|

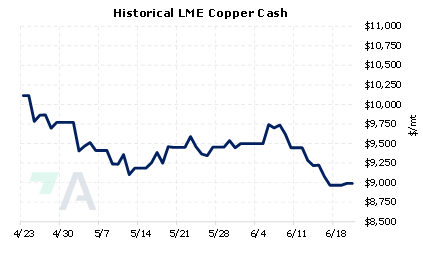

Recession fears and a poor outlook for Chinese demand have weighed on copper prices, and analysts fear these factors could continue to do so. This is an about-face from bullish estimates earlier this year, as analysts quoted by mining-journal.com in January predicted $10,500/mt or higher due to a forecasted pre-Beijing Olympics demand boom and supply-chain bottlenecks that would impact supply. On Monday, Ole Hansen, head of commodity strategy at Saxo Bank A/S proclaimed, “Copper is facing a triple challenge currently… the technical outlook is weak following the lowest weekly close in 14 months, extended China lockdowns, and not least increased recession concerns following last week’s multiple rate hikes.” In a note late last week, UBS Group analysts made similar comments regarding copper, stating “demand outlook is mixed with a China recovery offset by the deteriorating macro outlook for Europe/US due to inflation.” |

|

|

|

LME Copper 3M Select last traded at $8,989/mt (7:00 AM CST), up $40/mt on the week, following last Friday’s close at $8,949/mt. Friday’s closing price was the lowest daily close since October 2021, and also the lowest weekly close since April 2021. So far for the month of June, copper has closed higher only three times, and the 3M Select contract is down almost 4.7% this month. Copper producers might consider applying simple hedges involving put options to protect from a further decline in prices. One other possible strategy is a costless collar. In this case, a “zero-cost collar” creates a maximum and minimum price for a copper producer, as they would simultaneously buy a put option (creating a floor, or minimum) and sell a call option (creating a cap, or maximum). The call and put premiums offset, making the construction costless. It is popular because of the downside price protection, but you sacrifice access to much higher prices if prices should rise. Such positions are standard for producer hedging, but they can result in opportunity costs or cash costs if metal prices increase. Please contact AEGIS for specific strategies that fit your operations. (6/21/2022) |

||

|

|

||

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

06/15/2022: AEGIS Factor Matrices: Most important variables affecting metals prices 05/23/2022: India's Steel Exports Tariffs Shock Producers 05/11/2022: China's Metals Exports are on the Rise |

||

|

|

||

| Important Headlines | ||

|

6/20/2022: Column: Iron ore suffers short-term demand woes, longer-term China threat 6/17/2022: Chile's Codelco to close Ventanas smelter 6/17/2022: Peru expects lower economic growth on impact of mine protests

|

||

|

|

||

|

|

||

|

Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as “edge,” “advantage,” “opportunity,” “believe” or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.

|

||