|

Revenue for Norsk Hydro jumped 46% year-over-over in Q1 2022 due to rising alumina and aluminum prices, according to their investor presentation released yesterday. They believe that global aluminum demand will exceed production, leading to a supply deficit, as high energy prices plague European smelters. The company expects its aluminum, bauxite, and alumina divisions to see rising raw materials costs in the second quarter. Norsk produced 540,000 mt of primary aluminum in Q1 2022, nearly unchanged from Q1 2021. Norsk Hydro is one of the world’s largest aluminum producers, according to Reuters. |

|

|

|

AEGIS notes Europe has recently set goals for reducing Russian gas flows, and instead sourcing gas from mainly increased liquefied natural gas (LNG) shipments by waterborne tanker. Oil imports are facing similar debates. Depending on how those policies unfold, energy costs may remain elevated in Europe for years, and could get worse faster than they get better. Consumers who are concerned about their aluminum input costs should consider financial swaps or purchasing call options. Such positions are standard for consumer hedging, but they can result in opportunity costs or cash costs if metal prices decline. Please contact AEGIS for specific strategies that fit your operations. (5/4/2022) |

||

|

|

||

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

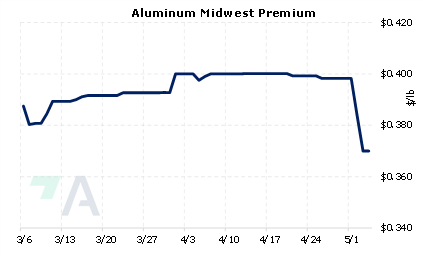

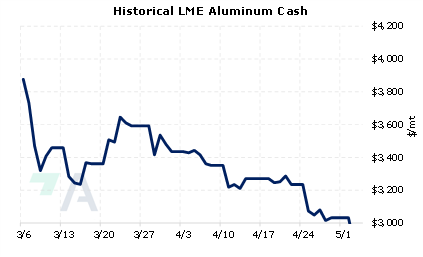

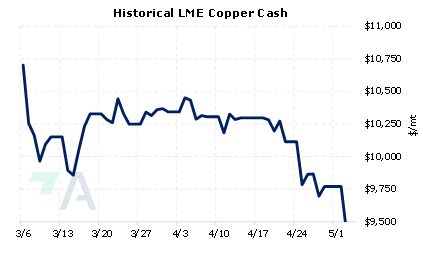

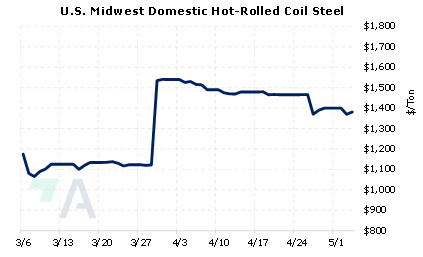

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

04/27/2022: AEGIS Factor Matrices: Most important variables affecting metals prices 04/21/2022: Russian Metals Production and Related News: Most Recent Developments (AEGIS Reference) |

||

|

|

||

| Important Headlines | ||

|

5/3/2022: Stock futures fall after big market reversal to start May 5/3/2022: Aluminium maker Hydro warns of rising costs after record Q1 profit |

||

|

|

||

|

|

||

| Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program.

|

||