|

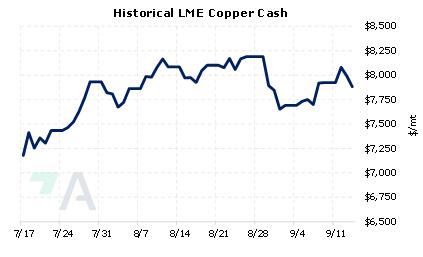

China’s copper demand could finally be on the mend. Evergrande, which is one of China’s largest real estate developers, has restarted construction on 668 of its 706 stalled projects, according to Bloomberg. China’s peak construction season usually lasts until the end of October, so this welcomed news comes just as metals demand for construction normally falls. According to Bloomberg, China’s property sector has been hit in recent months as home prices and sales volumes have fallen. Many home builders, including Evergrande, stopped construction on new projects, thereby weighing on copper demand. |

|

|

|

This expected pickup in demand by Chinese real-estate developers could tighten global supplies, leading to higher prices. Due in part to lower Chinese demand, LME Copper prices have dropped precipitously in recent months. Likewise, the forward curve has also plummeted. Compared to three months ago, LME Copper’s forward curve has shifted vertically lower by nearly $1,900/mt. Also, the forward curve is now backwardated, meaning that futures prices are lower than spot. This could provide a better opportunity for end-users to hedge future needs into 2023 and beyond by buying swaps, as this strategy would establish a maximum copper price. Such positions are standard for consumer hedging; however, they can result in opportunity costs or cash costs if metal prices decrease. Please contact AEGIS for specific strategies that fit your operations. (9/14/2022) |

||

|

|

||

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

8/31/2022: Will Chilean Production Issues Drive Copper Prices Higher? 8/31/2022: AEGIS Factor Matrices: Most important variables affecting metals prices 8/24/2022: Chinese Aluminum Supply Issues Could Rally Prices 8/16/2022: Zinc Prices Are On The Rebound Due To Supply Issues 8/9/2022: Aluminum prices are finding support: Consumers can lock in lower costs in 2023 and beyond |

||

|

|

||

| Important Headlines | ||

|

9/13/2022: US HRC: Prices rise, market uncertain 9/12/2022: Electricity restrictions in Yunnan may increase aluminum price 9/9/2022: Current gas, electricity prices threaten European steelmaking viability: Eurofer 9/8/2022: BHP says copper strategy does not depend on M&A after OZ Minerals snub 9/7/2022: EU, US step up Russian aluminum, nickel imports since Ukraine war 9/6/2022: US HRC: Prices flat on holiday |

||

|

|

||

|

Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as “edge,” “advantage,” “opportunity,” “believe” or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.

|

||