|

AEGIS is attending the Harbor Aluminum Summit at the Radisson Blu Aqua Hotel in Chicago on June 7 – 9. If you would like to schedule a meeting during the summit, please contact Patrick McCrann at pmccrann@aegis-hedging.com or (713) 936-2806.

|

|

|

|

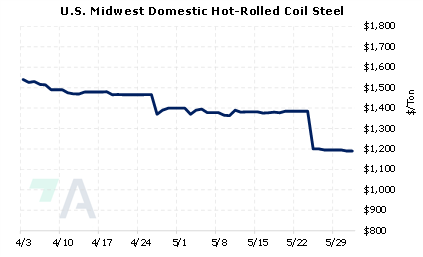

India implemented a 15% tariff on HRC and CRC steel exports early last week, with no forewarning to domestic producers and exporters. At the time, producers cited by Reuters feared the move would close off export markets, specifically Europe. However, JSW Steel, which is India’s largest producer, will not pass along the export tax to its buyers, according to its CEO. In an interview with The Economic Times on Monday, CEO Seshagiri Rao stated "Exporting after paying 15% duty is definitely a loss-making proposition. But we have to look at the long term…. If we don't supply to our customers that we have developed over the last decade, we will lose them." JSW produced 17.62 million mt of steel in the fiscal year 2022, with 4.57 million mt going to foreign buyers, according to their FY2022 results. India exported 13.5 million mt of finished steel in the fiscal year 2022, according to the Ministry of Steel. (For a more detailed overview, please see our latest post: India's Steel Exports Tariffs Shock Producers). Although JSW Steel will continue exporting, India’s new tariff could be supportive of CME HRC prices if other Indian exporters stop shipments, thereby reducing global supply. Also, re-routing of steel to the Eurozone and other regions, and away from the US, could strain American supplies and increase prices. CME HRC steel is thinly traded, but end-users that are concerned about increasing prices could consider financial swaps or purchasing call options. Such positions are standard for consumer hedging, but they can result in opportunity costs or cash costs if metal prices decline. Please contact AEGIS for specific strategies that fit your operations. (6/1/2022) |

||

|

|

||

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

05/25/2022: AEGIS Factor Matrices: Most important variables affecting metals prices 05/23/2022: India's Steel Exports Tariffs Shock Producers 05/11/2022: China's Metals Exports are on the Rise |

||

|

|

||

| Important Headlines | ||

|

5/30/2022: JSW Steel to maintain shipments to Europe without passing on cost of India's new export tax 5/30/2022: Steel export duty dilemma: Sell at a loss or lose customers, says JSW Steel's Seshagiri Rao 5/30/2022: JSW Steel sees Indian steel export duties as temporary |

||

|

|

||

|

|

||

|

Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as “edge,” “advantage,” “opportunity,” “believe” or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.

|

||