|

AEGIS is attending the Harbor Aluminum Summit at the Radisson Blu Aqua Hotel in Chicago on June 7 – 9. If you would like to schedule a meeting during the summit, please contact Patrick McCrann at pmccrann@aegis-hedging.com or (713) 936-2806.

|

|

|

|

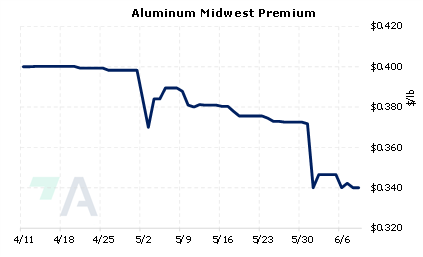

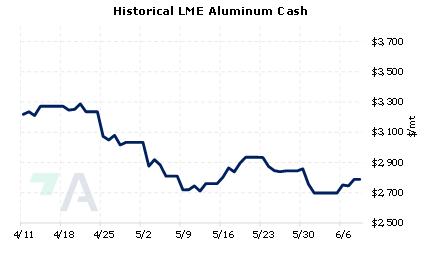

The “best ever” aluminum demand in 2021 and early 2022 will dissipate and lead to large surpluses in 2023 and 2024, according to Harbor Aluminum. According to their estimates, the supply surplus could reach 1.1 million mt in 2023 and 1.4 million in 2024, up considerably from an expected surplus of 200,000 mt in 2022. At its annual summit this week, Harbor’s managing director asserted “We all know that last year and so far this year has been the best ever in terms of demand. But there’s one component of that demand borrowed from the future, and we’ll need to pay that -- consumers cannot sustain this level of goods spending seen the past two years.” As for prices, Harbor predicts that aluminum prices will average $2,250/mt next year, with a potential downside of reaching $1,850/mt. LME Aluminum 3M last traded at $2,782/mt (6:55 AM CST) and is down about 31.7% from the March highs. Aluminum producers might consider applying simple hedges involving put options to protect from a further decline in prices. One other possible strategy is a costless collar, meaning a producer would buy a put and simultaneously sell a call option, thereby creating “zero cost.” Such positions are standard for producer hedging, but they can result in opportunity costs or cash costs if metal prices increase. Please contact AEGIS for specific strategies that fit your operations. (6/9/2022) |

||

|

|

||

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

06/8/2022: AEGIS Factor Matrices: Most important variables affecting metals prices 05/23/2022: India's Steel Exports Tariffs Shock Producers 05/11/2022: China's Metals Exports are on the Rise |

||

|

|

||

| Important Headlines | ||

|

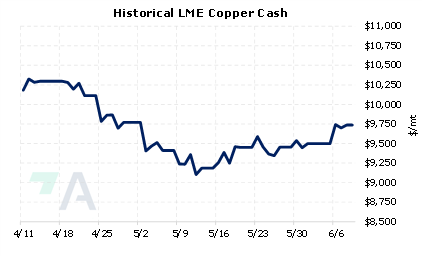

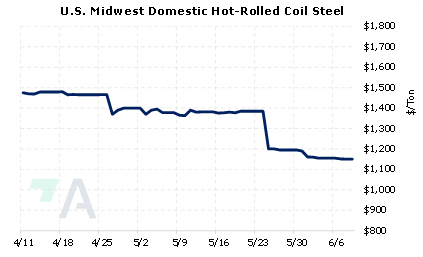

6/7/2022: Steel output starts June with a lull 6/6/2022: Stronger China demand prospects propel copper to five-week peak 6/3/2022: Peru Cabinet meeting ends with no word on Las Bambas mine crisis 6/2/2022: Copper price scales $10,000 on Chinese stimulus, lockdown reprieve 6/1/2022: UPDATE 1-Global aluminium producers seek Q3 premiums of $172-$177/T in Japan talks - sources |

||

|

|

||

|

|

||

|

Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as “edge,” “advantage,” “opportunity,” “believe” or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.

|

||