|

Century Aluminum, which is the largest American primary aluminum producer, is temporarily idling its largest smelter due to “skyrocketing energy costs,” according to a June 22 press release. This is the first major announcement of a shutdown by a US metal producer, according to Bloomberg. The Hawesville, KY facility, which has a production capacity of 250,000 mt/year, will begin idling procedures on Monday, June 27. According to Century’s CEO, the “unprecedented rise in global energy prices arising from the Russian war in Ukraine has dramatically increased the price of energy in the U.S. and around the globe. The power cost required to run our Hawesville, KY, facility has more than tripled the historical average in a very short period. Unfortunately, this makes it necessary to temporarily curtail operations for approximately nine to twelve months until energy prices return to more normalized levels. We are confident that energy prices will moderate in the next year and believe strongly in the future prospects of the Hawesville smelter given its recent performance and the continuing important role it plays in US national security.” Most of the smelter’s 600+ employees will be laid off while the plant is idled. |

|

|

|

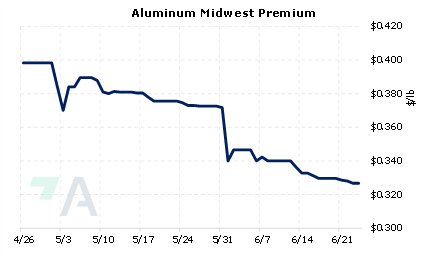

Like global aluminum prices, the CME Aluminum Midwest Premium (MWP) has dropped in recent months. The CME Midwest Premium is a premium that midwestern US buyers pay on top of the LME price. The prompt month MWP (June) is down over 14% this quarter but is nearly unchanged in June. June CME MWP last settled at 32.67 cents. This premium has its own traded market, so the MWP can be hedged. Aluminum end-users such as beverage producers who are concerned that US smelter shutdowns could increase premiums should consider hedging the CME Midwest Premium via swaps. The CME Midwest Premium swap market is thinly traded, and there is no options market. Hedging in this market is tricky, so we recommend using strategically placed limit orders. Please contact AEGIS for specific strategies that fit your operations. (6/24/2022) |

||

|

|

||

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

06/23/2022: What is Green Steel Anyways? 06/22/2022: AEGIS Factor Matrices: Most important variables affecting metals prices 05/23/2022: India's Steel Exports Tariffs Shock Producers |

||

|

|

||

| Important Headlines | ||

|

6/22/2022: Chile copper workers begin nationwide strike over smelter closure 6/22/2022: Explainer: Why is there a worldwide oil-refining crunch? 6/22/2022: Toyota cuts July global production plan by 50,000 vehicles 6/21/2022: Steel output and price drops hit ferrous market 6/21/2022: Copper price rises as looming strike in Chile adds to supply worries 6/21/2022: Column: Global aluminium production pendulum swings back to China 6/20/2022: Column: Iron ore suffers short-term demand woes, longer-term China threat 6/20/2022: China power demand sets new records as heatwaves bake northern cities 6/20/2022: Analysis: Quantity over quality - China faces power supply risk despite coal output surge 6/17/2022: Chile's Codelco to close Ventanas smelter 6/17/2022: Peru expects lower economic growth on impact of mine protests |

||

|

|

||

|

|

||

|

Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as “edge,” “advantage,” “opportunity,” “believe” or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.

|

||