|

China’s exports of alumina to Russia have increased dramatically this year; however, increasing production costs for Chinese alumina producers could hurt margins and lead to lower export volumes, according to S&P Global. This could in turn further squeeze Russian aluminum production profitability. China exported 188,768 mt of alumina in May, up 3,903.9% on the year, with 153,362 mt, or nearly 81% going to Russia, according to customs data released late last week. Last Friday, one anonymous trader cited S&P Global claimed “The main risk to Russia's supply from China is if high-cost refineries are forced to curtail output due to rising production costs…. Refineries could need to keep long-standing relations with existing customers and prioritize them, even if Russia is able to pay slightly more." Sources also told S&P Global that higher bauxite, coal and caustic soda prices and decreasing domestic alumina prices could also lead to more curtailments. |

|

|

|

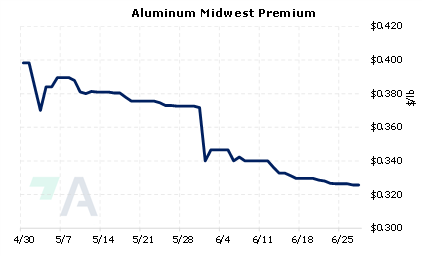

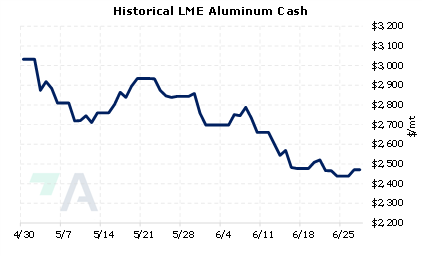

Despite Western sanctions, Russia continues to export aluminum. For example, Russian aluminum exports to China have increased from 8,111 mt in October 2021 to 42,526 mt in May. This has helped to push down global aluminum prices. Aluminum prices at the LME are down nearly 38% from the March highs, to $2,520/mt (7:00 AM CST), and down almost 10% in June alone. This could be an opportunity for end-users such as automobile producers to hedge future needs. End-users might consider applying simple hedges involving swaps and call options. One other possible strategy is a costless collar. In this case, a “zero-cost collar” creates a maximum and minimum aluminum price for a automobile producer, as they would simultaneously buy a call option (creating a cap, or maximum) and sell a put option (creating a floor, or minimum). The call and put premiums offset, making the construction costless. It is popular because of the upside price protection, but you sacrifice access to much lower prices if prices should fall. Such positions are standard for consumer hedging, but they can result in opportunity costs or cash costs if metal prices decrease. Please contact AEGIS for specific strategies that fit your operations. (6/28/2022) |

||

|

|

||

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

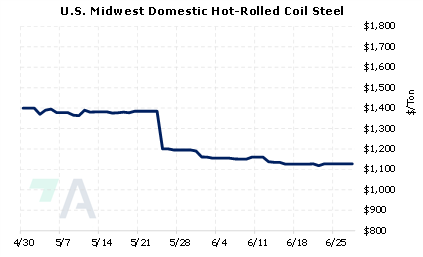

06/23/2022: What is Green Steel Anyways? 06/22/2022: AEGIS Factor Matrices: Most important variables affecting metals prices 05/23/2022: India's Steel Exports Tariffs Shock Producers |

||

|

|

||

| Important Headlines | ||

|

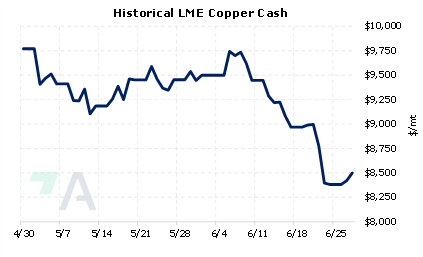

6/27/2022: Copper steadies, but recession fears dominate mood 6/24/2022: Copper heads for worst weekly loss in a year, nickel and tin plunge 6/24/2022: China's May bauxite imports hit record high; alumina exports soar on Russian demand 6/23/2022: European stainless steel longs demand to rebound to 1.2 million mt in 2022: CAS |

||

|

|

||

|

|

||

|

Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as “edge,” “advantage,” “opportunity,” “believe” or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.

|

||