|

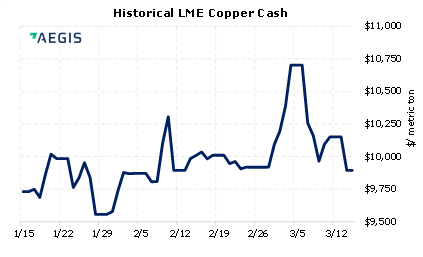

LME Copper 3M last traded at $9,834/mt, down nearly $349.50/mt (7:15AM CST) this week, adding to last week’s losses of $490.50/mt. Shenzhen, a city of 17.5 million and large technology hub in southern China, entered a lockdown last weekend due to a spike in COVID cases. Foxconn, a major supplier to Apple, has halted production at its Shenzhen-based facility due to the lockdown. Several other tech firms have also stopped or slowed production, according to Fortune magazine. Market participants cited by Bloomberg fear the lockdowns will slow demand for copper. Even though prices have dropped recently, consumers who are still concerned about their copper input costs might consider purchasing swaps or call options. Please note that doing so might incur losses if prices decrease. Please contact AEGIS for specific strategies that fit your operations. (3/15/22) |

|

|

|

|

||

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

03/02/2022: AEGIS Factor Matrices: Most important variables affecting metals prices 02/15/2022: Section 232 Tariffs: Most relevant developments (AEGIS Reference) |

||

|

|

||

| Important Headlines | ||

|

3/14/2022: The Shenzhen lockdown will affect everything from cars to iPhones: ‘It’s going to be really bad’ 3/14/2022: UPDATE 1-China's Tsingshan agrees standstill agreement on LME nickel margins with banks 3/14/2022: China Covid spike: Shenzhen shuts production, Shanghai closes schools 3/14/2022: Palladium dives about 17% as Russia supply fears recede 3/13/2022: Wall St Week Ahead Investors jump into commodities while keeping eye on recession risk 3/12/2022: UPDATE 1-Russia's Nornickel has new routes for palladium supplies -Potanin tells RBC |

||

|

|

||

|

|

||

| Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program.

|

||