|

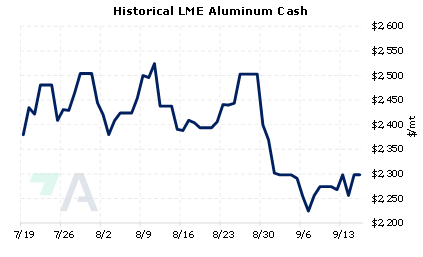

Due to a worsening power crisis, aluminum producers in China’s Yunnan province, a key production hub, might cut production by 20 to 30%, or 1 to 1.5 million mt, Shanghai Metals Market stated yesterday, citing a recent producer survey. This revelation comes just days after the local government ordered local producers to curtail production by 10%, or 500,000 mt. Earlier this week, an anonymous source cited by Fastmarkets, proclaimed that deeper production cuts than the initial 10% could occur, as the government plans to ration power until May 2023. At 5 million mt, Yunnan province represents about 12.8% of China’s total aluminum production last year, based on USGS and Fastmarkets data. |

|

|

|

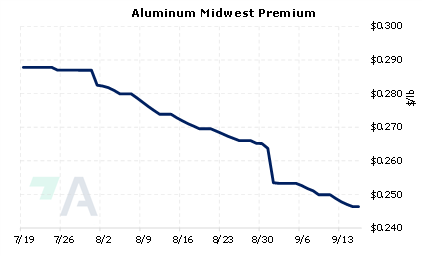

Will more production cuts cause LME aluminum prices to rally? Prices are down nearly 19% in 2022, as last trade on the 3M Select contract was $2,268.50/mt (7:00 AM CST). Also, this is barely off the 2022 low price of $2,233/mt, which was set on September 7. Aluminum end-users might consider using the recent dip in prices by applying simple hedges involving swaps and call options. One other possible strategy is a costless collar. In this case, a “zero-cost collar” creates a maximum and minimum aluminum price for an end user, as they would simultaneously buy a call option (creating a cap, or maximum) and sell a put option (creating a floor, or minimum). The call and put premiums offset, making the construction costless. It is popular because of the upside price protection, but you sacrifice access to much lower prices if prices should fall. Such positions are standard for consumer hedging, but they can result in opportunity costs or cash costs if metal prices decrease. Please contact AEGIS for specific strategies that fit your operations. (9/16/2022) |

||

|

|

||

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

9/14/2022: AEGIS Factor Matrices: Most important variables affecting metals prices 8/31/2022: Will Chilean Production Issues Drive Copper Prices Higher? 8/24/2022: Chinese Aluminum Supply Issues Could Rally Prices 8/16/2022: Zinc Prices Are On The Rebound Due To Supply Issues 8/9/2022: Aluminum prices are finding support: Consumers can lock in lower costs in 2023 and beyond |

||

|

|

||

| Important Headlines | ||

|

9/15/2022: European metals producers say EU energy measures fall short 9/15/2022: To buy or not to buy: Russian aluminium dilemma for Europe's buyers 9/13/2022: US HRC: Prices rise, market uncertain 9/12/2022: Electricity restrictions in Yunnan may increase aluminum price 9/9/2022: Current gas, electricity prices threaten European steelmaking viability: Eurofer 9/8/2022: BHP says copper strategy does not depend on M&A after OZ Minerals snub 9/7/2022: EU, US step up Russian aluminum, nickel imports since Ukraine war 9/6/2022: US HRC: Prices flat on holiday |

||

|

|

||

|

Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as “edge,” “advantage,” “opportunity,” “believe” or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.

|

||