|

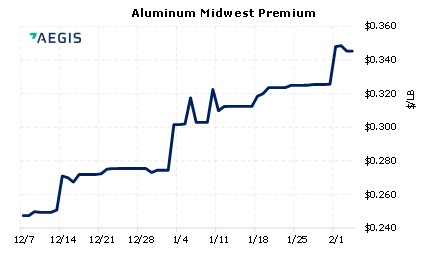

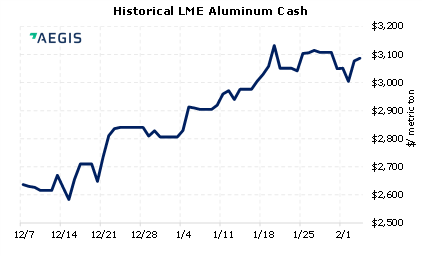

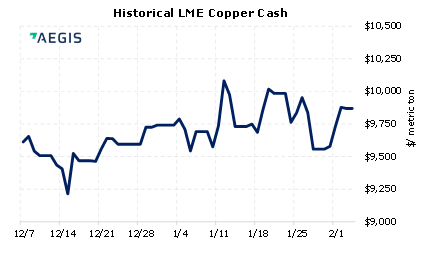

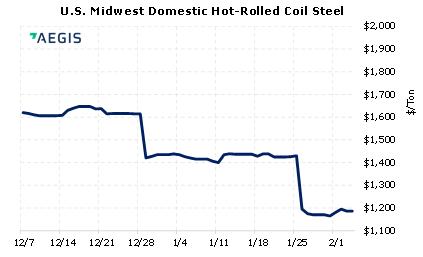

Metals markets are mixed again this week. China was on their New Year holiday this week, which might be partially to blame for the muted action. The Russia-Ukraine tensions continue to simmer. Many Western countries are threatening sanctions if Russia invades Ukraine. This could severely impact European metals production, which is heavily reliant upon on natural gas. Many European countries, and therefore metals producers, import large volumes of natural gas from Russia. Natural gas inventories in the region are already low and could dissipate further if Russian flows are shut off. For example, as of January 31, the European Union’s natural gas storage facilities are only 39 percent full, down from 52 percent in 2021 and 72 percent in 2020, according to Germany Eye. Europe gets 35 percent of their natural gas from Russia, according to Reuters. (2/4/2022)

|

|

|

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

01/26/2022: AEGIS Factor Matrices: Most important variables affecting metals prices 01/10/2022: Section 232 Tariffs: Most relevant developments (AEGIS Reference) 11/30/2021: Will the Omicron COVID Variant Impact South African Metals Production or Exports? |

||

|

|

||

Important Headlines & Economic Data |

||

|

AISI Steel Capability Utilization Rate Investing.com Economic Calendar 2/2/2022: Ukraine tensions: US trying to draw Russia into war, Putin says 2/2/2022: US troops to deploy to Eastern Europe amid Ukraine crisis 2/2/2022: Glencore reports 43% higher ferrochrome production 2/1/2022: German natural gas storage facilities only 37 percent full 1/31/2022: POSCO projects 5% drop in 2022 crude steel output 1/28/2022: Teck Resources’ QB2 to cost up to $500m more than planned |

||

|

|

||

|

|

||

| Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program.

|

||