|

The Russian invasion of Ukraine shut off American imports of pig iron from the region, causing US electric arc furnace (EAF) operators to scramble to secure domestic ferrous scrap as an alternate feedstock, according to S&P Global. However, American steelmakers have found new suppliers or adjusted production to use less pig iron in steel production. Also, transportation issues in the US are starting to subside. Bob Broom, vice president of trading at Houston-based Tri Coastal Trading recently stated “We are starting to see some improvements. For a price, you can get a truck or you can get a vessel." Spot scrap prices have tumbled as supply chain issues have lessened. On June 27, S&P Global set its price assessment for domestic US shredded scrap at $480/lt, down from a record $610/lt in March and April 2022. |

|

|

|

CME MW Busheling Fe Scrap futures have tumbled alongside spot prices. Prompt month (July) CME MW Busheling Fe Scrap last settled at $528/gross ton (7:00 AM CST), down nearly 40% from the late-March highs. However, traders cited by S&P Global believe that demand for prime scrap will increase in 2H 2022, as mills such as Steel Dynamics’ new 3 million st/year EAF in Sinton TX ramp up production. This could drive spot and futures prices higher, so this could be a good time for busheling scrap buyers to hedge a small portion of their future needs via swaps while prices are depressed. This will help a scrap steel consumer, such as a steel mill, ensure a fixed raw materials cost. This recent price drop provides a better opportunity for scrap consumers to hedge future needs than they had a mere three months ago. The CME MW Busheling Fe Scrap market is thinly traded, so we would suggest strategically placed limit orders. Using swaps can help guard against a potential increase in scrap input costs. Such positions are standard for consumer hedging, but they can result in opportunity costs or cash costs if metal prices decline. Please note there is no options market for CME MW Busheling Fe Scrap. Please contact AEGIS for specific strategies that fit your operations. (6/29/2022) |

||

|

|

||

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

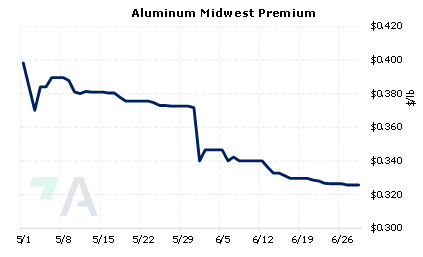

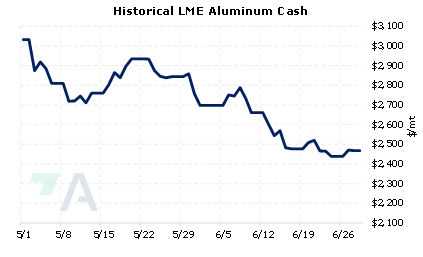

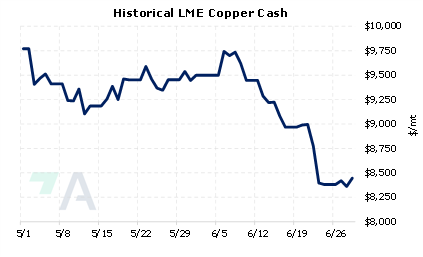

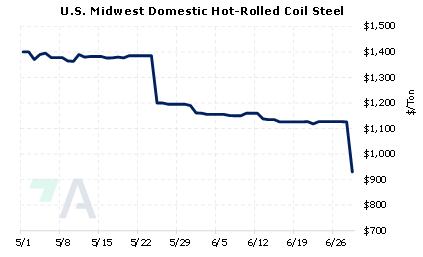

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

06/23/2022: What is Green Steel Anyways? 06/22/2022: AEGIS Factor Matrices: Most important variables affecting metals prices 05/23/2022: India's Steel Exports Tariffs Shock Producers |

||

|

|

||

| Important Headlines | ||

|

6/27/2022: FEATURE: Pandemic fades, recession looms for H2 US ferrous scrap market 6/27/2022: Copper steadies, but recession fears dominate mood 6/24/2022: Copper heads for worst weekly loss in a year, nickel and tin plunge 6/24/2022: China's May bauxite imports hit record high; alumina exports soar on Russian demand 6/23/2022: European stainless steel longs demand to rebound to 1.2 million mt in 2022: CAS

|

||

|

|

||

|

|

||

|

Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as “edge,” “advantage,” “opportunity,” “believe” or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.

|

||