|

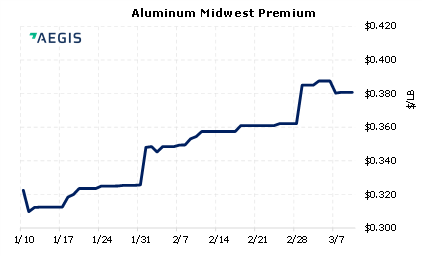

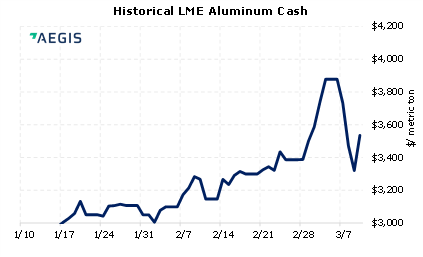

Rusal’s export market might change in the coming years if it partners with Chinese aluminum producers. Early this week Bloomberg reported that several state-owned Chinese metals and energy companies are seeking stakes in major commodities firms, including Rusal. Rusal is the largest aluminum producer outside of China. These potential ventures are meant to strengthen China’s energy and metals security, according to Bloomberg. China already heavily relies on Russian aluminum. Last year, approximately 18.4% of China’s primary aluminum imports came from Russia, according to Chinese customs data. Similarly, approximately 7.5% of Rusal’s aluminum exports were shipped to China that year, based on Rusal and Chinese customs data. Rusal’s exports to China might increase if a state-owned Chinese aluminum company invests in Rusal. However, this might have little effect on aluminum prices in the short term. Consumers who are concerned about their aluminum input costs might consider purchasing swaps or call options. Please note that doing so might incur losses if prices decrease. Please contact AEGIS for specific strategies that fit your operations. (3/10/22) |

|

|

|

|

||

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

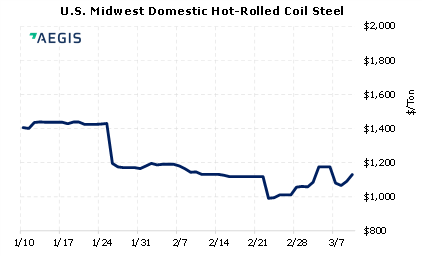

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

03/02/2022: AEGIS Factor Matrices: Most important variables affecting metals prices 02/15/2022: Section 232 Tariffs: Most relevant developments (AEGIS Reference) |

||

|

|

||

| Important Headlines | ||

|

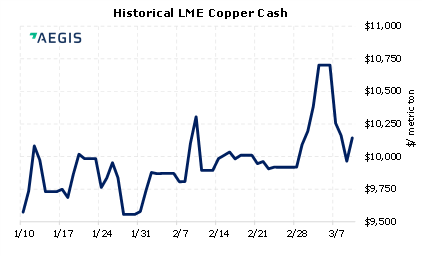

3/8/2022: LME cancels nickel trades after prices double to over $100,000 3/8/2022: VIEW LME suspends nickel trading after price surge 3/7/2022: Chile a step closer to nationalizing copper and lithium 3/7/2022: Oil, wheat, nickel storm higher on fears of supply chaos 3/7/2022: Oil, nickel, commodities prices soar as global shares tumble 3/7/2022: London bullion market bars Russian gold refineries |

||

|

|

||

|

|

||

| Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program.

|

||