|

Supply deficits of lead in Europe and the US will offset a surplus in China, putting the global market in balance this year, according to Reuters. On Monday, Wood Mackenzie analyst Farid Ahmed told Reuters "Demand has been super-hot in North America and Europe for almost two years and is only now starting to show indications of easing. But it remains tight with supply struggling to keep up with demand." Ahmed also added, "Globally, the refined lead market is quite well balanced." Wood Mackenzie is predicting a global supply surplus of 78,000 mt in 2022. |

|

|

|

LME Lead 3M last traded at $2,094.50/mt (7:00 AM CST), a nearly 22% drop from the high on March 7 of $2,700/mt. End-users such as battery producers might consider using the recent dip in prices by applying simple hedges involving swaps and call options. One other possible strategy is a costless collar. In this case, a “zero-cost collar” creates a maximum and minimum lead price for a battery producer, as they would simultaneously buy a call option (creating a cap, or maximum) and sell a put option (creating a floor, or minimum). The call and put premiums offset, making the construction costless. It is popular because of the upside price protection, but you sacrifice access to much lower prices if prices should fall. Such positions are standard for consumer hedging, but they can result in opportunity costs or cash costs if metal prices decrease. Please contact AEGIS for specific strategies that fit your operations. (6/15/2022) |

||

|

|

||

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

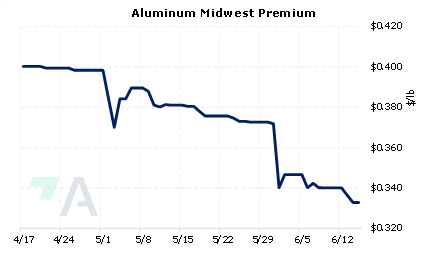

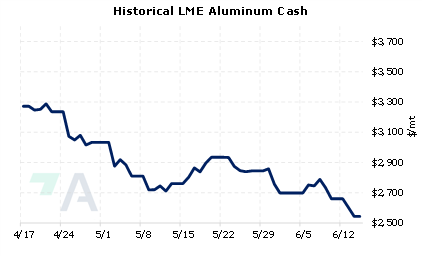

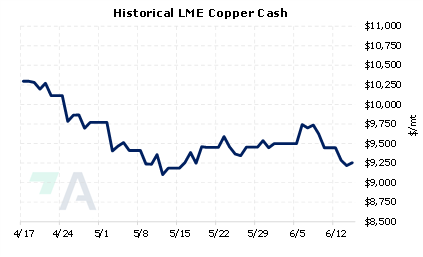

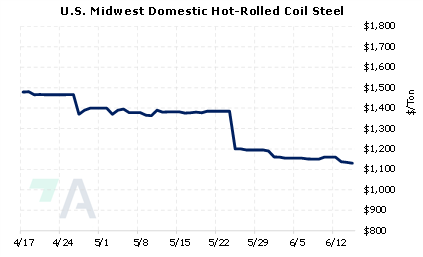

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

06/8/2022: AEGIS Factor Matrices: Most important variables affecting metals prices 05/23/2022: India's Steel Exports Tariffs Shock Producers 05/11/2022: China's Metals Exports are on the Rise |

||

|

|

||

| Important Headlines | ||

|

6/14/2022: South Korea's truckers end crippling strike, reach deal with govt 6/13/2022: Dollar at two-decade high as risky assets sell off; yen recovers ground 6/13/2022: China's lead surplus to offset shortages in U.S. and Europe 6/13/2022: Copper’s outlook under threat as economic risks pile up 6/12/2022: Top Steelmaker in South Korea Halts Production on Trucker Strike 6/12/2022: POSCO to halt some plants as South Korea trucker strike continues |

||

|

|

||

|

|

||

|

Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as “edge,” “advantage,” “opportunity,” “believe” or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.

|

||