|

Europe’s stainless-steel market should recover to near the pre-COVID level of 1.2 million mt of finished longs products this year, up from 1.05 million mt in 2021, Italian producer Cogne Acciai Speciali (CAS) told S&P Global late last week. CAS proclaims that stainless-steel demand is increasing in the automotive, aerospace, oil and gas, medical and food sectors. Regarding raw material costs, CAS’s director of sales declared, "Raw materials prices went up, but like most of our competitors we managed to transfer the costs into our final products," later adding that high energy and nickel prices were also partially covered by flexibility in the company's long-term contracts. |

|

|

|

Nickel, a key component for stainless-steel production, has seen wild price swings in 2022, trading to $55,000/mt in early March. Prices are down over 57% since then, to $23,425/mt (7:00 AM CST), and down almost 17% in June alone. This could be an opportunity for end-users such as stainless-steel producers to hedge future needs. End-users might consider applying simple hedges involving swaps and call options. One other possible strategy is a costless collar. In this case, a “zero-cost collar” creates a maximum and minimum nickel price for a stainless-steel producer, as they would simultaneously buy a call option (creating a cap, or maximum) and sell a put option (creating a floor, or minimum). The call and put premiums offset, making the construction costless. It is popular because of the upside price protection, but you sacrifice access to much lower prices if prices should fall. Such positions are standard for consumer hedging, but they can result in opportunity costs or cash costs if metal prices decrease. Please contact AEGIS for specific strategies that fit your operations. (6/27/2022) |

||

|

|

||

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

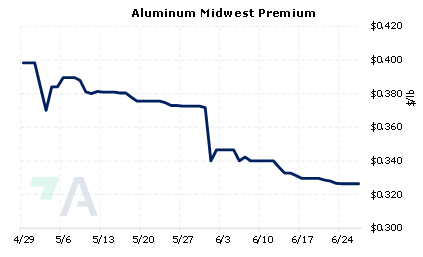

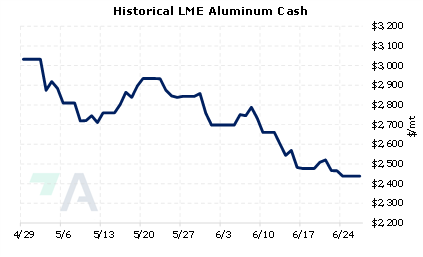

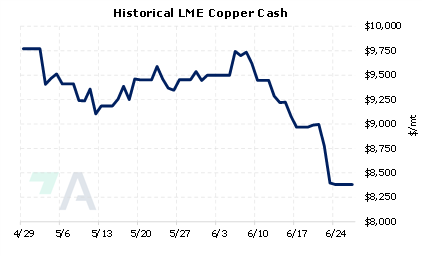

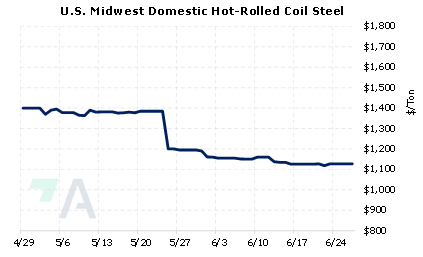

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

06/23/2022: What is Green Steel Anyways? 06/22/2022: AEGIS Factor Matrices: Most important variables affecting metals prices 05/23/2022: India's Steel Exports Tariffs Shock Producers |

||

|

|

||

| Important Headlines | ||

|

6/22/2022: Chile copper workers begin nationwide strike over smelter closure 6/22/2022: Explainer: Why is there a worldwide oil-refining crunch? 6/22/2022: Toyota cuts July global production plan by 50,000 vehicles 6/21/2022: Steel output and price drops hit ferrous market 6/21/2022: Copper price rises as looming strike in Chile adds to supply worries 6/21/2022: Column: Global aluminium production pendulum swings back to China 6/20/2022: Column: Iron ore suffers short-term demand woes, longer-term China threat 6/20/2022: China power demand sets new records as heatwaves bake northern cities 6/20/2022: Analysis: Quantity over quality - China faces power supply risk despite coal output surge 6/17/2022: Chile's Codelco to close Ventanas smelter 6/17/2022: Peru expects lower economic growth on impact of mine protests |

||

|

|

||

|

|

||

|

Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as “edge,” “advantage,” “opportunity,” “believe” or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.

|

||