|

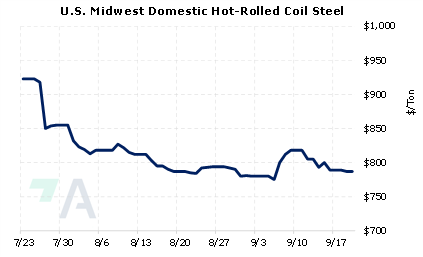

Due to “market conditions and continued high levels of imports,” US Steel has idled its 1.5 million ton/year blast furnace and 140,000 ton/year tin line, both in Gary, IN. The company made these announcements in its 3Q 2022 Guidance press release last Thursday. It is unclear when either plant will resume production. The Gary, IN closure, is the first closure by a US steelmaker due to deteriorating market conditions “in recent memory,” according to Argus. Earlier this summer, US Steel announced it would be temporarily idling its 1.4 million ton/year Mon Valley steel plant for 30 days for routine maintenance. The company “pulled forward” maintenance on the Mon Valley plant from October to September. Similarly, the company “pulled forward” scheduled maintenance on a Slovakia-based plant from October to September. |

|

|

|

Industry sources recently cited by Argus proclaim that the steel market is oversupplied, however, the industry is largely reluctant to reduce production volumes. These issues have pressured steel prices lower, as prompt month (September) CME HRC futures are down nearly 50% from the highs of mid-March. This could be a good time for steel end-users such as automotive equipment manufacturers (OEMs) to hedge future needs into 2023 by buying swaps, as this strategy would establish a maximum steel price. We suggest using strategically placed limit orders in case prices weaken further. Such positions are standard for consumer hedging; however, they can result in opportunity costs or cash costs if metal prices decrease. Please contact AEGIS for specific strategies that fit your operations. (9/20/2022) |

||

|

|

||

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

9/14/2022: AEGIS Factor Matrices: Most important variables affecting metals prices 8/31/2022: Will Chilean Production Issues Drive Copper Prices Higher? 8/24/2022: Chinese Aluminum Supply Issues Could Rally Prices 8/16/2022: Zinc Prices Are On The Rebound Due To Supply Issues 8/9/2022: Aluminum prices are finding support: Consumers can lock in lower costs in 2023 and beyond |

||

|

|

||

| Important Headlines | ||

|

9/18/2022: China's August aluminium imports fall 19% on-year as domestic output rises 9/18/2022: Column: Zinc caught between weakening demand and sliding supply 9/15/2022: US Steel idles Indiana blast furnace |

||

|

|

||

|

Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as “edge,” “advantage,” “opportunity,” “believe” or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.

|

||