

Important Headlines & Economic Data |

||

|

AISI Steel Capability Utilization Rate Investing.com Economic Calendar 12/7/2021: Aluminium prices may gain next year on demand, supply concerns 12/6/2021: China Evergrande shares plunge as it teeters on brink of default 12/6/2021: China frees up $188 billion for banks in second reserve ratio cut this year |

||

|

|

||

|

|

||

| Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program.

|

||