|

AEGIS is attending the Harbor Aluminum Summit at the Radisson Blu Aqua Hotel in Chicago on June 7 – 9. If you would like to schedule a meeting during the summit, please contact Patrick McCrann at pmccrann@aegis-hedging.com or (713) 936-2806.

|

|

|

|

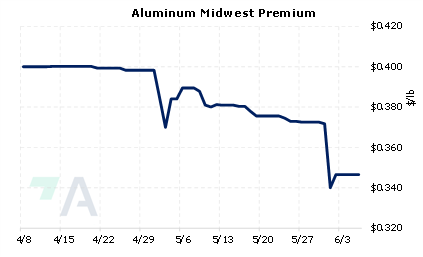

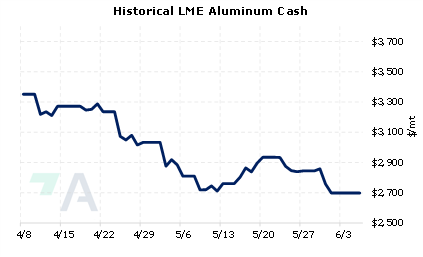

Aluminum producers are currently offering premiums of $172/mt to $177/mt for July-September shipments to Japan, nearly unchanged from last quarter’s premium of $172/mt, according to Reuters. This is the premium over the London Metal Exchange (LME) cash price that Japanese importers agree to pay for primary aluminum shipments. One trader cited by Reuters proclaimed "A significant volume of aluminum has been transported in recent months from LME warehouses in Asia to Europe, where premiums were much higher…. But the Asian market is still in a glut due to the lack of easy container arrangements to ship more metal out of the region." Negotiations for 3Q are ongoing but should conclude by month’s end. The country imported approximately 2.793 million mt of aluminum in 2021, or about 4% of global production, according to the Japan Ministry of Finance and USGS data. LME Aluminum prices were up about 23% in 1Q; however, are down nearly 20% this quarter (7:15AM CST), due in part to softening Asian demand and higher Chinese exports. End users might take advantage of the recent drop in prices by using simple hedges involving swaps and call options. These could cap your aluminum costs, guarding against a price recovery. Such positions are standard for consumer hedging, but they can result in opportunity costs or cash costs if metal prices decline. Please contact AEGIS for specific strategies that fit your operations. (6/6/2022) |

||

|

|

||

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

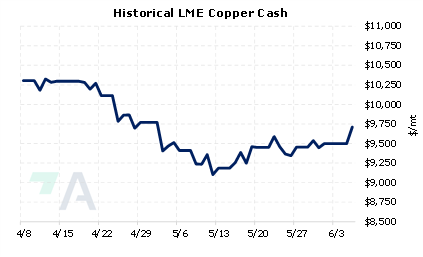

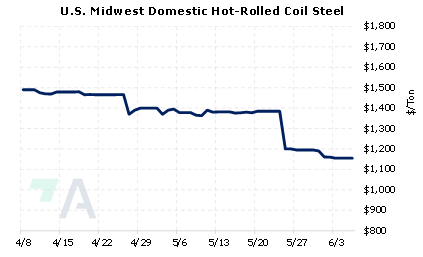

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

06/1/2022: AEGIS Factor Matrices: Most important variables affecting metals prices 05/23/2022: India's Steel Exports Tariffs Shock Producers 05/11/2022: China's Metals Exports are on the Rise |

||

|

|

||

| Important Headlines | ||

|

6/3/2022: Peru Cabinet meeting ends with no word on Las Bambas mine crisis 6/2/2022: Copper price scales $10,000 on Chinese stimulus, lockdown reprieve 6/1/2022: UPDATE 1-Global aluminium producers seek Q3 premiums of $172-$177/T in Japan talks - sources |

||

|

|

||

|

|

||

|

Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as “edge,” “advantage,” “opportunity,” “believe” or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.

|

||