|

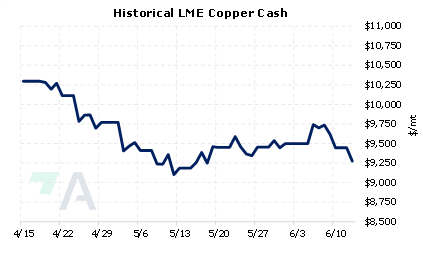

LME Copper 3M Select is down $160/mt, with last trade at $9,275/mt (7:00 AM CST), due in part to Shanghai reinstating COVID lockdowns late last week. Over the weekend, authorities conducted COVID screenings in 15 out of 16 of Shanghai’s districts, and six of these districts were on lockdown during the tests. These new lockdowns come less than a week after Shanghai and Beijing reopened in early June. Copper prices jumped early last week; however, the optimism quickly faded after Beijing restarted some lockdowns on Thursday. LME copper finished nearly unchanged last week, but pessimism reins today. |

|

|

|

As Reuters columnist Andy Home stated late last week, “Shanghai copper inventory and curve structure suggest a domestic market that is not yet prepared for a significant rebound in demand without a shift change in imports.” Excessive inventories and poor Chinese demand could keep a cap on copper prices. Copper producers might consider applying simple hedges involving put options to protect from a further decline in prices. One other possible strategy is a costless collar, meaning a producer would buy a put and simultaneously sell a call option, thereby creating “zero cost.” Such positions are standard for producer hedging, but they can result in opportunity costs or cash costs if metal prices increase. Please contact AEGIS for specific strategies that fit your operations. (6/13/2022) |

||

|

|

||

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

06/8/2022: AEGIS Factor Matrices: Most important variables affecting metals prices 05/23/2022: India's Steel Exports Tariffs Shock Producers 05/11/2022: China's Metals Exports are on the Rise |

||

|

|

||

| Important Headlines | ||

|

6/9/2022: Copper price slips after new China lockdowns 6/9/2022: China COVID jitters flare up as parts of Shanghai resume lockdown 6/7/2022: Steel output starts June with a lull |

||

|

|

||

|

|

||

|

Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as “edge,” “advantage,” “opportunity,” “believe” or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.

|

||