|

Automotive manufacturers are experiencing reduced profit margins due to all-time high costs for raw materials such as metals and petrochemicals, according to the Wall Street Journal’s summary of comments from Bank of America. According to BofA’s calculations, raw material costs for the average US vehicle now total $4,950, nearly 86% higher than the 30-year historical average of $2,660. BofA also adds “Record vehicle prices have helped auto makers offset those higher costs. But the bank sees vehicle prices easing in the next few years, compressing margins if raw materials remain elevated.” |

|

|

|

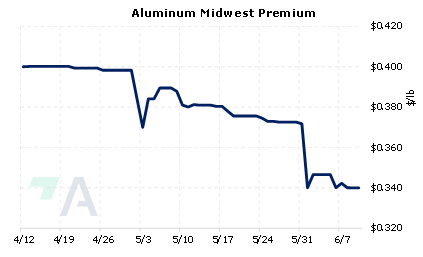

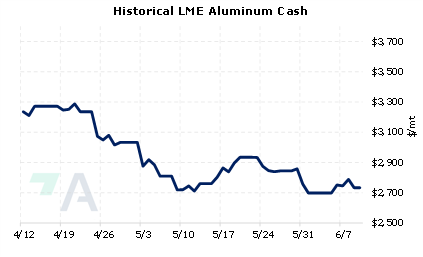

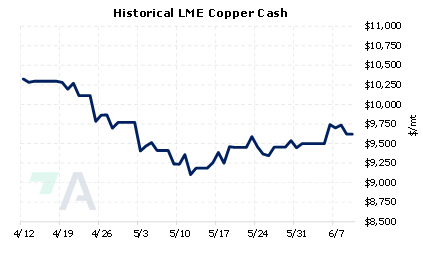

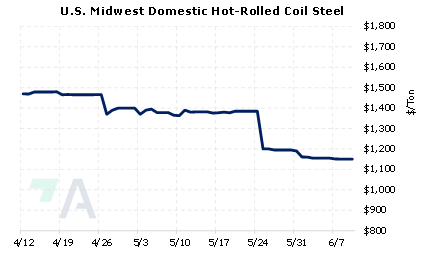

HRC Steel and aluminum are two key raw materials for automotive production. Prices for both metals have dropped since early March, and LME Aluminum 3M contract and prompt month (June) CME HRC Steel futures are now nearly unchanged for the year. End users for either metal might consider using the recent dip in prices by applying simple hedges involving swaps and call options. One other possible strategy is a costless collar, meaning a consumer would buy a call and simultaneously sell a put option, thereby creating “zero cost.” These could cap your raw materials costs, guarding against a price recovery. Such positions are standard for consumer hedging, but they can result in opportunity costs or cash costs if metal prices decline. Please contact AEGIS for specific strategies that fit your operations. (6/10/2022) |

||

|

|

||

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

06/8/2022: AEGIS Factor Matrices: Most important variables affecting metals prices 05/23/2022: India's Steel Exports Tariffs Shock Producers

|

||

|

|

||

| Important Headlines | ||

|

6/9/2022: Copper price slips after new China lockdowns 6/9/2022: China COVID jitters flare up as parts of Shanghai resume lockdown 6/7/2022: Steel output starts June with a lull 6/6/2022: Stronger China demand prospects propel copper to five-week peak 6/3/2022: Peru Cabinet meeting ends with no word on Las Bambas mine crisis 6/2/2022: Copper price scales $10,000 on Chinese stimulus, lockdown reprieve 6/1/2022: UPDATE 1-Global aluminium producers seek Q3 premiums of $172-$177/T in Japan talks - sources |

||

|

|

||

|

|

||

|

Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as “edge,” “advantage,” “opportunity,” “believe” or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.

|

||