|

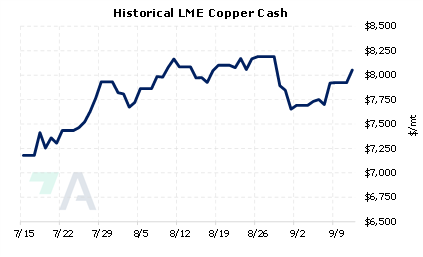

Due to a lack of new discoveries and an expected increase in demand from global decarbonization efforts, the copper and nickel markets could be undersupplied in the long term, according to Oz Minerals. Although they downplayed comments from competitor BHP over a feared short-term supply glut, Oz did say that the markets for both metals could be volatile in the short term. In its most recent production guidance, Oz expects to produce between 127,000 - 149,000 mt of copper this year. However, according to comments they made to Bloomberg, the company expects its copper production to double within the next “half dozen” years and will begin nickel production soon. |

|

|

|

This expected supply strain for both nickel and copper could be supportive of prices for both metals. End-users of either metal might consider hedging future needs by applying simple hedges involving swaps and call options. One other possible strategy is a costless collar. In this case, a “zero-cost collar” creates a maximum and minimum aluminum price for an end user, as they would simultaneously buy a call option (creating a cap, or maximum) and sell a put option (creating a floor, or minimum). The call and put premiums offset, making the construction costless. It is popular because of the upside price protection, but you sacrifice access to much lower prices if prices should fall. Such positions are standard for consumer hedging, but they can result in opportunity costs or cash costs if metal prices decrease. Please contact AEGIS for specific strategies that fit your operations. (9/12/2022) |

||

|

|

||

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

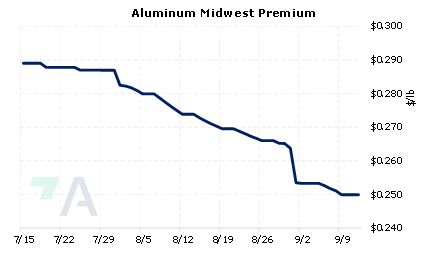

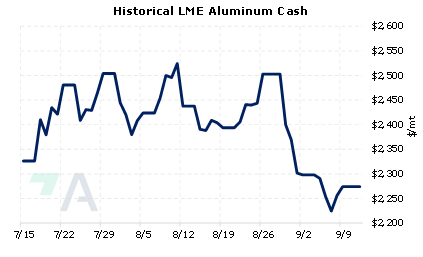

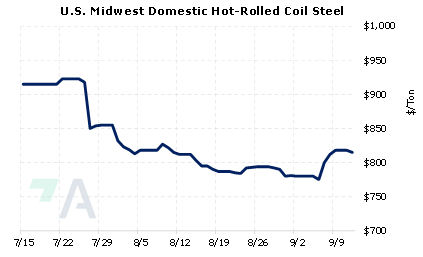

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

8/31/2022: Will Chilean Production Issues Drive Copper Prices Higher? 8/31/2022: AEGIS Factor Matrices: Most important variables affecting metals prices 8/24/2022: Chinese Aluminum Supply Issues Could Rally Prices 8/16/2022: Zinc Prices Are On The Rebound Due To Supply Issues 8/9/2022: Aluminum prices are finding support: Consumers can lock in lower costs in 2023 and beyond |

||

|

|

||

| Important Headlines | ||

|

9/8/2022: BHP says copper strategy does not depend on M&A after OZ Minerals snub 9/7/2022: EU, US step up Russian aluminum, nickel imports since Ukraine war 9/6/2022: US HRC: Prices flat on holiday |

||

|

|

||

|

Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as “edge,” “advantage,” “opportunity,” “believe” or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.

|

||