According to Reuters data, U.S. nickel imports from Russia averaged 23,049 tons/month from March to June, up over 70% year-over-year. Also, U.S. aluminum imports averaged around 25,116 tons during the same period, a 21% increase compared to the same period in 2021.

| The EU has seen similar increases in metals imports from Russia. Despite the increase in metals imports, the EU, U.S. have been leading the charge to impose sanctions on Russian energy shipments. Prices of both metals surged to record highs following Russia’s decision to invade Ukraine on Feb. 24 on fears that sanctions or difficult logistics would block shipments. So far, that has not been the case; however, if that changes, aluminum and nickel prices could be prone to price spikes as supply becomes scarcer. (Reuters, 9/8/2022) |

|

|

|

|

||

|

|

||

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

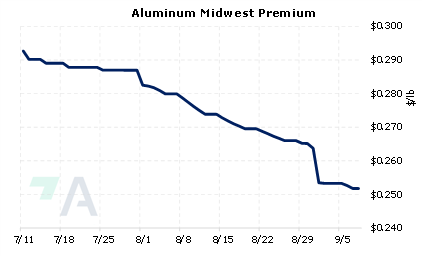

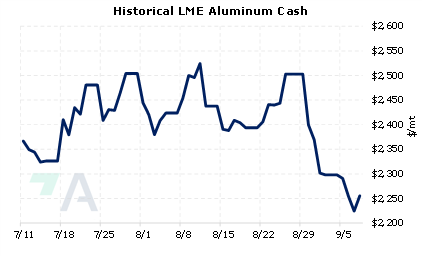

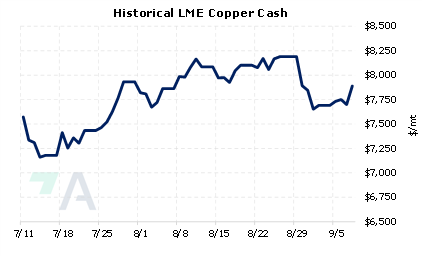

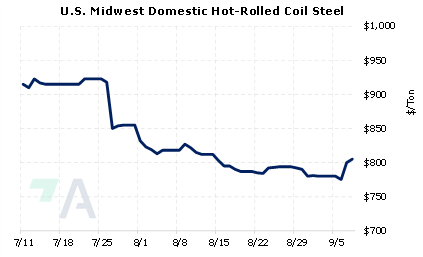

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

8/31/2022: Will Chilean Production Issues Drive Copper Prices Higher? 8/31/2022: AEGIS Factor Matrices: Most important variables affecting metals prices 8/24/2022: Chinese Aluminum Supply Issues Could Rally Prices 8/16/2022: Zinc Prices Are On The Rebound Due To Supply Issues 8/9/2022: Aluminum prices are finding support: Consumers can lock in lower costs in 2023 and beyond |

||

|

|

||

| Important Headlines | ||

|

9/1/2022: Column: European smelter closures fracture aluminium pricing 8/31/2022: Copper output from Chile's Codelco to fall further in 2023, newspaper says 8/30/2022: Lista Smelter in Norway to Partially Curtail to Offset Energy Costs 8/30/2022: China's Sichuan, Chongqing resume power supply to industry 8/29/2022: Copper price back below $8,000 as hawkish Fed outweighs supply risk 8/26/2022: China's aluminum prices seen volatile as power crunch disrupts production: sources 8/26/2022: Codelco lowers 2022 copper production outlook 8/26/2022: Steel prices near bottom: Stelco CEO |

||

|

|

||

|

Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as “edge,” “advantage,” “opportunity,” “believe” or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.

|

||