|

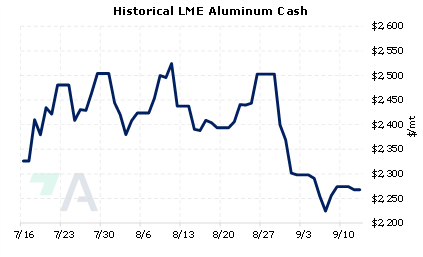

China, which is the world’s largest aluminum producer and exporter, is experiencing potentially bullish production problems. Due to an ongoing power shortage, an estimated 10%, or 500,000 mt of Yunnan province’s aluminum production has been ordered offline by the local government. However, one anonymous source cited by Fastmarkets estimates that an additional 500,000 mt could be cut, thereby doubling the announced amount, as the government plans to ration power until May 2023. Based on these estimates, approximately 1 million mt, or 20%, of Yunnan province’s production could be curtailed. At 5 million mt, Yunnan province represents about 12.8% of China’s total aluminum production last year, based on USGS and Fastmarkets data. |

|

|

|

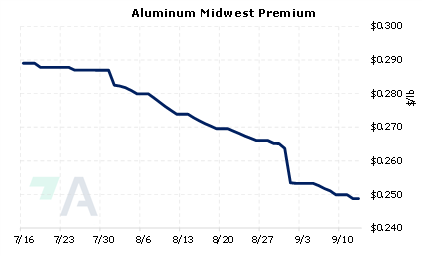

Despite the recent production cuts in China and elsewhere, aluminum prices at the LME have largely trended sideways for the past two months. However, aluminum prices could rally if more Chinese production is taken offline, or they cut back on exports. To control price inflation, aluminum end-users could consider buying swaps or call options, as either would establish a maximum aluminum price. However, if you feel that production could return sooner than industry predictions, then a costless collar could be a viable strategy. In this case, a “zero-cost collar” creates a maximum and minimum aluminum price for an end user, as they would simultaneously buy a call option (creating a cap, or maximum) and sell a put option (creating a floor, or minimum). The call and put premiums offset, making the construction costless. It is popular because of the upside price protection, but you sacrifice access to much lower prices if prices should fall. Such positions are standard for consumer hedging, but they can result in opportunity costs or cash costs if metal prices decrease. Please contact AEGIS for specific strategies that fit your operations. (9/13/2022) |

||

|

|

||

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

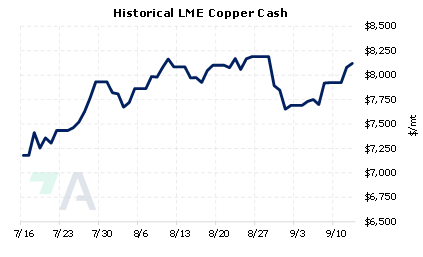

8/31/2022: Will Chilean Production Issues Drive Copper Prices Higher? 8/31/2022: AEGIS Factor Matrices: Most important variables affecting metals prices 8/24/2022: Chinese Aluminum Supply Issues Could Rally Prices 8/16/2022: Zinc Prices Are On The Rebound Due To Supply Issues 8/9/2022: Aluminum prices are finding support: Consumers can lock in lower costs in 2023 and beyond |

||

|

|

||

| Important Headlines | ||

|

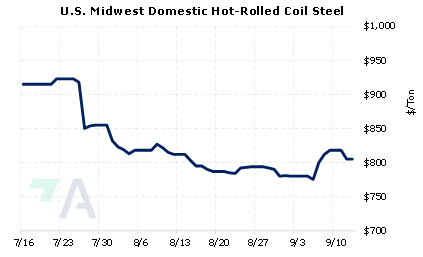

9/12/2022: Electricity restrictions in Yunnan may increase aluminum price 9/9/2022: Current gas, electricity prices threaten European steelmaking viability: Eurofer 9/8/2022: BHP says copper strategy does not depend on M&A after OZ Minerals snub 9/7/2022: EU, US step up Russian aluminum, nickel imports since Ukraine war 9/6/2022: US HRC: Prices flat on holiday |

||

|

|

||

|

Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as “edge,” “advantage,” “opportunity,” “believe” or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.

|

||