|

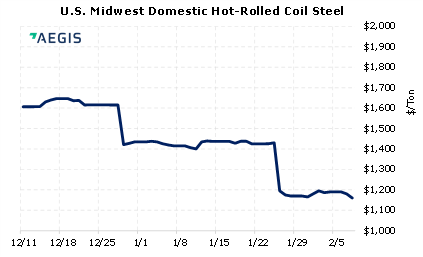

The US will end the current 25% tariff on Japanese steel imports, according to Bloomberg. No date has been set for when the tariff will be removed. Removing the tariff allows Japanese steel to be imported at a lower cost, so price reaction might be bearish. The current tariff was set in 2018 as part of the Section 232 tariffs that sought to reduce the flow of metals imports, thereby preventing foreign exporters from dumping cheap steel onto the US market. At 732,157 mt, Japan was the sixth-largest source of steel imports into the US in 2020. (2/8/2022)

|

|

|

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

01/26/2022: AEGIS Factor Matrices: Most important variables affecting metals prices 01/10/2022: Section 232 Tariffs: Most relevant developments (AEGIS Reference) 11/30/2021: Will the Omicron COVID Variant Impact South African Metals Production or Exports? |

||

|

|

||

Important Headlines & Economic Data |

||

|

AISI Steel Capability Utilization Rate Investing.com Economic Calendar 2/7/2022: MMG to halt Las Bambas copper mine amid fresh blockade 2/4/2022: Peru copper output up almost 7% despite social unrest 2/4/2022: Chip shortage forces Ford to cut production of F-150, Bronco and other important vehicles |

||

|

|

||

|

|

||

| Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program.

|

||