|

The Henan province, which is a key aluminum production region in China, could curb production if power generation problems occur this summer, according to Reuters. The province experienced a record power load this past Sunday, and “electricity supply in Henan is expected to be relatively difficult this summer,” according to Reuters’ summation of a state media report from this past weekend. Andy Home of Reuters predicts “power will be prioritised for cooling homes with big industrial users facing rationing.” China produced a record 3.423 million mt of primary aluminum in May, according to the National Bureau of Statistics. The Henan province produces about 36% of China’s primary aluminum, according to the South China Morning Post. |

|

|

|

China has become a major aluminum exporter to Europe in recent months, as domestic demand has waned while European supplies have shrunk due to power-generation issues. Production issues in China could therefore affect supplies in Europe and the global balance of supply and demand. End-users who are concerned that shrinking global supplies might support aluminum prices could consider applying simple hedges involving swaps and call options. One other possible strategy is a costless collar. In this case, a “zero-cost collar” creates a maximum and minimum aluminum price for a consumer, as they would simultaneously buy a call option (creating a cap, or maximum) and sell a put option (creating a floor, or minimum). The call and put premiums offset, making the construction costless. It is popular because of the upside price protection, but you sacrifice access to much lower prices if prices should fall. Such positions are standard for consumer hedging, but they can result in opportunity costs or cash costs if metal prices decrease. Please contact AEGIS for specific strategies that fit your operations. (6/22/2022) |

||

|

|

||

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

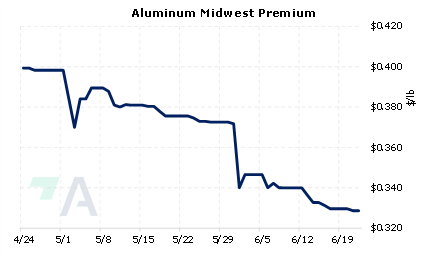

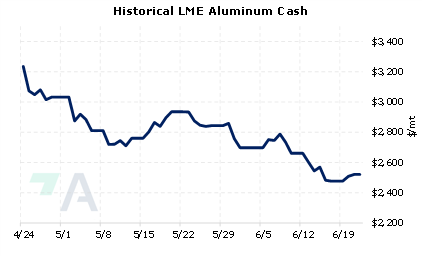

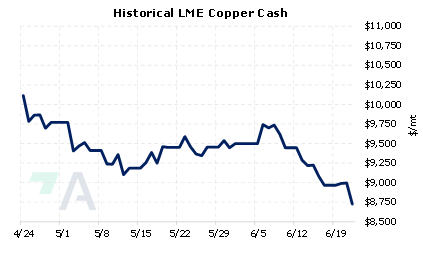

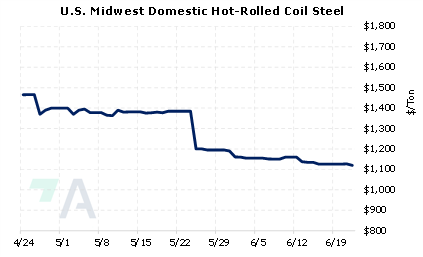

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

06/15/2022: AEGIS Factor Matrices: Most important variables affecting metals prices 05/23/2022: India's Steel Exports Tariffs Shock Producers 05/11/2022: China's Metals Exports are on the Rise |

||

|

|

||

| Important Headlines | ||

|

6/21/2022: Copper price rises as looming strike in Chile adds to supply worries 6/21/2022: Column: Global aluminium production pendulum swings back to China 6/20/2022: Column: Iron ore suffers short-term demand woes, longer-term China threat 6/20/2022: China power demand sets new records as heatwaves bake northern cities 6/20/2022: Analysis: Quantity over quality - China faces power supply risk despite coal output surge 6/17/2022: Chile's Codelco to close Ventanas smelter 6/17/2022: Peru expects lower economic growth on impact of mine protests

|

||

|

|

||

|

|

||

|

Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as “edge,” “advantage,” “opportunity,” “believe” or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.

|

||