|

The LME Nickel 3M Select contract is currently pegged limit-down at $36,915/mt. Limit up/down maximum amount that a commodity future can increase or decrease in a single trading day. Daily trading limits are now +/- 12% starting with today’s trade. A technical glitch allowed several nickel trades to occur below the new 12% daily trading limit band. These incorrect trades will be canceled, according to Bloomberg and the LME. This is similar to Wednesday morning’s restart, as a technical glitch in the LMEselect electronic trading platform allowed several nickel trades to occur below the then 5% daily trading limit band. The LME halted electronic trading and the improper trades were cancelled. Once the market reopened, futures quickly went limit-down on little volume. After the close, the LME expanded the trading limit to +/- 8% beginning with Thursday’s trade. Debacles occurred in Thursday’s trade, as several electronic trades were executed below the 8% trading limit – before the market opened. These erroneous trades were cancelled, and the opening was briefly delayed. Thursday’s trade ended limit-down, with few contracts changing hands. All other LME metals have a daily price limit of +/- 15% the prior day’s closing price on the 3M contract. Even though prices have dropped recently, consumers who are still concerned about their nickel input costs might consider purchasing swaps or call options. Please note that doing so might incur losses if prices decrease. Please contact AEGIS for specific strategies that fit your operations. (3/18/22) |

|

|

|

|

||

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

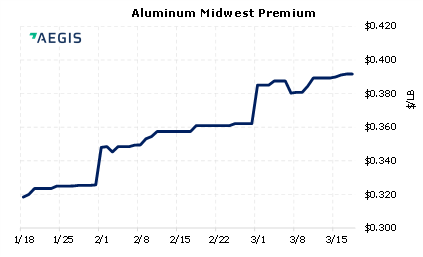

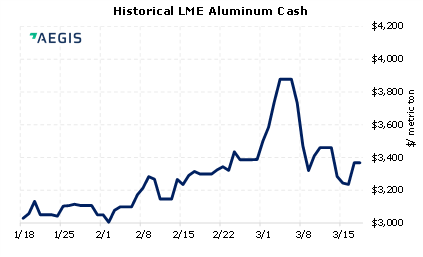

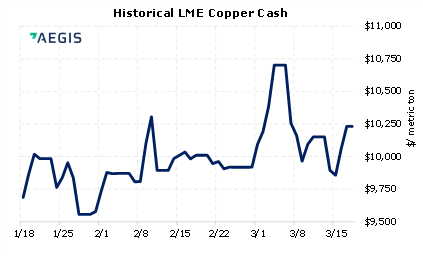

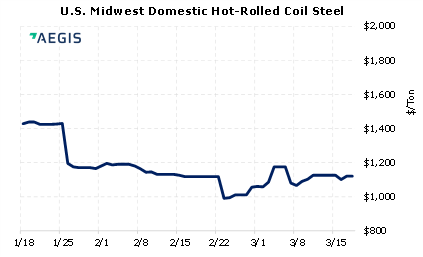

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

03/02/2022: AEGIS Factor Matrices: Most important variables affecting metals prices 02/15/2022: Section 232 Tariffs: Most relevant developments (AEGIS Reference) |

||

|

|

||

| Important Headlines | ||

|

3/17/2022: LME Boosts Nickel Trading Limit Again, to 12%, After Fresh Chaos 3/17/2022: LME nickel slides as technical glitches hit trading again 3/16/2022: LME expands nickel daily price limit to 8% from 5% 3/16/2022: Ukraine peace talks, China stimulus, U.S. rate rise prospects lift stocks, yields 3/16/2022: Shenzhen: Lockdown in China’s Silicon Valley rattles investors 3/16/2022: LME nickel trading halted in chaotic market resumption 3/15/2022: China's Tsingshan enters deal with bankers to resolve nickel trade position 3/14/2022: The Shenzhen lockdown will affect everything from cars to iPhones: ‘It’s going to be really bad’ 3/14/2022: UPDATE 1-China's Tsingshan agrees standstill agreement on LME nickel margins with banks 3/14/2022: China Covid spike: Shenzhen shuts production, Shanghai closes schools 3/14/2022: Palladium dives about 17% as Russia supply fears recede 3/13/2022: Wall St Week Ahead Investors jump into commodities while keeping eye on recession risk 3/12/2022: UPDATE 1-Russia's Nornickel has new routes for palladium supplies -Potanin tells RBC |

||

|

|

||

|

|

||

| Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program.

|

||