|

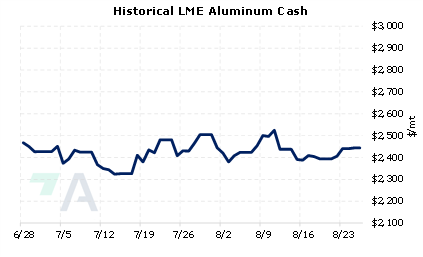

On Monday, LME Aluminum inventories posted their largest increase since February, rising 11% to 308,375 tons. However, LME Aluminum inventories are still a fraction of their historical average of around 2.95 MM tons. The aluminum forward curve is in extreme contango, with the 12-month contract currently trading at around a $59.50 premium to the prompt-month (M1) contract. |

|

|

|

The Aluminum forward curve has only been in contango since May, but storage inventories have continued to decline. The LA1-LA2 (Prompt-month aluminum (M1) – M2) futures spread just crossed into negative territory, which is consistent with the large increase in inventories, corroborating the principle that a contango curve is needed to incentivize increasing builds in storage. The prompt-month (LA1) aluminum contract is currently trading 42% or $1,632 lower than the $3,875.50 recent high on March 2, 2022, at around $2,259/ton, much higher than the $2,021/ton average during the 2010-2022 period. The month-2 aluminum contract is trading at about $2,290/ton. |

||

|

|

||

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

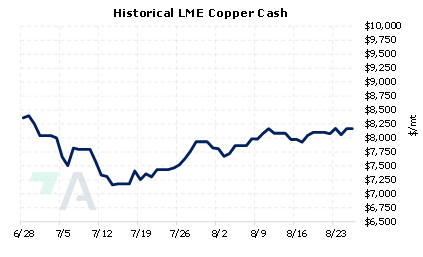

8/31/2022: Will Chilean Production Issues Drive Copper Prices Higher? 8/31/2022: AEGIS Factor Matrices: Most important variables affecting metals prices 8/24/2022: Chinese Aluminum Supply Issues Could Rally Prices 8/16/2022: Zinc Prices Are On The Rebound Due To Supply Issues 8/9/2022: Aluminum prices are finding support: Consumers can lock in lower costs in 2023 and beyond |

||

|

|

||

| Important Headlines | ||

|

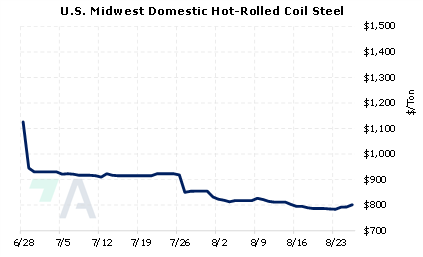

9/1/2022: Column: European smelter closures fracture aluminium pricing 8/31/2022: Copper output from Chile's Codelco to fall further in 2023, newspaper says 8/30/2022: Lista Smelter in Norway to Partially Curtail to Offset Energy Costs 8/30/2022: China's Sichuan, Chongqing resume power supply to industry 8/29/2022: Copper price back below $8,000 as hawkish Fed outweighs supply risk 8/26/2022: China's aluminum prices seen volatile as power crunch disrupts production: sources 8/26/2022: Codelco lowers 2022 copper production outlook 8/26/2022: Steel prices near bottom: Stelco CEO |

||

|

|

||

|

Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as “edge,” “advantage,” “opportunity,” “believe” or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.

|

||