|

Most commodities and equities sold off yesterday as the escalating Ukrainian situation weighed on markets. Nickel was no exception and closed down nearly 7% on the day. Equities recovered late in session, after the LME markets closed. Nickel prices are hovering near unchanged this morning. Also out yesterday, China’s Tsingshan Holding Group Co, has shipped its first batch of nickel matte from its Indonesia-based plant, according to Bloomberg. Production at the plant began last month. The company currently has three nickel matte production lines of nickel matte under operation with a monthly capacity of approximately 3,000 tons of nickel content per line, with more production lines planned in the future. At current capacity Nickel matte is an intermediate product that can be further processed into battery chemicals. This new production could ease supply constraints that currently plague the market. Estimated global production was 2,500,000 mt in 2020 according to USGS. (1/25/2022) |

|

|

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

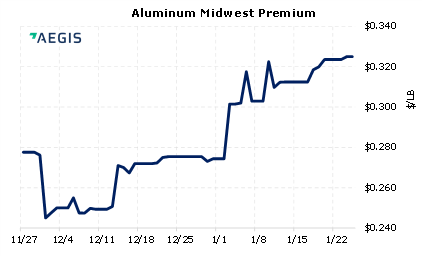

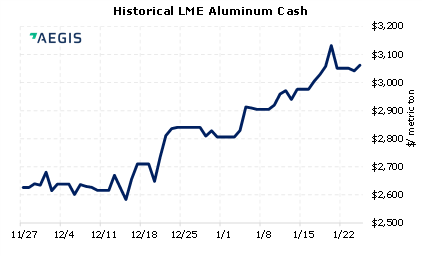

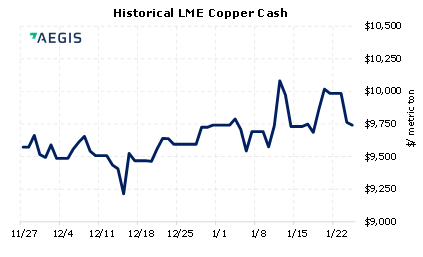

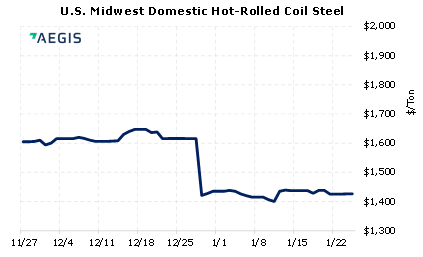

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

01/10/2022: Section 232 Tariffs: Most relevant developments (AEGIS Reference) 01/05/2022: AEGIS Factor Matrices: Most important variables affecting metals prices 11/30/2021: Will the Omicron COVID Variant Impact South African Metals Production or Exports? |

||

|

|

||

Important Headlines & Economic Data |

||

|

AISI Steel Capability Utilization Rate Investing.com Economic Calendar 1/19/2022: Antofagasta says Chile water shortage to hit 2022 production |

||

|

|

||

|

|

||

| Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program.

|

||