|

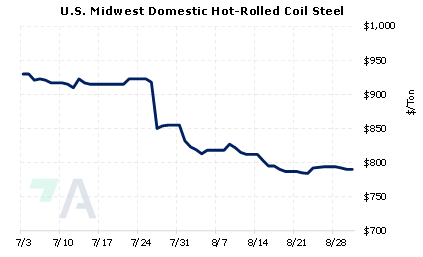

Canadian steelmaker Stelco predicts that lower scrap volumes will push scrap prices higher, thereby leading to higher finished-steel prices. According to Stelco, steel scrap prices have fallen tremendously this year due to falling demand and ample supply. In fact, according to Argus’s latest assessments, Ferrous #1 busheling scrap last traded at $404/gt in the Midwest, which is a $16/gt discount to lower-yielding shredded scrap. In a preemptive move, several companies, including Stelco, have already raised their flat-rolled steel prices by $50 to $75/st in recent weeks, according to Argus. |

|

|

|

CME MW Busheling Fe Scrap futures have tumbled alongside spot prices. Prompt month (September) CME MW Busheling Fe Scrap last settled at $450/gross ton (7:00 AM CST), down over 40% from the late-March highs. This could be a good time for busheling scrap buyers to hedge future needs via swaps while prices are depressed. This will help a scrap steel consumer, such as a steel mill, ensure a fixed raw materials cost. The CME MW Busheling Fe Scrap market is thinly traded, so we would suggest strategically placed limit orders. Such positions are standard for consumer hedging, but they can result in opportunity costs or cash costs if metal prices decline. Please note there is no options market for CME MW Busheling Fe Scrap. Please contact AEGIS for specific strategies that fit your operations. (8/31/2022) |

||

|

|

||

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

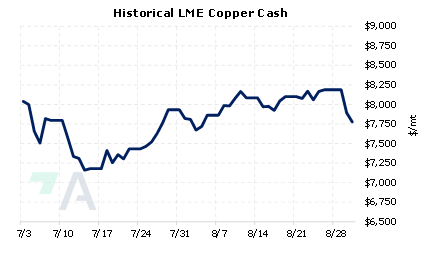

8/31/2022: Will Chilean Production Issues Drive Copper Prices Higher? 8/24/2022: Chinese Aluminum Supply Issues Could Rally Prices 8/24/2022: AEGIS Factor Matrices: Most important variables affecting metals prices 8/16/2022: Zinc Prices Are On The Rebound Due To Supply Issues 8/9/2022: Aluminum prices are finding support: Consumers can lock in lower costs in 2023 and beyond |

||

|

|

||

| Important Headlines | ||

|

8/30/2022: China's Sichuan, Chongqing resume power supply to industry 8/29/2022: Copper price back below $8,000 as hawkish Fed outweighs supply risk 8/26/2022: China's aluminum prices seen volatile as power crunch disrupts production: sources 8/26/2022: Codelco lowers 2022 copper production outlook 8/26/2022: Steel prices near bottom: Stelco CEO |

||

|

|

||

|

Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as “edge,” “advantage,” “opportunity,” “believe” or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.

|

||