|

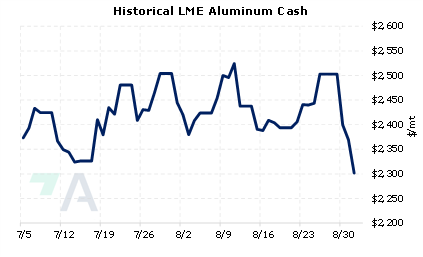

European aluminum production continues to drop, which could be supportive of global prices. On Wednesday, Alcoa announced that they will immediately begin closing one 31,000 mt/yr potline at its 94,000 mt/yr smelter in Lista, Norway due to soaring spot electricity costs. According to their press release, Norwegian spot electricity prices have soared to over $600/MWh, making aluminum production unfeasible. Including the Lista smelter, only about 5% of Alcoa’s global smelting portfolio is exposed to short-term electricity costs. |

|

|

|

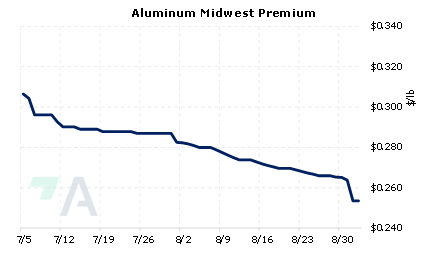

By our last count, over a dozen European aluminum smelters have fully or partially curtailed production due to soaring electricity costs since October 2021. The estimated annual production loss of this curtailed production is now just over 1 million mt. However, aluminum prices at the LME are down nearly 18.1% in 2022 (7:00 AM CST) and are approaching 16-month lows. End-users might consider using the recent dip in prices by applying simple hedges involving swaps and call options. One other possible strategy is a costless collar. In this case, a “zero-cost collar” creates a maximum and minimum aluminum price for an end user, as they would simultaneously buy a call option (creating a cap, or maximum) and sell a put option (creating a floor, or minimum). The call and put premiums offset, making the construction costless. It is popular because of the upside price protection, but you sacrifice access to much lower prices if prices should fall. Such positions are standard for consumer hedging, but they can result in opportunity costs or cash costs if metal prices decrease. Please contact AEGIS for specific strategies that fit your operations. * Please note that due to the US Labor Day holiday, the CME will be closed on Monday, September 5. We will not produce the First Look that morning. However, the trading desk will provide LME coverage, and current clients can contact metals@aegis-hedging.com for indications. * (9/2/2022) |

||

|

|

||

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

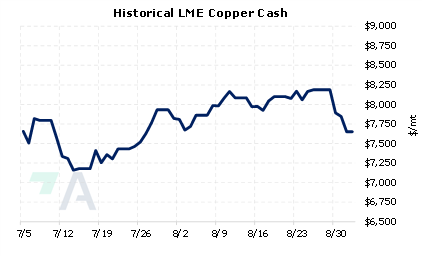

8/31/2022: Will Chilean Production Issues Drive Copper Prices Higher? 8/31/2022: AEGIS Factor Matrices: Most important variables affecting metals prices 8/24/2022: Chinese Aluminum Supply Issues Could Rally Prices 8/16/2022: Zinc Prices Are On The Rebound Due To Supply Issues 8/9/2022: Aluminum prices are finding support: Consumers can lock in lower costs in 2023 and beyond |

||

|

|

||

| Important Headlines | ||

|

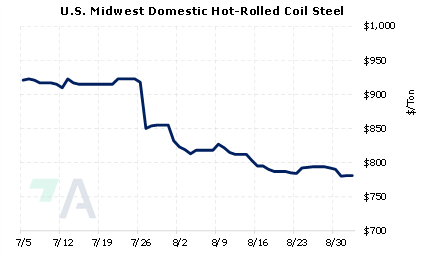

8/31/2022: Copper output from Chile's Codelco to fall further in 2023, newspaper says 8/30/2022: Lista Smelter in Norway to Partially Curtail to Offset Energy Costs 8/30/2022: China's Sichuan, Chongqing resume power supply to industry 8/29/2022: Copper price back below $8,000 as hawkish Fed outweighs supply risk 8/26/2022: China's aluminum prices seen volatile as power crunch disrupts production: sources 8/26/2022: Codelco lowers 2022 copper production outlook 8/26/2022: Steel prices near bottom: Stelco CEO |

||

|

|

||

|

Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as “edge,” “advantage,” “opportunity,” “believe” or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.

|

||