|

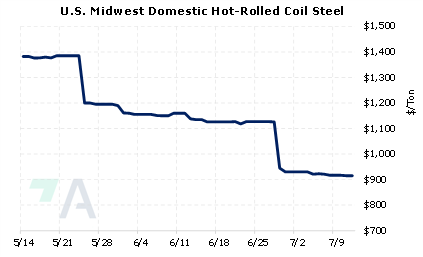

India will likely abolish or reduce the 15% export tariff on certain steel products, according to Bloomberg’s summation of local media reports. This 15% export tariff, which was implemented in late-May 2022, sought to reduce domestic prices and raise supplies. However, domestic demand has remained subdued and domestic end-users have not rebuilt inventories despite lower prices. According to the Ministry of Steel, in June, exports dropped by 53% year-over-year. Trade sources cited by the Hindu Business Line believe this drop in exports was because the export tariff made Indian steel uncompetitive compared to Chinese offerings, and recession fears weighed on global demand. Major steel industry producers are planning to meet with ministry officials later this week to discuss the tariffs, according to the Hindu Business Line. |

|

|

|

Dropping this tariff could be bearish to CME HRC prices, if Indian exporters restart shipments, thereby increasing global supply. CME HRC steel is thinly traded, but steel producers that are concerned about decreasing prices might consider hedges that provide downside protection. These might include applying simple hedges involving swaps to lock in a price or put options to establish a minimum price. One other possible strategy is a costless collar. In this case, a “zero-cost collar” creates a maximum and minimum price for a steel producer, as they would simultaneously buy a put option (creating a floor, or minimum) and sell a call option (creating a cap, or maximum). The call and put premiums offset, making the construction costless. It is popular because of the downside price protection, but you sacrifice access to much higher prices if prices should rise. Such positions are standard for producer hedging, but they can result in opportunity costs or cash costs if metal prices increase. Please contact AEGIS for specific strategies that fit your operations. (7/12/2022) |

||

|

|

||

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

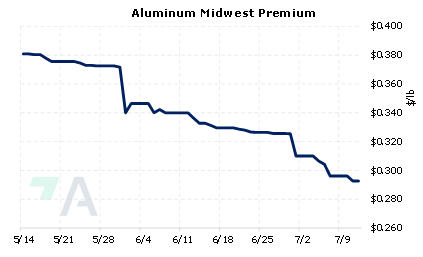

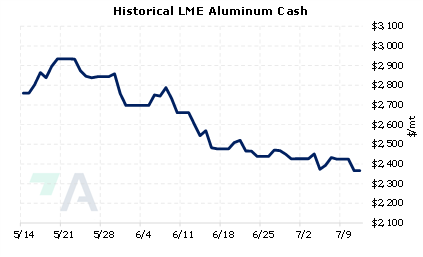

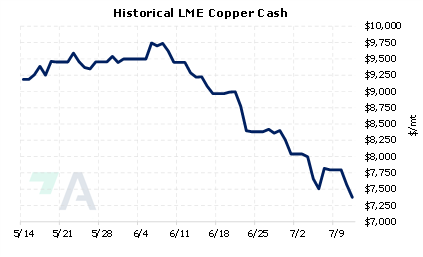

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

07/07/2022: Have Copper Prices Begun to Find a Bottom? 07/06/2022: AEGIS Factor Matrices: Most important variables affecting metals prices 06/23/2022: What is Green Steel Anyways? |

||

|

|

||

| Important Headlines | ||

|

7/11/2022: Explainer: What happens if Germany's Russian gas flows stop 7/11/2022: Column: China's massive stimulus talk does little for metals as confidence fades 7/11/2022: Indian shares pare losses to end flat after reports of export tax on steel ending 7/11/2022: India’s finished steel exports fall 53 per cent in June |

||

|

|

||

|

|

||

|

Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as “edge,” “advantage,” “opportunity,” “believe” or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.

|

||