China prints awful statistics for metals demand. |

||

|

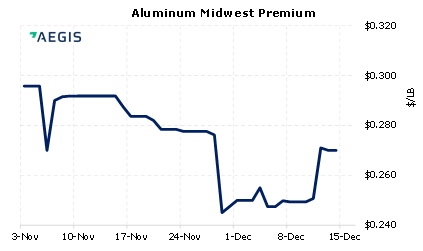

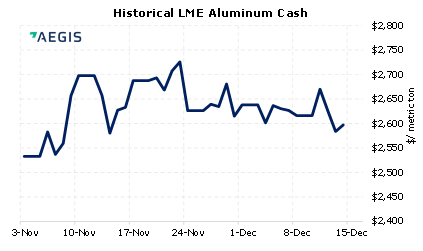

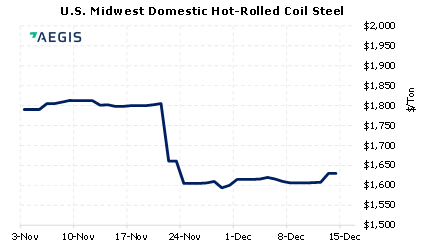

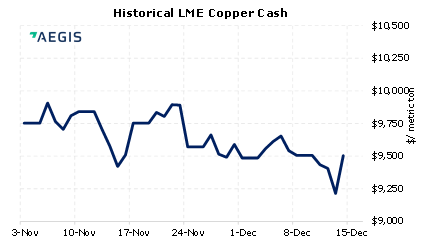

According to Reuters, Chinese new home prices fell by 0.3% month-over-month in November. This was the largest price drop since February 2015. New construction starts (as measured by floor area) were down 21.03% on year, according to government data. This marks the eighth consecutive monthly decline for new construction starts. Demand for metals such as steel, copper and aluminum might slow if these issues persist. (12/16/2021) |

|

|

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

12/13/2021: Section 232 Tariffs: Most relevant developments (AEGIS Reference) 12/10/2021: AEGIS Factor Matrices: Most important variables affecting metals prices 11/30/2021: Will the Omicron COVID Variant Impact South African Metals Production or Exports? |

||

|

|

||

Important Headlines & Economic Data |

||

|

AISI Steel Capability Utilization Rate Investing.com Economic Calendar 12/15/2021: China housing market slumps again as another developer runs into trouble 12/14/2021: Global supply chain: Toyota extends Japan production stoppages 12/13/2021: Raw Steels MMI: Steel prices decline; more tariff negotiations 12/9/2021: China steps up overseas hunt for ore needed to make aluminum |

||

|

|

||

|

|

||

| Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program.

|

||