|

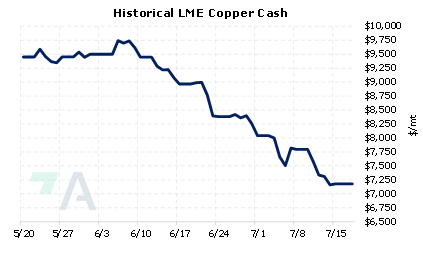

Copper is up nearly 2.4%, with last trade at $7,351/mt (7:00 AM CST), after Chinese officials stated that they are “urging” banks to increase loans to real-estate developers to finish incomplete projects, according to Bloomberg. Today’s positive price action comes after last week’s drop of 7.8%, the largest percentage decline in a year. Last Thursday, Bloomberg cited a “plethora” of reasons for copper’s recent price plunge, including US Federal Reserve interest rate policy, China’s real-estate mortgage problems, and slowing economies in Europe. Last week, Goldman Sachs cut their three-month price target to $6,700/mt, down from $8,650/mt, as a gloomy demand outlook could weigh on prices into 3Q and 4Q. |

|

|

|

Even though it has been doom and gloom for copper demand lately, this could be an opportunity for copper buyers. End-users such as battery producers might consider using the recent dip in prices by applying simple hedges involving swaps and call options. One other possible strategy is a costless collar. In this case, a “zero-cost collar” creates a maximum and minimum lead price for a battery producer, as they would simultaneously buy a call option (creating a cap, or maximum) and sell a put option (creating a floor, or minimum). The call and put premiums offset, making the construction costless. It is popular because of the upside price protection, but you sacrifice access to much lower prices if prices should fall. Such positions are standard for consumer hedging, but they can result in opportunity costs or cash costs if metal prices decrease. Please contact AEGIS for specific strategies that fit your operations. (7/18/2022) |

||

|

|

||

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

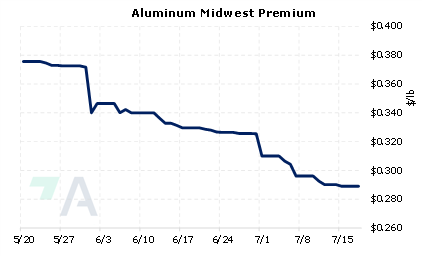

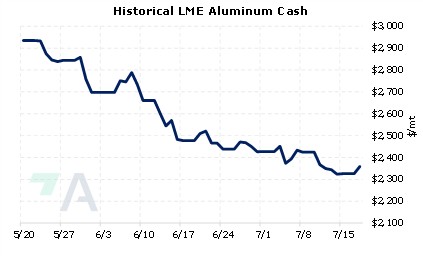

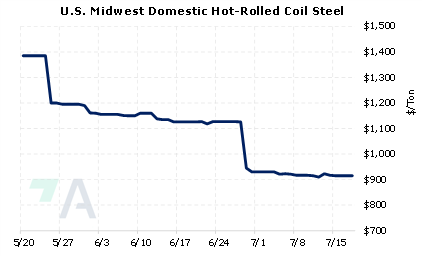

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

07/13/2022: AEGIS Factor Matrices: Most important variables affecting metals prices 07/07/2022: Have Copper Prices Begun to Find a Bottom? 06/23/2022: What is Green Steel Anyways? |

||

|

|

||

| Important Headlines | ||

|

7/13/2022: Historic US plate/HRC spread stokes concerns 7/13/2022: Column: Collapsing metal inventories clash with plunging prices 7/13/2022: Latin America steel demand to fall in 2022 -industry report 7/12/2022: US HRC: Prices fall below $900 7/12/2022: Goldman goes cold on copper price 7/12/2022: China ramp-up pushes aluminum prices to 14-month lows 7/11/2022: Explainer: What happens if Germany's Russian gas flows stop 7/11/2022: Column: China's massive stimulus talk does little for metals as confidence fades 7/11/2022: Indian shares pare losses to end flat after reports of export tax on steel ending 7/11/2022: India’s finished steel exports fall 53 per cent in June |

||

|

|

||

|

|

||

|

Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as “edge,” “advantage,” “opportunity,” “believe” or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.

|

||