|

The LME has suspended trading for at least the day after the LME Nickel 3M contract traded to $101,365/mt, up $51,065 on the day. The exchange stated that “the LME has taken this decision on orderly market grounds.” The LME is contemplating “a possible multi-day closure, given the geopolitical situation which underlies recent price moves.” All nickel trades executed on or after midnight UK time Tuesday have been cancelled, according to Bloomberg. Bloomberg also stated that a short squeeze “has embroiled the largest nickel producer as well as a major Chinese bank.” Consumers who are concerned about their nickel input costs might consider purchasing swaps or call options. Please note that doing so might incur losses if prices decrease. Please contact AEGIS for specific strategies that fit your operations. (3/8/22) |

|

|

|

|

||

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

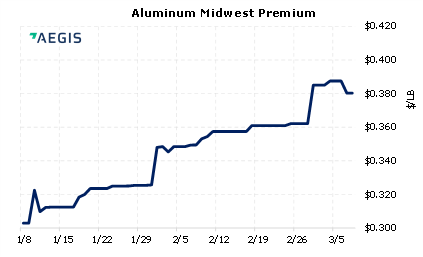

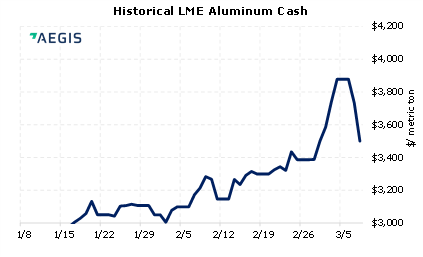

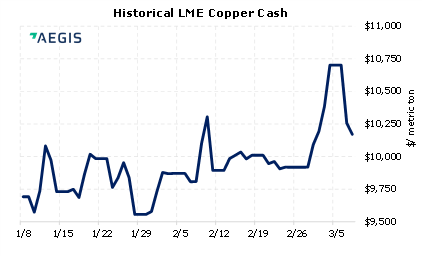

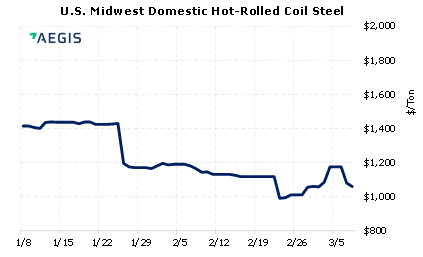

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

03/02/2022: AEGIS Factor Matrices: Most important variables affecting metals prices 02/15/2022: Section 232 Tariffs: Most relevant developments (AEGIS Reference) |

||

|

|

||

| Important Headlines | ||

|

3/8/2022: LME suspends nickel trading after prices soar past $100,000 3/8/2022: VIEW LME suspends nickel trading after price surge 3/8/2022: London Metal Exchange suspends nickel trading after contract soars to $100,000 a tonne 3/7/2022: Chile a step closer to nationalizing copper and lithium 3/7/2022: Oil, wheat, nickel storm higher on fears of supply chaos 3/7/2022: Oil, nickel, commodities prices soar as global shares tumble 3/7/2022: London bullion market bars Russian gold refineries |

||

|

|

||

|

|

||

| Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program.

|

||