The world’s ninth-largest copper mine is set to shut down. |

||

|

Citing high electricity costs, Nyrstar is shutting down its Auby, France based zinc smelter in January. The duration of the possible shutdown is currently unknown. According to a recent factsheet from the company, the smelter can produce 149,000 mt of zinc per year. The smelter’s production had already been cut by 50% in October 2021 due to soaring energy costs. Nystrar is the one of the world’s largest zinc producers, with 720,000 mt of annual zinc production in Europe, according to Reuters. Most of Nystar’s production is based in Europe, with smaller operations in Australia and the US. According to Reuters, global zinc supplies this year are estimated at around 14 million tonnes. This outage represents about 1% global production. Zinc prices rose on this news late last week and might stay supported if energy costs remain high. (12/20/2021) |

|

|

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

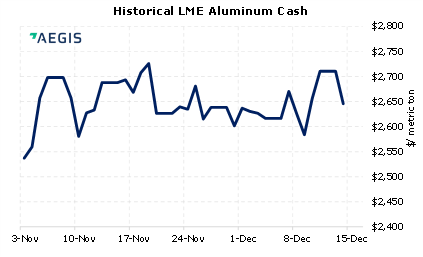

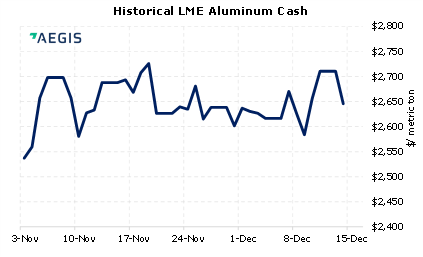

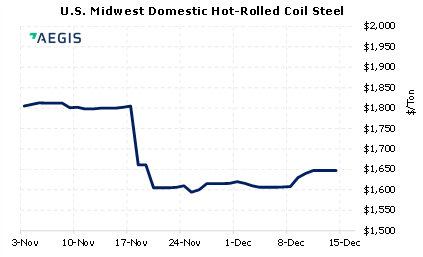

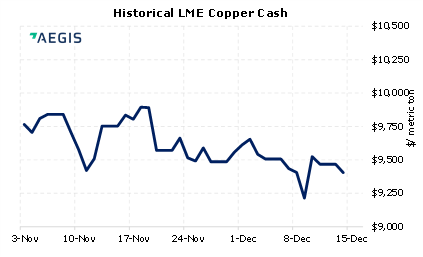

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

12/13/2021: Section 232 Tariffs: Most relevant developments (AEGIS Reference) 12/10/2021: AEGIS Factor Matrices: Most important variables affecting metals prices 11/30/2021: Will the Omicron COVID Variant Impact South African Metals Production or Exports? |

||

|

|

||

Important Headlines & Economic Data |

||

|

AISI Steel Capability Utilization Rate Investing.com Economic Calendar 12/17/2021: Zinc price soars as power crunch forces Nyrstar to idle French plant 12/16/2021: Nyrstar's Auby zinc operation on care and maintenance from Jan |

||

|

|

||

|

|

||

| Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program.

|

||