|

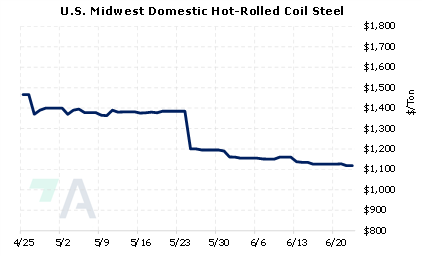

Spot ferrous scrap prices are off 20% since March, and many expect more weakness. American steel and ferrous scrap markets “seem to be heading into the summer with reduced momentum,” according to Recycling Today. According to Kallanish Commodities, a reduced “buying appetite” by Turkish mills, cheaper Russian billet, a weakening Chinese steel market, and overall bearish industry sentiment are to blame for lower American scrap prices. Shredded steel scrap prices have already tumbled this year. In its monthly index update released on Monday, the Raw Material Data Aggregation Service confirmed that spot shredded scrap prices are down from $604/T in March to $481/T in June. Some scrap market participants remain bearish, as one anonymous steel supplier quoted by Kallanish Commodities on Monday stated “All grades are likely to fall. I am having difficulties in foreseeing a recovery in the near future.” Kallanish itself echoed similar comments, proclaiming “US scrap market conditions are pointing to further price falls.” |

|

|

|

Prompt month (July) CME MW Busheling Fe Scrap last traded at $520/gross ton (7:00 AM CST), down over 40% from the late-March highs. Even though some players in the steel industry are predicting lower scrap prices, this could be a good time for busheling scrap buyers to hedge a small portion of their future needs via swaps while prices are already depressed. This will help a scrap steel consumer, such as a steel mill, ensure a fixed raw materials cost. This recent price drop provides a better opportunity for scrap consumers to hedge future needs than they had a mere three months ago. If prices drop further, a consumer can consider additional hedges. The CME MW Busheling Fe Scrap market is thinly traded, so we would suggest strategically placed limit orders. Using swaps can help guard against a potential increase in scrap input costs. Such positions are standard for consumer hedging, but they can result in opportunity costs or cash costs if metal prices decline. Please note there is no options market for CME MW Busheling Fe Scrap. Please contact AEGIS for specific strategies that fit your operations. (6/23/2022) |

||

|

|

||

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

06/22/2022: AEGIS Factor Matrices: Most important variables affecting metals prices 05/23/2022: India's Steel Exports Tariffs Shock Producers 05/11/2022: China's Metals Exports are on the Rise |

||

|

|

||

| Important Headlines | ||

|

6/22/2022: Explainer: Why is there a worldwide oil-refining crunch? 6/22/2022: Toyota cuts July global production plan by 50,000 vehicles 6/21/2022: Steel output and price drops hit ferrous market 6/21/2022: Copper price rises as looming strike in Chile adds to supply worries 6/21/2022: Column: Global aluminium production pendulum swings back to China 6/20/2022: Column: Iron ore suffers short-term demand woes, longer-term China threat 6/20/2022: China power demand sets new records as heatwaves bake northern cities 6/20/2022: Analysis: Quantity over quality - China faces power supply risk despite coal output surge 6/17/2022: Chile's Codelco to close Ventanas smelter 6/17/2022: Peru expects lower economic growth on impact of mine protests |

||

|

|

||

|

|

||

|

Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as “edge,” “advantage,” “opportunity,” “believe” or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.

|

||